The contamination of a chemical used to make 3D NAND that hurt output at Kioxia and Western Digital’s joint venture NAND fabs at Yokkaichi and Kitakami in Japan has been fixed.

WD said the plants’ contamination was resolved in late February, although it never clarified what the specific chemical was.

It said normal production has restarted and will ramp up in its third and fourth fiscal quarters, meaning the January-June period. Overall its flash output will be reduced by approximately seven exabytes. This is slightly more than the initial 6.5EB estimate and represents 29 per cent of WD’s 2022 Q2 output.

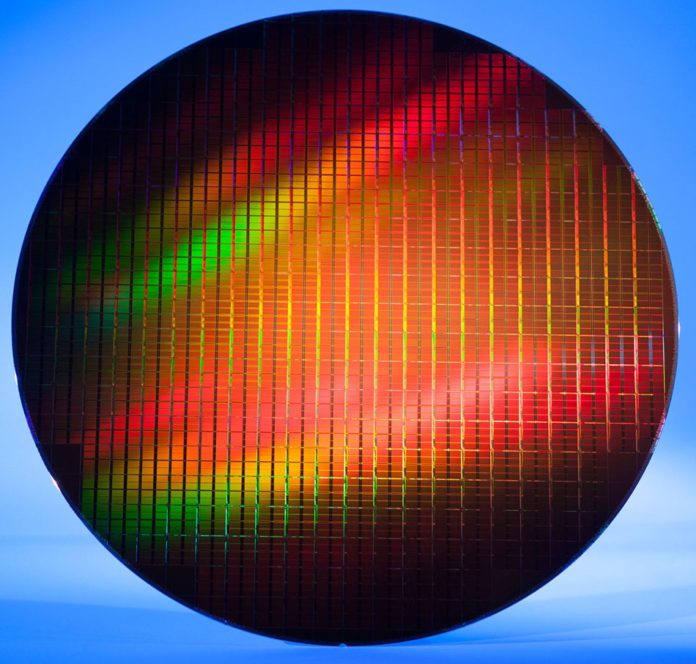

Kioxia’s equivalent statement was much blander: “As the manufacturing plants ramp back to full production, Kioxia anticipates that 3D flash memory BiCS FLASH shipments will be affected. The company will continue to make every effort to minimise customer impacts.”

According to Wells Fargo analyst Aaaron Rakers, WD and Kioxia take approximately 40 and 60 per cent shares of the NAND chip output from the two plants so we can expect Kioxia to lose about 11EB of output in the same January-June period, meaning an 18EB overall hit.

WD reassessed revenue guidance for its third 2022 quarter, ending April 1, and now expects revenues to be $4.2bn-$4.4bn – $4.3bn at the mid-point. It had previously guided revenues for the quarter to be between $4.45bn and $4.65bn – $4.55bn at the mid-point.

This implies, Rakers says, that the output loss will cost WD $250m in its Q3 and we can expect a greater financial hit at Kioxia as it takes more of the fabs’ output. The loss should be lower in WD’s Q4 and Kioxia’s equivalent quarter as production will have ramped higher than the Q3 level.

But Rakers told subscribers he considers “NAND Flash price increases more than offsetting WD’s bit shipment impact – leaving us to consider increased F4Q22 estimates” for WD rather than lower ones.

Kioxia and WD accounted for 33 per cent of the NAND market in the second 2020 quarter. Research house TrendForce agrees with Rakers, estimating NAND prices could rise by 5 to 10 per cent in the April-June quarter.