In its latest storage market review for the first quarter of 2023, Gartner reports that both NetApp and Pure Storage experienced a decline in market share.

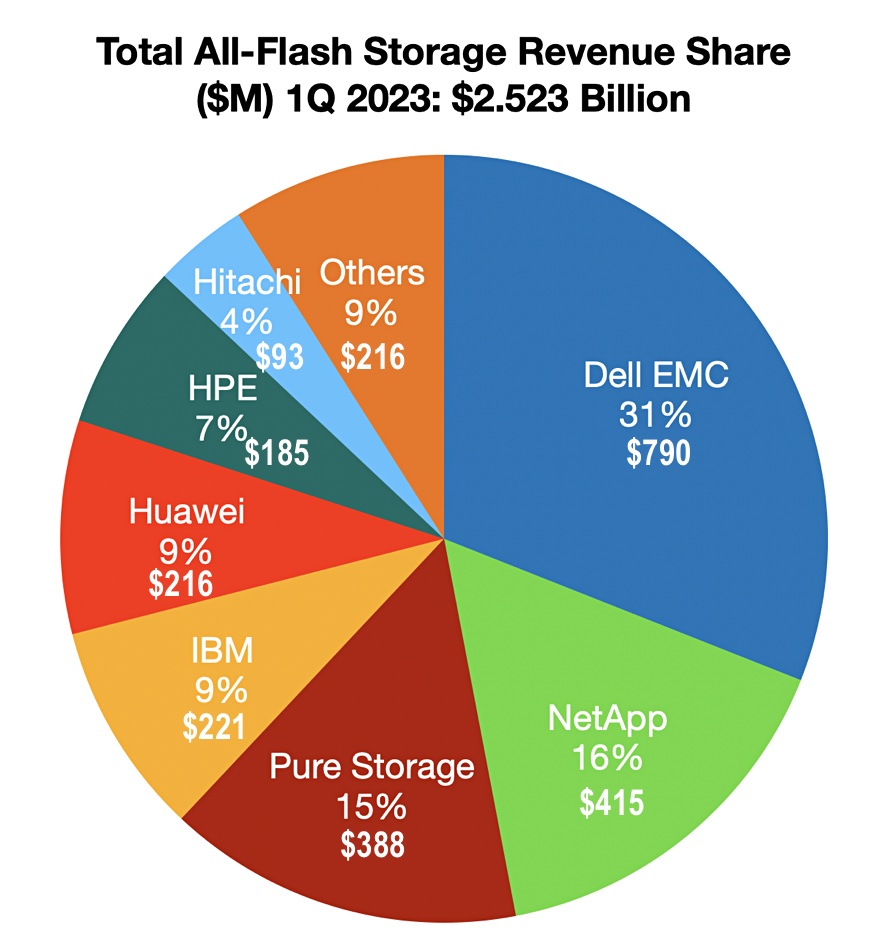

The total all-flash market reached $2.523 billion, representing 50.4 percent of the overall storage market in monetary terms, with a year-on-year growth of 4 percent. However, it was down 22 percent compared to the previous quarter. Flash storage accounted for 31 percent of the total capacity shipped, marking a significant increase from the prior quarter’s 18.2 percent and a notable rise from the 16.8 percent recorded a year ago.

The supplier revenue shares are shown in a pie chart compiled by Gartner:

