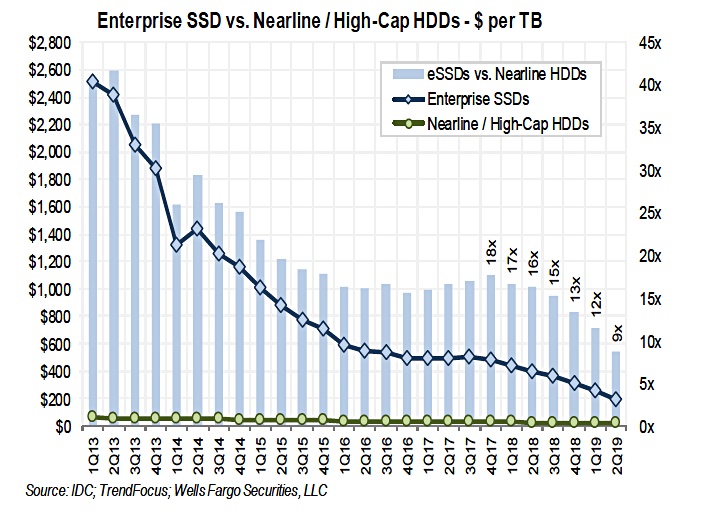

Aaron Rakers, the Wells Fargo analyst, thinks enterprise storage buyers will start to prefer SSDs when prices fall to five times or less that of hard disk drives. They are cheaper to operate than disk drives, needing less power and cooling, and are much faster to access.

So when will the wholesale switch from nearline HDD to SSDs begin? We don’t have a clear picture yet but a chart of $/TB costs for enterprise SSDs and nearline disk drives shows how much closer the two storage mediums have come in the past 18 months.

It is unwise to extrapolate too much but it is clear the general trend direction is that Enterprise SSD cost per terabyte is falling faster than nearline disk drive cost/TB. Our chart below shows the price premium for enterprise SSDs has dropped from 18x in the fourth 2017 quarter to 9x in the second 2019 quarter.

Business disk drive sales are mostly dependent on high capacity – 8TB to 14TB, spinning at 7.2K rpm – drives that to store secondary or nearline data. Fast mission-critical disk drives, spinning at 10K to 15K rpm, have largely given way to faster access SSDs.

Disk drives are getting a capacity jump from the use of heat- and microwave-assisted magnetic recording (HAMR) and a speed boost through dual read-write head technology.

However, SSD capacities are growing even faster. QLC (4 bits/cell) NAND adds 25 per cent more capacity, compared to current TLC (3bits/cell). And layer counts in 3D NAND are set to rise from the 64-layer mainstream and arriving 96-layer product to 128-layers and beyond.

A 128 layer 3D NAND die will have twice the capacity of a 64-layer die and a third more than a 96-layer die. With our simplistic math that means a 128Gbit 64-layer TLC die will become a 340Gbit 128-layer QLC die and cost substantially less per TB to make than the 64-layer TLC 128Gbit version.

And PLC (5bits/cell) flash is being developed, with 25 per cent more capacity than QLC flash.

This time next year the three disk drive makers -Seagate, Toshiba and Western Digital – could see their nearline business start spinning down.

Toshiba and Western Digital are partners in NAND fabrication and make and sell SSDs. Seagate has no NAND fab interest and is a small player in the SSD market, making it the most vulnerable to SSD cannibalisation of the nearline disk business.

Micron’s against this view

Colm Lysaght, Micron’s Senior Director, Marketing Strategy and Innovation, took issue with this and told Blocks & Files by email: “I don’t argue with the cost trends shown ]above], and clearly SSD price/GB will get closer to HDD price/GB over time.

“I also don’t dispute the lower TCO of an SSD compared to an HDD, nor the faster access.

“However, the raw number of EB needed for a “wholesale switch” from nearline HDD to SSD is far too large for the NAND flash industry to contemplate. The capital investment needed to generate the EB required (which will continue to grow at a rate of about 30 per cent per year) is prohibitively expensive.

“SSDs may nibble (and maybe even munch) at the nearline HDD market, but both will coexist for many years to come.”

Good points, all.

Rakers rebuts

Wells Fargo senior analyst Aron Rakers told subscribers: “While we see most investors already appreciating the SSD replacement of mission-critical HDDs, we have seen little debate at this point over the possible encroachment into nearline HDD workloads.

“However, we think this could evolve as the NAND industry looks to integrate / leverage QLC-based 3D NAND (note: Pure Storage expected to intro new QLC-based all-Flash arrays for lower-performance primary storage applications next week) and we have also seen SSD $/GB fall to sub-10x vs. nearline HDDs.”

Our take is that SSD encroachment of nearline drives could start but will take many years to complete, if it does complete, because vast amounts of new SSD foundry capacity will be needed.