Airbyte has announced an integration with Datadog, the monitoring and security platform for cloud applications. It gives customers the ability to monitor and analyze data pipelines with reporting of nearly 50 metrics – at no additional cost. Users get an overview of the overall performance of Airbyte data pipelines from a centralized location, detection and instant alerts on failing syncs or connections, and notifications on long-running jobs, which could indicate latency issues. The integration is available immediately. To begin using it, existing Datadog customers can configure their Airbyte deployments to send metrics to Datadog. Users not already on Datadog can sign up and get started with a free trial. Users not already on Airbyte can sign up for free.

…

Backup software supplier Bacula has revealed its product roadmap. It aims to:

- Further heighten security levels via smart alerts on suspicious patterns

- Detect Data Poisoning

- Monitor and detect anomalies in your data

- Get more insights on how your data evolves and changes

- Get details about infected, corrupted or error files in your infrastructure

- Improve security levels of your environment with personalized recommendations

- Detect any insecure or inadvisable configuration

- Plus possible OpenStack support

…

CData has achieved Google Cloud Ready – Cloud SQL Designation for Cloud SQL, Google Cloud’s fully managed relational database service for MySQL, PostgreSQL, and SQL Server. We’re told that this designation enables organizations to simplify data connectivity in the cloud, eliminate data silos, and break down barriers to insights. CData says it provides enterprise data connectivity offerings that ingest live data from more than 250 applications, systems, and data sources directly into Cloud SQL to support analytics, reporting, and other business initiatives.

…

Data protector Commvault has hired Ian Wood to be its as Senior Sales Engineering Director for the UK & Ireland. He spent 23 years at Veritas, where most recently he was Senior Sales Engineering Director for the UK & Ireland.

…

Cloud database supplier Couchbase reported revenues of $43.1 million, up 8 percent anually, for its Q2 ended July 31. Total ARR as of that date was $180.7 million, up 24 percent. Counchbase says it “is not able, at this time, to provide GAAP targets for operating loss for the third quarter or full year of fiscal 2024 because of the difficulty of estimating certain items excluded from non-GAAP operating loss that cannot be reasonably predicted, such as charges related to stock-based compensation expense. The effect of these excluded items may be significant.” Operating loss was $21.9 million versus an operating loss of $15.2 million a year earlier.