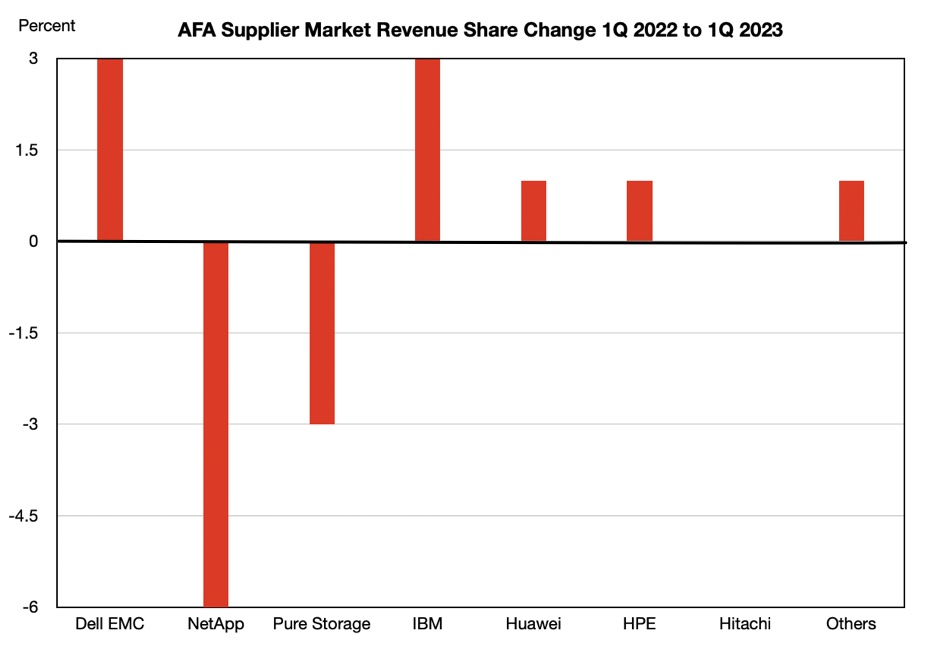

According to Wells Fargo analyst Aaron Rakers, Dell’s flash revenue rose by 17 percent year-on-year and 12 percent quarter-on-quarter, while HPE’s all-flash revenue also saw a 17 percent year-on-year bounce. However, Pure Storage’s revenue suffered a decline of 10 percent year-on-year and a substantial 24 percent plunge quarter-on-quarter, leading to a decrease in its market share from 17.7 percent a year ago to the current 15.4 percent in the all-flash array (AFA) market.

Rakers further mentioned that Pure Storage’s all-flash capacity share of 624EB increased by 5 percent year-on-year, but remained unchanged compared to the previous year at 4.7 percent.

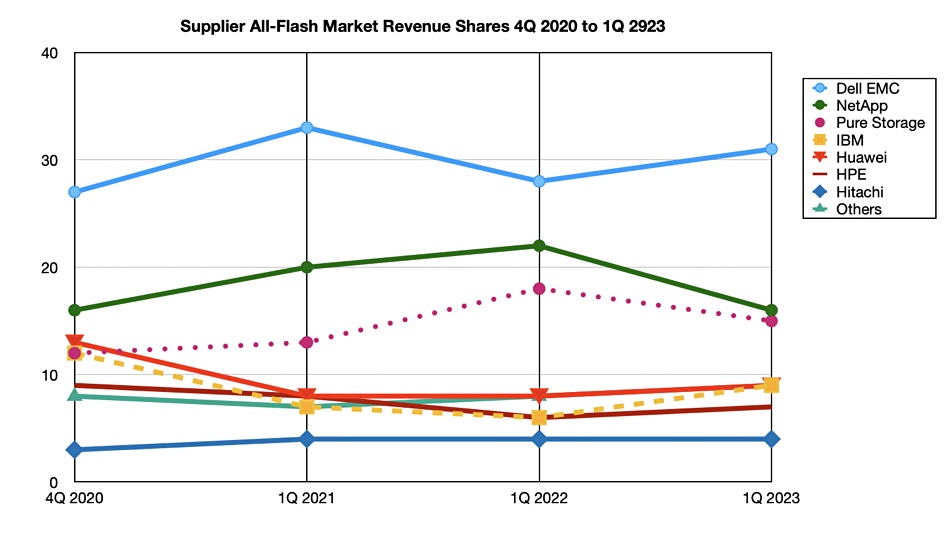

While there is no detailed insight into the share changes of other suppliers, prior data from B&F articles indicates that NetApp’s market share dropped from 22 percent a year ago to 16 percent in Q1 2023. Pure Storage’s share also experienced a decline, although not as significant, meaning it narrowed the gap with NetApp. IBM, on the other hand, has been catching up with Huawei and is gradually distancing itself from HPE.

Among the Y/Y revenue share gainers were Dell EMC, IBM, Huawei, HPE, and the “Others” category. These changes in revenue share have been charted to illustrate their magnitude.

Overall, both NetApp and Pure Storage lost share to other players in the market.

The rest of the storage market

As for the total storage market, Gartner reports that it was worth a little more than $5.005 billion, showing a modest one percent year-on-year growth. Primary storage increased by one percent year-on-year, while secondary storage and backup and recovery rose by 4 percent and 9 percent, respectively.

Hybrid flash/disk and disk revenues declined 2 percent year-on-year. The total external storage capacity shipped experienced a 24 percent year-on-year growth, with secondary storage capacity witnessing a massive 70 percent increase, backup storage rising by 18 percent, and primary storage capacity seeing a modest 3 percent rise.