Data protector Acronis has become a member of the Microsoft Intelligent Security Association (MISA), an ecosystem of independent software vendors (ISV) and managed security service providers (MSSP). MISA members have integrated their products with Microsoft security technology to build a better defense against increasing cybersecurity threats.

…

Dell’Oro Group predicts that the SmartNIC market will exceed $5 billion by 2028. Accelerated computing will continue to push the boundaries in server connectivity, demanding port speeds of 400 Gbps and higher speeds.

- The total Ethernet Controller and Adapter market, excluding the AI backend network market, is forecast to exceed $8 billion by 2028.

- The majority of accelerated servers will have server access speeds of 400 Gbps and higher by 2028.

- SmartNICs are expected to cannibalize standard NICs during the forecast period.

…

HPE has hired Jim O’Dorisio as its SVP and GM for storage, replacing the promoted Tom Black. O’Dorisio comes from being SVP and GM at Iron Mountain. He was VP and COO of business and technology at EMC before that, in the period before Dell bought EMC, spending 14 years at EMC altogether. He’ll report to Fidelma Russo, EVP of Hybrid Cloud at HPE, as does Black. O’Dorisio and Russo overlapped at Iron Mountain and EMC.

…

Storage industry analyst firm DCIG has named Infinidat‘s InfiniBox and InfiniGuard solutions as among the top five cyber secure backup targets. DCIG reviewed 27 different 2 PB+ cyber secure backup targets as part of its independent research in the enterprise market where ransomware and malware are first attacking backup targets to hinder an enterprise from recovering from a cyberattack. DCIG opted to solely focus its report on cyber secure backup targets that supported NAS interfaces. The top five suppliers/products were ExaGrid EX189, Huawei OceanProtect X9000, Infinidat InfiniBox/InfiniGuard, Nexsan Unity NV10000, and VAST Data’s Data Platform. The “2024-25 DCIG TOP 5 2PB+ Cyber Secure Backup Targets Global Edition” report is now available here.

…

Neurelo emerged from stealth, introducing a comprehensive and extensible data access platform that enhances developer productivity by simplifying and accelerating the way they build and run applications with databases. The Neurelo Cloud Data API Platform is generally available as of today, providing auto-generated, purpose-built REST and GraphQL APIs, AI-generated custom-query endpoints, deep query observability, and Schema as Code. The company has secured $5 million in seed funding led by Foundation Capital with participation from Cortical Ventures, Secure Octane Investments, and Aviso Ventures.

Torsten Volk, managing research director, Enterprise Management Associates (EMA), said: “Neurelo turns data sources into centrally controlled and governed APIs that developers can simply consume instead of having to worry about the intricacies of the specific type of database. The ability for DBAs, cloud admins, IAM admins, and other relevant roles to ensure consistency and compliance of individual databases organization-wide instead of chasing after each data source separately is a significant upside of the Neurelo platform.”

…

Belgian company MT-C S.A., which produces the Nodeum HPC data mover product, is renaming itself Nodeum.

…

Own Company, a SaaS data protection supplier, launched a global Channel Partner Program so resellers and system integrators can prevent their customers from losing mission-critical data and metadata. With automated backups and rapid recovery, Own partners will be equipped with the resources, skills, and support necessary to generate new lines of business and increase profit margins.

…

Scale-out filer Qumulo announced the availability of Superna Data Security Edition for Qumulo and its Ransomware Defender, which automates real-time detection of malicious behaviors, false positives, and other events consistent with ransomware access patterns for both SMB and NFS files. Superna Data Security Edition for Qumulo detects malicious behavior at the onset (often referred to as the “burrowing event”) and also automates access lockout. Superna’s native integrations with SIEM, SOAR, and ticketing platforms automatically alerts administrators and other users involved in incident response, providing them with the information required to accurately prioritize the incident. Get more information here.

…

Wells Fargo analyst Aaron Rakers met Seagate CFO Gianluca Romano and told subscribers: “Seagate is not focused on, nor does it expect, its leadership position in HAMR-based HDDs to drive nearline market share expansion.” No need for Western Digital and Toshiba to worry then.

