Seagate reported slower sequential sales growth for the third quarter of its fiscal 2022 ended 1 April amid component shortages and with government imposed lockdowns in China blamed for disrupting production.

Revenues came in at $2.8 billion, up 2.6 percent year-on-year but down on the $3.2bn booked in the prior quarter. The drive maker generated a $346 million net profit, up 5.2 percent annually. Seagate originally estimated better Q3 income growth, forecasting 6.2 percent, although it revised that guidance downwards as the quarter progressed.

CEO Dave Mosley cited outside pressures: “Seagate’s March quarter financial results were consistent with our revised outlook, with record nearline product revenue driven by cloud customers partially offsetting multiple macro-related headwinds that impacted other end markets, particularly video and image applications, and pressured profitability.”

He added: “Our focus is on mitigating these external challenges through ongoing expense discipline, new pricing strategies and operational efficiencies.” He talked of taking aggressive actions in these areas.

The company said video and image apps (VIA) demand was affected by non-HDD component shortages and COVID-19 lockdown measures, particularly in China. PC-related demand sank as OEMs bought fewer drives. The bright spot was mass-capacity nearline drive revenues, up 24 percent annually, with capacity shipped up 23 percent year-on-year, thanks to cloud customers bulking up their disk drive estates.

Financial summary

- Gross margin – 28.8 percent, up 3 percent annually, down 10 percent quarter-on-quarter

- Free cash flow – $363 million, up 32 percent year-over-year

- Diluted EPS – $1.56, up 12 percent year-on-year, down 30 percent quarter-on-quarter

- Operating expenses – $345 million, 5 percent higher year-on-year

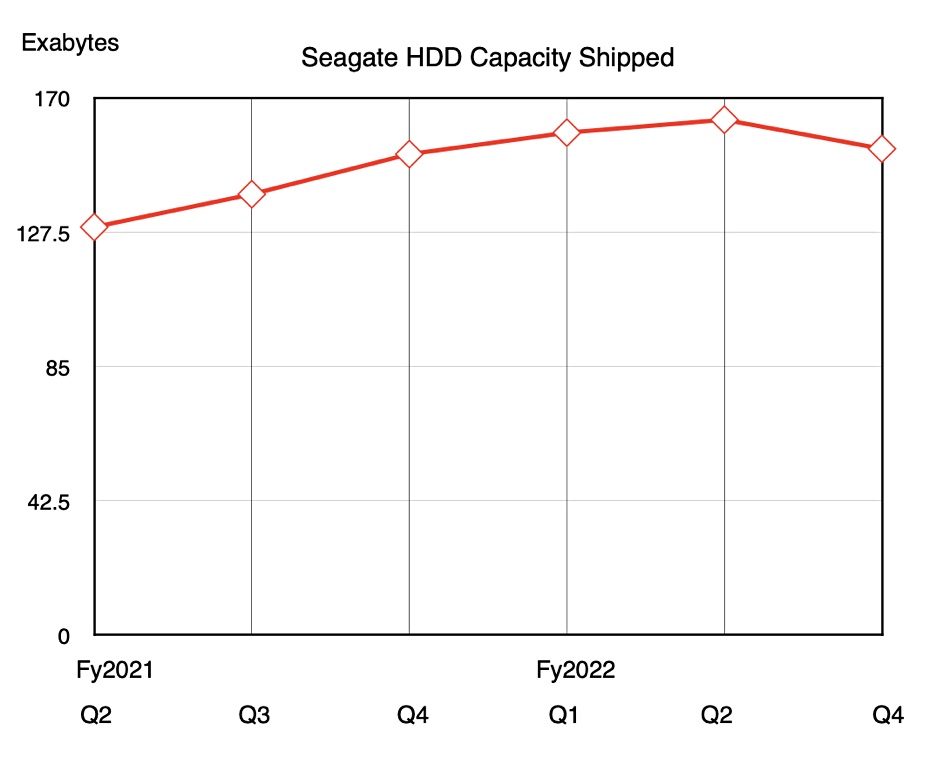

Overall disk drive exabytes shipped were lower than the previous two quarters, as the chart shows:

This was unexpected as capacity shipped was on a seemingly inexorable rise. The nearline increase did not compensate for the lower VIA and legacy drive revenues.

In the earnings call, Mosley revealed that Seagate is “shipping 20-plus terabyte drives in high volume” and expects unit shipments “to more than triple quarter-over-quarter in Q4 to well over 1 million units. This puts us on a pace for the company to achieve crossover with 18-terabyte drives early in the new fiscal year.”

Mosley repeated the point, saying: “The 20-plus terabyte products… represents the highest capacity drives commercially available today.” But Seagate has not announced any 20-plus TB drives, only reaching 20TB with the Exos X20. We expect an announcement soon. He also said Seagate had “30-plus terabyte HAMR products under development” and almost ready.

The VIA market, affected by delays to new security surveillance and smart city infrastructure projects due in large part to physical installations being hindered, should pick up in the second half of the year, Mosley hopes.

Seagate’s outlook for the next quarter was affected by industry-wide supply challenges from the ongoing conflict in Ukraine and COVID restrictions, which are constraining growth over the near term. It is expecting revenues of $2.8 billion plus or minus $150 million, which would represent a 6.7 percent decline year-on-year at the mid-point.

Mosley did say Seagate was convinced that in general there would be a very strong second half of the calendar year. As for legacy drives, he said: “the legacy market is not going down very much anymore. So flat is probably the way I’d call it for a couple of quarters.” On that basis we should see a return to exabytes shipped growth.

Disk industry analysts will now be looking at Western Digital to see if its forthcoming results are similarly affected. They are scheduled to come out later today.