Privately owned Peer Software has sold its file-replicating Windows Server software to more than 10,000 customers who use it to replicate files to/from NetApp ONTAP and PowerScale Isilon OneFS filers. It also offers file migration and analysis services.

CEO Jimmy Tam spoke to B&F about his US-based company that was founded in 1993 by Paul Marsala in Centreville, Virginia, to provide a better way to synchronize files between Windows Server systems in and between datacenters. The product is PeerGFS, with GFS meaning Global File Service.

Distributed file service

DFRS (Distributed File Replication Service) is a Windows Server feature that can replicate and synchronize files across multiple servers in the same or different locations. It does not support non-Windows cloud, Unix/Linux or NAS file systems, has scaling and performance limitations, no file locking when files are in use or version management, and problematic debugging.

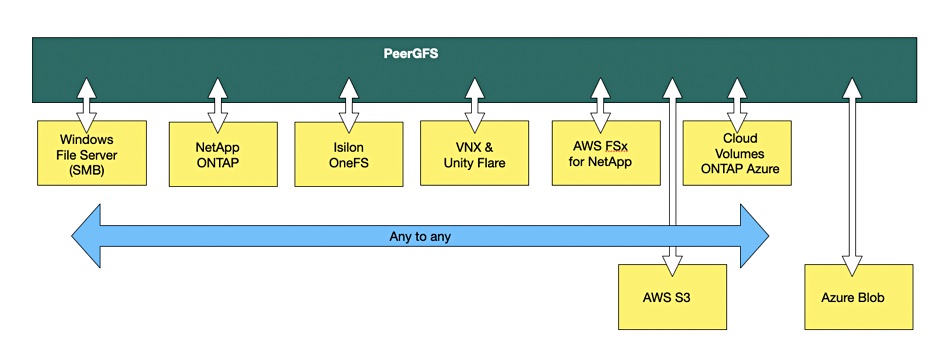

Peer says PeerGFS fixes these problems and provides a distributed file system service layer above Windows File Server. It supports NetApp ONTAP and PowerScale/Isilon filers, on-premises and, where appropriate, in the public cloud. Both NFS and SMB were supported originally but Peer “pulled out of NFS because it didn’t scale.”

Amazon S3 and Azure Blob support has also been added. Tam said Peer tends to replicate to S3 or Azure Blob and not from those targets. S3 and Blob are separate from a distributed file system. According to Tam: “Object is a backup for file systems for our customers.”

The company has taken in no venture capital funding whatsoever and says it was profitable since it started trading. It has operated in a specific niche, gradually extending outwards from its Windows Server base to add in support for NetApp ONTAP, Isilon and PowerScale, and also S3. AWS FSx for NetApp is now supported as is Cloud Volumes ONTAP for Azure. Azure NetApp Files support is a work in progress.

Tam said: “We might look at supporting Qumulo in the future. It has a massive media and entertainment presence.”

Peer competes with CTERA, DataDobi, DataDynamics, Egnyte, Komprise, Nasuni, Panzura, and WANdisco. All these companies have different products and services in the file and object replication, migration, synchronization, and analysis markets, and partial overlap with each other’s products.

Under the radar

Peer has three offices in the US and three in Europe, around 100 employees, and 1,200 customers with active support contracts. Sales are split roughly 50:50 between direct and the channel – with Dell EMC, NetApp, and Nutanix included as channel partners. There is a 60-35-25 percent sales split between the North America, EMEA, and APAC respectively.

Tam said: “We are about twice the size of Nasuni’s corporate accounts business.”

Peer has a new product program rolling out and needs to raise its profile, particularly against the migrators and cloud file system suppliers like Nasuni and CTERA. Tam said Peer’s main differentiation is that its replication does not involve scanning a complete file system, apart from the initial full scan for a new customer on day one. It is driven by events, a file creation write or delete, or folder creation or delete, occurring in the source system’s file event log, which Peer accesses through an API, such as Dell EMC’s CEE (Common Event Enabler).

He told B&F: “We take each company’s file event stream and normalize it, coalescing three events in one company’s stream to one in another’s if necessary.”

This means it is real-time and asynchronous. This facilitates an active:active relationship between the source and target systems for disaster recovery failover and failback. Not an active:passive one.

No filer replacement ambition

Peer has no wish to replace the edge file systems or the core data centre filers with a cloud-based global file system, which is the Nasuni and CTERA concept. It is an adjunct to them, providing a global distributed file system above them but not instead of them. Tam said his customers are relieved because “we are not a file system… They can have a distributed file system service and synchronized files without having to replace their familiar NetApp or Isilon systems… We are not a Cloud NAS like Nasuni, CTERA or Panzura. We overlay our service on top of NetApp, Isilon, etc.”

As far as filer suppliers are concerned, “we are agnostic. We’re storage Switzerland.”

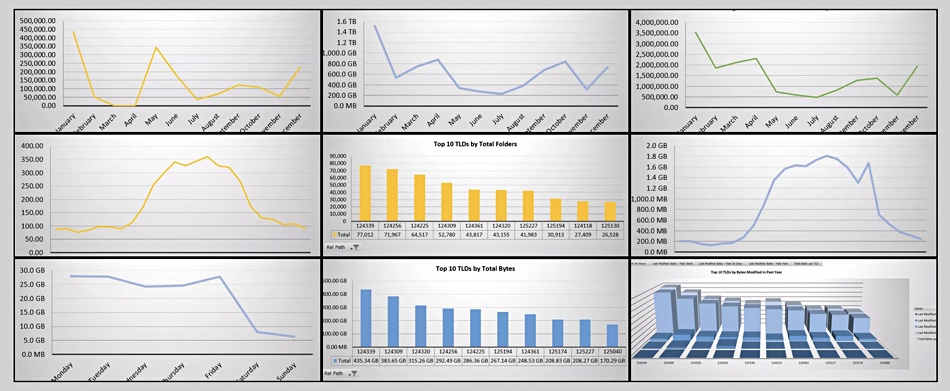

Peer also has a PeerSync Migration product, about which Tam said: “We have done a lot of migration historically but it is not our core business.” And there is PeerFSA, a scan-based File System Analyzer offering which can analyse a file system and report on aspects of it, such as storage used per folder and file, files per folder, and so forth. Tam added: “We give the telemetry of the file system to customers.”

Future developments include tiering of files, cyber-resilience, more dashboard-type analytics and the return of NFS support. We expect to hear more throughout the summer and fall.