Everspin, a pioneer in MRAM, recently released its earnings report, shedding light on the progess for the technology.

The company supplies Spin-Transfer Torque Magneto-resistive RAM (STT-MRAM) non-volatile memory devices. Thanks to their DRAM-class speed, they function as storage-class memories. However, like Intel’s Optane, the technology has failed to break through the NAND-DRAM gap to become a mainstream technology. Factors such as high chip prices have affected sales volume, while low manufacturing volume has kept costs elevated.

Everspin also supplies Toggle MRAM, a variant of STT-MRAM with lower density.

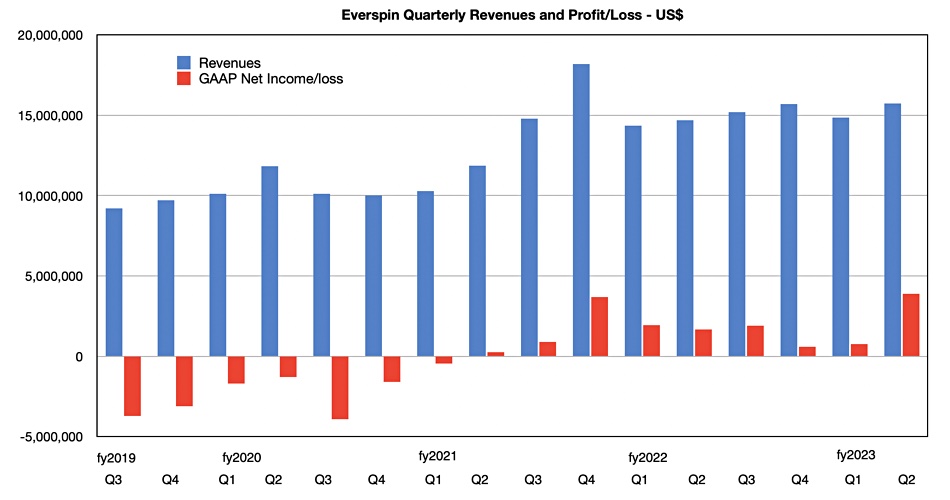

For Q2 of the company’s fiscal 2023 ended June 30, Everspin reported revenues of $15.7 million, surpassing its guidance and equating to year-on-year growth of six percent.

Actual MRAM product sales in the quarter were $13.4 million, up from the $13.22 million recorded a year earlier. Licensing, royalties, patents, and other revenue was $2.3 million, $857,000 higher than in the first quarter, mostly due to Radiation Hard license deals. Radiation Hard MRAM is used to provide memory for FPGA devices that are exposed to high amounts of radiation and used in defense and space applications.

The resulting net profit came in at $3.9 million, up from $1.671 million in the same quarter of 2022.

The company has sustained profitability for nine consecutive quarters. This suggests it is being run as a mature entity with a focus on profitability rather than as a business with high-growth turnover ambitions being run at a loss. Everspin certainly started out as a VC-funded operation, raising $80.3 million across five funding events with a five-phase B-round closing in 2015, culminating in a successful IPO in 2016 under president and CEO Phil LoPresti. Since then, the company has operated independently for eight years.

LoPresti resigned in September 2017, having, as his LinkedIn profile says, “created vision, mission, strategy and business plan to address a $2B market opportunity with a new product roadmap. Identified staffing requirements and expanded staff to deliver and support $100M+ revenue.” Despite these ambitious goals, six years later, the company is tracking to a $60 million annual run rate.

Board member Kevin Conley succeeded LoPresti as CEO in September 2017 but stepped down in January 2021. Darin Billerbeck, ex-CEO of Lattice Semiconductor and Zilog, joined Everspin’s board in 2018. He became Everspin’s executive chairman in March 2019 then interim CEO when Conley quit following reduced earnings. Sanjeev Aggarwal, previously VP R&D and CTO, became president and CEO in March 2022, with Billerbeck retaining his exec chairman role.