…

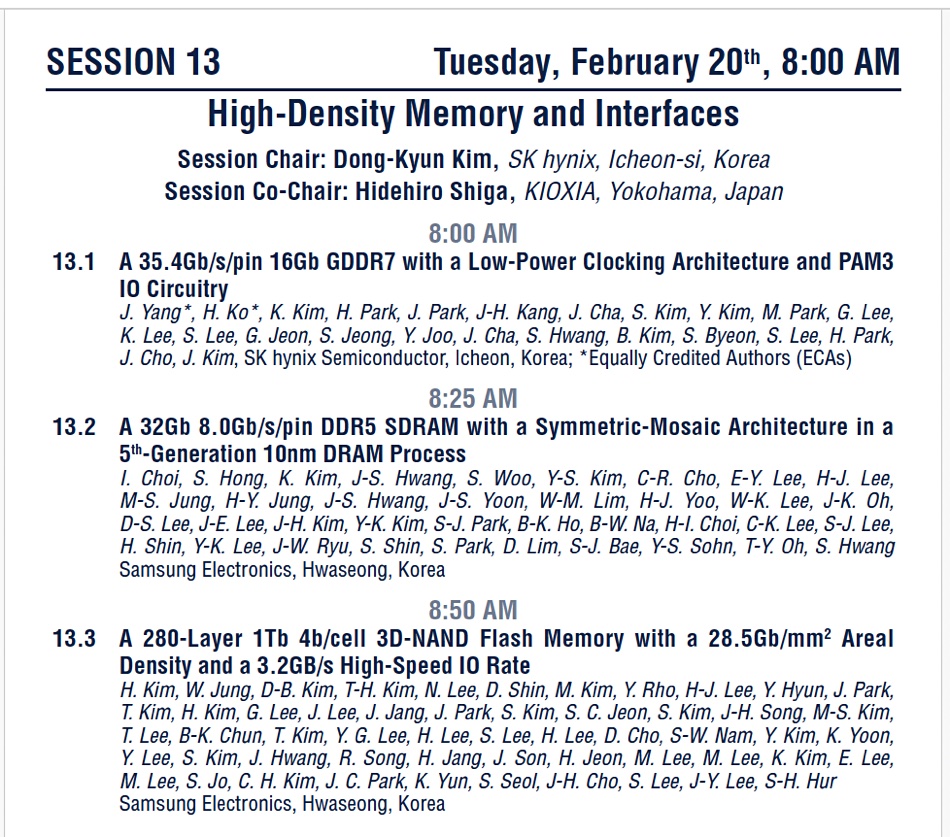

The Financial Times reports that SK hynix will build a plant in Indiana to stack DRAM chips into HBM units for packaging with Nvidia GPUs in other, possibly TSMC, plants in the USA.

…

The SNIA’s Storage Management Initiative (SMI) announced that the Swordfish v1.2.6 bundle is now available for public review. Swordfish provides a standardized approach to manage storage and servers in hyperscale and cloud infrastructure environments. Swordfish v1.2.6 key features include:

- New “NVMe-oF and Swordfish” white paper, which discusses how NVMe over Fabrics (NVMe-oF) configurations are represented in Swordfish Application Programming Interface (API).

- New metrics for FileSystem, StoragePool, StorageService, and enhancements to VolumeMetrics.

- New mapping and masking models using Connections in the Fabric model and deprecates StorageGroups.

- Support for new volume properties: ProvidingStoragePool, ChangeStripSize, Asymmetric Logical Unit Access (ALUA) to manage reservations

- Enhancements to NVMe Domain Management, including ALUA support.

- Updates to NVMe namespaces, such as simplified Logical Block Address (LBA) Format representation and multiple namespace management.

…

Startup Zilliz, which supplies the open source Milvus vector database, has a forthcoming Zilliz Cloud service update, with RAG/GenAI, recommendation systems, and cybersecurity/fraud detection capability. RAG/GenAI will empower autonomous agents replacing human support agents. Recommendation systems will be powering ads, product, and news recommendations based on user preferences and actions taken. The cybersecurity features will be applied in banking transactions and antivirus systems to quickly identify anomalies in new data by finding similarities within a short time frame.