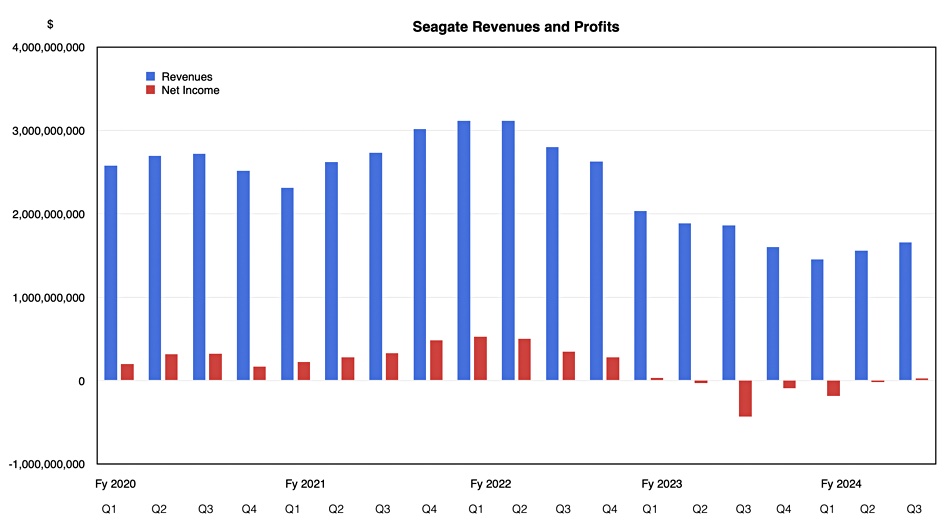

Disk drive supplier Seagate reported its first profit after five consecutive quarters of losses as major buyers upped their nearline high-capacity drive orders. Broadcom has acquired its ASIC assets, including development engineering and related IP, for $600 million in cash.

Although revenues of $1.66 billion beat last quarter’s $1.65 billion guidance, they were down 11 percent year-on-year, with a $25 million profit, just 1.5 percent of its revenues, contrasting with the year-ago $433 million loss. It made $1.18 billion from high-capacity drives (down 4.3 percent year-on-year), $297 million from legacy drives (down 20 percent), and $178 million from enterprise drive systems and SSDs (down 30.5 percent). Seagate shipped 99.1 EB of capacity, down 16.5 percent on the year, with an average of 8.7 TB per drive capacity, up 7 percent from 8.2 TB a year ago.

CEO Dave Mosley, focused on the quarterly picture, said: “Seagate’s March quarter revenue grew six percent and non-GAAP EPS more than doubled over the December quarter as we benefit from improving cloud demand, our strong operating discipline, and price execution. This combination sets the foundation for a return to target margin performance as the markets recover.”

Putting up its prices again, as it did yesterday, will certainly help improve margins.

Mosley said in the earnings call: “Nearline cloud demand trends are increasingly positive across both US and China customers, and we also saw a sequential improvement in the enterprise OEM markets in the March quarter … Cloud continues to lead the demand recovery … We believe the long-running cloud customer inventory correction is mostly complete and their end demand is also improving.”

He added: ”We expect enterprise OEM revenue to improve as server growth resumes.” Seagate has better visibility of its large customer demand due to its build-to-order initiative that is now in place with the majority of large mass-capacity customers.

The cloud demand increase offset seasonally lower video surveillance market demand.