…

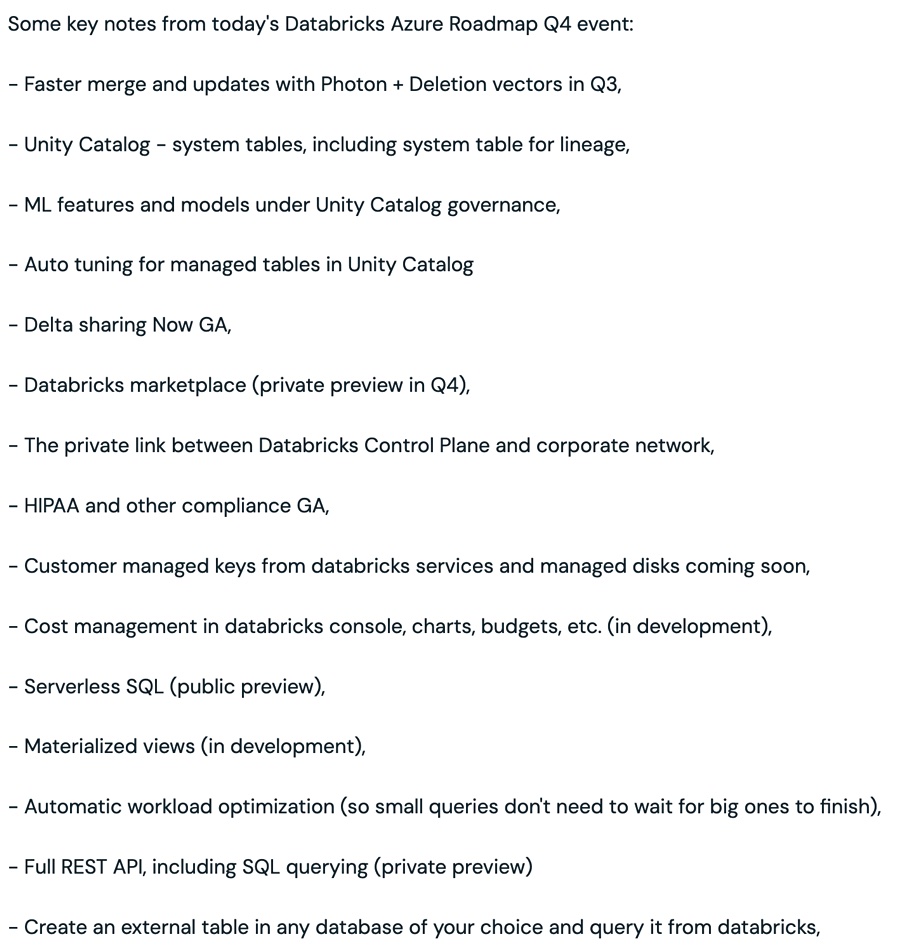

Databricks has revealed an extensive product roadmap for its Azure version, with more than 20 bullet point items. Here’s a sample:

…

GRAX, a supplier of Salesforce data management and protection, has released GRAX Lite for free Salesforce backup and recovery. It enables backups into AWS or Azure cloud storage environments and runs entirely in the customer-owned cloud. There are automated incremental backups of Salesforce data, including files and attachments, with granular control; users can restore individual records. More info here.

…

SaaS backup supplier HYCU’s CEO and co-founder, Simon Taylor, has a book coming out: Averting the SaaS Data Apocalypse. It will be launched at the Empire Boston in Boston, MA, on September 12. Attendees are promised “a captivating presentation by Simon offering insights into the challenges and solutions presented in the book.”

…

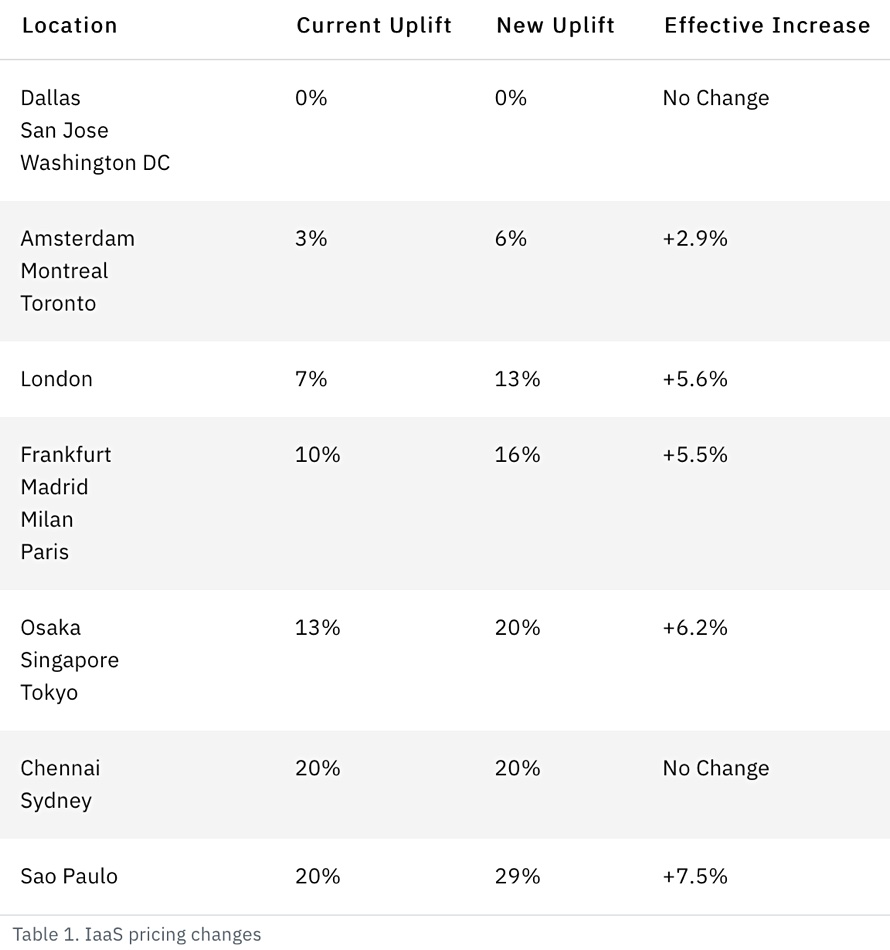

IBM’s public cloud has raised its prices outside the USA, effective January 1, 2024. The rises are listed here. They are presented as uplifts from US base prices and vary from 2.9 to 7.5 percent.

