Nutanix delivered poor topline results for its fourth fiscal 2019 quarter and full year, with quarterly revenue down and deeper losses. A good outlook, a smaller loss per share than expected plus internal growth indicators made it all okay and shares rose 19 per cent in post-market trading.

But when will the hyperconvergence vendor stop losing money?

Wells Fargo senior analyst Aaron Rakers said “Nutanix’s F4Q19 results and F1Q20 (Oct ’19) guide should be considered net-positive; albeit it remains difficult to envision Nutanix’s path to profitability.”

Jason Ader, an analyst at William Blair, said: “We believe Nutanix has… a path to cash breakeven within the next few years…. While Nutanix’s subscription transition has been painful, it should yield better visibility/predictability, customer lifetime value, and sales leverage over time.”

Cash breakeven “within the next few years” could mean three to five years time, and that’s breakeven, not a profit.

The Q1 fy2020 outlook is for revenues between $300m and $310m, which compares to $313.3m reported in Q1 fy2019. Shares rose 13.5 per cent after the results were announced.

Background

Nutanix believes customers want and need subscription software that can run on-premises and in the public cloud. Tying software to hardware is the wrong way to go in a hybrid cloud era. Nutanix says it is easier for a hybrid cloud with a Linux-based on-premises offering such as Nutanix to work with the big public cloud players which also use Linus, than non-Linux competitors such as VMware.

Consequently it is shifting from hardware life-bounded license sales to subscription billing. And it is also getting out of selling hardware. The transition has resulted in “revenue compression”. Nutanix says this is necessary pain and it will gain more predictable, consistent and larger revenues as a result of the two switches. It also claims competitors will have to go through the same painful transition.

Additionally the company reported revenue generation issues last quarter, which it attributed to a spending switch from lead generation to engineering and product development at the start of fiscal 2019. There was also a shortfall in sales rep headcount and sales execution issues in the USA.

Lastly, competitors NetApp and HPE have reported a slowdown in large systems sales to enterprises, due to macro-conomic factors such as trade disputes, and this may have affected Nutanix too..

The numbers

In a statement CEO Dheeraj Pandey declared: “We delivered a solid fourth quarter and believe our performance reflects our execution improvements and the meaningful progress we have made transitioning our business to a subscription model.”

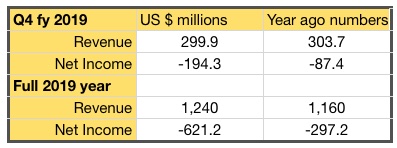

The revenue and net income numbers were:

Q4 fy2019 revenues were down 1.3 per cent while the loss more than doubled. Full year revenues increased 6.9 per cent and the loss for the year also more than doubled.

Under the surface of this picture of a high-growth company apparently running towards the buffers, there are encouraging signs.

- Q4 revenue came in at the top end of its $290m -$300m guidance.

- Nutanix added 990 new customers in the quarter, taking the total to 14,180, and the highest increase for 6 quarters.

- Sales and marketing headcount increased by 254, compared to 107 and 207 in the two prior quarters respectively.

- Exited quarter with more than 2.5 times the order backlog of the prior quarter.

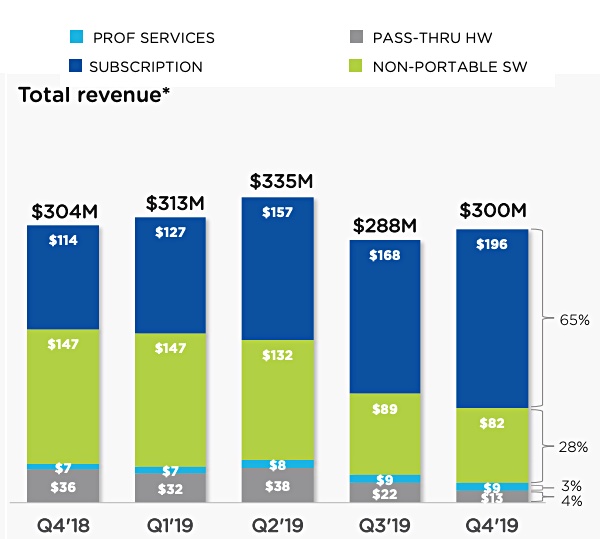

- Subscription revenues were $196m, up 72 per cent, representing 65 per cent of revenues. The company is targeting 75 per cent subscription revenues in 12 months.

- Software and support revenues rose seven per cent to $286.9m.

- Gross margin of 80 per cent rose 2.3 per cent and is a record.

- Loss per share of $0.57 vs analyst expectations of $0.64

Free cashflow was -$33.3m though, compared to $6.5m a year ago.

Subscriptions soaring

A look at the revenue mix trends shows the rising subscription revenue trend:

Sales of software above the basic hyperconverged hypervisor layer rose, CFO Duston Williams noted: ”26 per cent of our deals included a product outside our core offering.” He’s talking about software such as Files, Era for database workloads, Cam and other multi-cloud workflow software.

Earnings Call

Pandey said in the earnings call: “Q4 was a good quarter for us, as we beat Street expectations on total billings and revenue and by $15 million each for software and support buildings and revenue… our Q4 results demonstrated measurable progress in our subscription transformation, our pipeline funnel, our sales re-enablement, our simpler messaging on the platform versus new apps and our hybrid cloud journey.”

He added: “Our solid quarter-over-quarter billings and revenue growth, as well as our progress in sales hiring are clear indicators that our execution is improving and our market remain strong.”

Wiliams said the subscription transition cost Nutanix $20m to $25m in revenues in the quarter.

Asked about signs of macro-economic weakness, he said: “There’s really been no additional signs or signals that we’ve seen.” The effects of its own subscription transition have masked any indication of the enterprise buying slowdown that has affected NetApp and HPE.

Sales force segmentation

Nutanix plans to split its salesforce between the enterprise and to the commercial mid-market. Pandey said: “We have segmented commercial completely out of our enterprise sales figures and [are] building a focused U.S. commercial sales leadership and an organization under them.”

It wants reduced sales person involvement “so prospects can go without any human touch from digital ads to our clusters in the cloud with a few clicks.”

Comment

Are the glory growth days, with 20 per cent plus revenue growth/quarter, over for Nutanix? The subscription transition will last through its fiscal 2020 and there’s no certainty beyond that. The company believes it will be better positioned than icompetitors for the hybrid multi-clouds oftware subscription era, but that means it predicts pain for them, not growth for itself.

Nutanix’ hardware-centric channel has to get used to selling subscription software deals and that’s uncharted waters. But there are good growth signs, including customer growth and the increased number of large deals.

Nutanix is an enigma. It’s like a hot air balloon that’s stopped rising while it changes its fuel to an untried type, hovering in mid-air waiting for the old fuel to burn off and the new stuff to start working

At some stage it has to turn a profit, and that means either growing revenues by more than $200m/quarter, the current net loss, and/or taking cost more than $200m/quarter costs out of the company. The first seems fanciful at the moment and the second … well, let’s not go there.