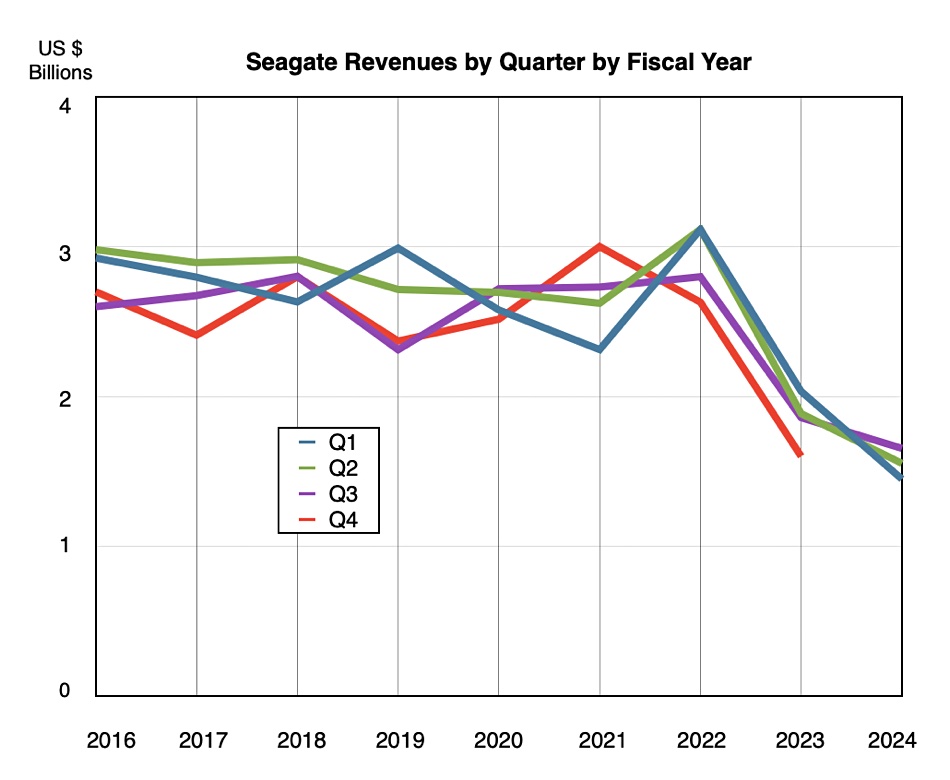

A chart of quarterly revenues by fiscal year shows a continuing downward trend:

The earnings recession has been deep and it will take a while for revenues to return to their FY 2016-2022 levels.

Qualification of its Mozaic 3 TB/platter HAMR drives is proceeding slowly. A lead cloud services provider qualification, where Seagate experienced a slowdown in recent weeks due to a non-HAMR, externally sourced, mechanical component failure, is expected in the current quarter, pending final test completion. A single top non-cloud customer has qualified the drives.

The qualification of its latest conventional PMR drives, at 24 TB and 28 TB SMR, is proceeding much faster. Mosley said they “are in qualification at most of our global cloud and enterprise customers. We have already completed qualification with one major enterprise customer, some global Tier 2 customers, and with our enterprise systems business.”

Seagate says prototype 4 TB/platter HAMR drives are now working with a launch set for the second half of calendar 2025. It claims there is a clear path to the gen 3 5 TB/platter HAMR drives, with 50-plus TB capacity.

Mosley said: “We are scaling drive capacity through aerial density gains rather than adding heads and disks … We believe HAMR provides the path for achieving margin performance beyond our current target range as production scales and also positions Seagate well to continue capitalizing on megatrends like AI and machine-learning, which drive long-term demand for cost-efficient mass storage.”

”Over the next several years, the volume of AI-generated content is expected to increase and also shift toward more imagery and videos, which can be up to 1,000 times larger than text. These trends bode well for HDD demand over the long term, as HDDs remain the most cost-effective means to house and subsequently use mass capacity data.”

In his view, there is no possibility of SSDs replacing HDDs, as Pure Storage claims will happen. Answering an analyst question, Mosley said: “This idea of mass capacity being in conflict with flash I don’t think is right. I don’t think that’s the way architects think about it in datacenters.”

“I don’t think that economically it makes sense. And even when you get into things like power and space, I think hard drives are going to stay very, very competitive on the workloads that they offer.”

Financial summary

- Gross margin: 25.7 percent vs 17.2 percent a year ago

- Diluted EPS: $0.12 vs -$2.09 last year

- Operating cash flow: $188 million

- Free cash flow: $128 million

- Quarterly dividend: $0.70/share and $147 million total

- Cash & cash equivalents at quarter end: $795 million

- Principal debt: $5.7 billion

The outlook for the final FY 2024 quarter is for $1.85 billion revenues, give or take $150 million, which is a substantial 15.5 percent uplift on the year-ago Q4 at the midpoint. This outlook would make for $6.5 billion in FY 2024 revenues, again at the midpoint, 22 percent down on FY 2023.