Commenting on the latest results, Aggarwal said: “Everspin [managed] through the supply chain constraints for our Toggle business and delivering a strong performance on our Radiation Hard programs. We continue to exceed expectations on our Radiation Hard programs to deliver STT-MRAM based solutions for a ‘high-density memory array’ and a ‘distributed configuration memory’ for instant-on FPGAs with multiple time programmability. Healthy backlog in our industrial and automotive markets indicate strength in our core businesses.”

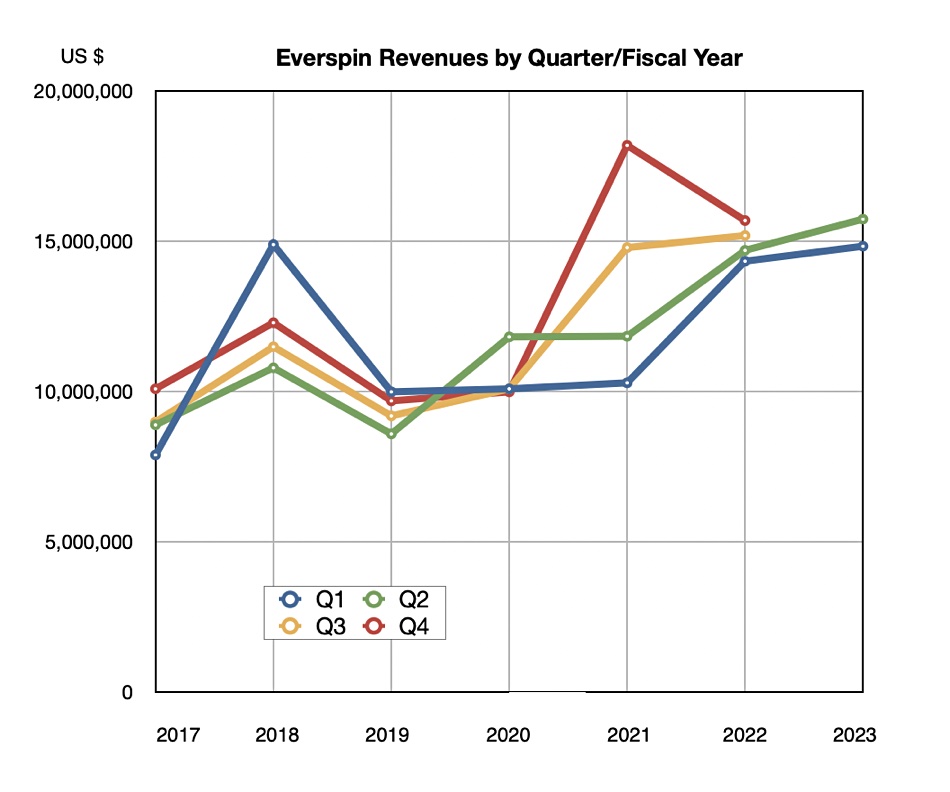

A look at Everspin’s revenue history shows a rise after the first 2021 quarter to a peak in the fourth quarter of that fiscal, caused by a patent license agreement. But then the wind went out of its sales, so to speak, and it has been generating around $15 million per quarter in revenue since then.

Charting its revenues by fiscal year (above) we can see it passed though a memory market downturn in fiscal 2019, grew somewhat patchily though 2020 and 2021, and is now poised to continue its relatively slow growth.

A cynic would say MRAM is not an emerging technology at all. It is a niche market centered on FPGAs.

Everspin expects next quarter’s revenues to be $15.9 million +/- $500K, and the company warned: “This outlook is dependent on Everspin’s current expectations, which may be impacted by, among other things, evolving external conditions, such as the resurgence of COVID-19 and its variants, local safety guidelines, worsening impacts due to supply chain constraints or interruptions, including due to the military conflict in Ukraine and recent market volatility, semiconductor downturn and the other risk factors.”