…

InfluxData, which built the time series platform InfluxDB, has announced InfluxDB Clustered, a self-managed time series database for on-prem or private cloud deployments, deployed natively in Kubernetes. It says this completes its commercial product line developed on InfluxDB 3.0, its rebuilt database engine optimized for real-time analytics with higher performance, unlimited cardinality, and SQL support. InfluxDB Clustered has 100x faster queries on high-cardinality data, 45x faster ingest, and 90 percent storage reduction cost compared to the preceding InfluxDB Enterprise. It has encryption at rest and in transit, single sign-on, attribute-based access control, and air-gap support. InfluxData also recently announced the availability of InfluxDB Cloud Dedicated, a fully managed and scalable single-tenant InfluxDB cluster based on the InfluxDB 3.0 architecture and intended for large-scale time series workloads.

…

Kingston has a new key fob-sized, all-black external SSD, the XS1000 with USB 3.2 gen 2 performance and 1TB or 2TB capacity. It sits alongside the existing XS2000 with its up to 4TB capacity. Both weigh less than 29 grams. The XS1000 provides read speeds up to 1,050MBps, write speeds up to 1,000MBps, and comes with a USB-C to USB-A cable.

…

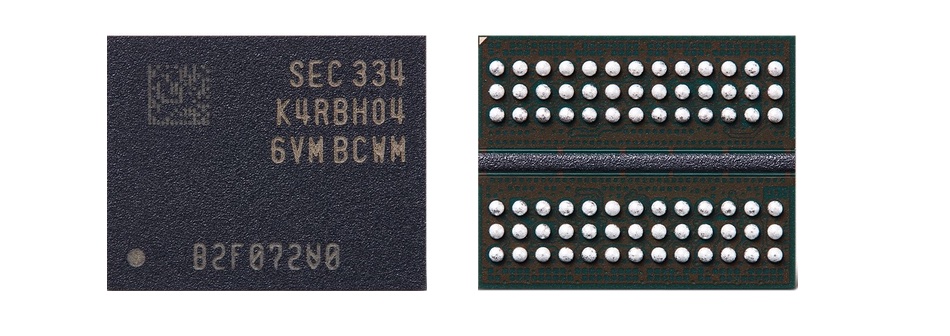

Samsung has doubled the capacity of its 16Gb DDR5 chip to 33Gb, using 12nm-class process technology, and with the same package size – but the die size is probably twice as big. It says this enables the production of 128GB DRAM modules, and it can see a route to producing 1TB DRAM modules with this technology. Development is fast as 16Gb DDR5 DRAM die production only started in May. The 32Gb die does not use Through Silicon Via (TSV) technology (electrically conducting holes through the die), unlike the existing 16Gb die. Specifically, “by using Samsung’s 32Gb DRAM, the 128GB module can now be produced without using the TSV process, while reducing power consumption by approximately 10 percent compared to 128GB modules with 16Gb DRAM.” Mass production of the new 12nm-class 32Gb DDR5 DRAM is scheduled to begin by year-end. What Samsung uses instead of TSVs is not revealed.

…

SK hynix is investigating how its NAND and LPDDR5 memory products are being used in Huawei’s Mate 60 Pro smartphone in contravention of US tech export restrictions. Bloomberg reported on the phone including SK hynix components based on a teardown exercise.

…

The SNIA’s Storage Developer Conference (SDC23) runs from September 18 to 21 in Fremont, CA. Presentation tracks include Magic Memory Access, Data Security, Emerging Technologies, Cloud Storage, DNA Data & Archival Storage, DPUs, AI/MI, and Data Placement. SNIA members get a $300 discount. View the sessions here. Register attendance here.

…

SAN supplier StorPool has announced its integration with Proxmox Virtual Environment (VE), a hyperconverged infrastructure hosted KVM hypervisor that can run operating systems like Linux and Windows on x64 hardware. Users get a block storage data platform, running on standard servers available as a fully managed storage-as-a-service (STaaS) bundle. Storpool says its Proxmox VE integration provides millions of IOPS for the most demanding applications.