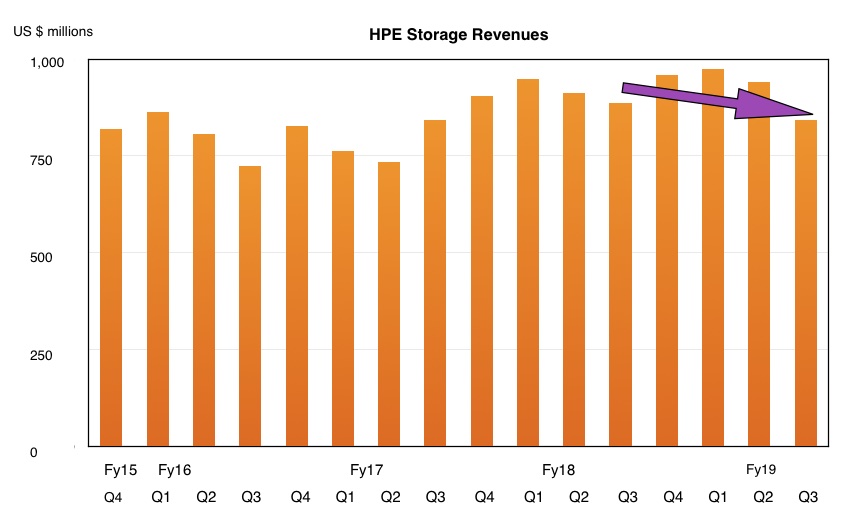

HPE storage revenues dipped five per cent Y/Y to $844m in its third 2019 quarter results, confirming NetApp’s enterprise buying slowdown signal as Trumponomics around China affect enterprise confidence.

Overall revenues slipped seven per cent to $7.2bn. Within that, server sales dipped 12 per cent to $3.15bn.

In the earnings call yesterday, CEO Antonio Neri talked of an uneven market and disciplined execution, which expanded profitability across the company while revenues fell.

The overall revenue downturn was attributed to portfolio rationalisation (getting out of cheap servers for hyperscalers) and macroeconomic factors. He said: “We continue to see uneven demand due in part to ongoing trade tensions which impact market stability and customer confidence.”

“This is showing up in elongated sale cycles, particularly in larger deals.” In storage Neri said HPE: “overall experienced a modest revenue decline against the tougher market backdrop in year-over-year compare.”

Storage sales

But there was a bright spot. In constant currency terms Nimble array sales grew 21 per cent while the SimpliVity hyperconverged product segment grew at a more modest four per cent, way down from its 25 per cent growth in the previous quarter.

The Synergy composable systems business grew most rapidly, up 28 per cent. This was also a marked reduction on its 78 per cent sales growth in the prior quarter.

The SimpiVity and Synergy growth slowdowns could be attributed to enterprise buyers slowing purchases.

It’s clear that the enterprise 3PAR array business did nor grow, and the newly announced Primera arrays were too recent to affect sresults.

Wells Fargo senior analyst Aaron Rakers told subscribers the: “Primera (3PAR) high-end cycle will materialize through 2H2019.”

SMB and US sales

Neri noted: “The SMB mid-market continues to be strong, and this is where we are putting a lot of emphasis on what we call the no touch low touch model for the transaction of high velocity business.”

As with NetApp, HPE acknowledged a US sales execution problem, which it is tying to fix: “We are actively addressing the sales coverage model in the United States. I am pleased with the actions taken to date that have resulted in positive [growth] with our US product business, which was up over 40 per cent sequentially.”

But the fundamentals are strong: “Explosion of data will continue to fuel underlying demand for solutions to help protect, store, manage and analyze their data. And this is where we are laser focused. We have a strong portfolio solutions and services that span the Intelligent Edge and hybrid cloud.”

Looking for growth

HPE’s strategic areas of product investment are high-performance computing, hyperconverged infrastructure, hybrid cloud (meaning servers and storage) and the PointNext/GreenLake subscriptions business.

Neri pointed out underlying signs of health with improving gross and operating margins and a record level of year-to-date free cash flow ($860m). HPE is shift its product mix towards higher-margin, higher value, software-defined products delivered as a service.

This will help it maintain margins as commodity prices, such as DRAM and NAND, fall. CFO Tarek Robbiati pointed out: “Fiscal year ’19 was not a year where we wanted to dial-up to growth. Fiscal year ’19 is a year, where we had to deliver on EPS commitment, drive free cash flow. These are the two most important metrics, prepare ourselves to dial-up to growth in the subsequent quarters.”

HPE’s fiscal 2020 then is being signalled as a revenue growth year, with Robbiati confirming that: “notwithstanding the consolidation of Cray, we will grow our business overall.” The Cray acquisition is expected to close in October.

The company has raised its non-GAAP earnings per share (EPS) outlook for the year, the seventh quarter in succession it has done this. There’s confidence and disciplined execution in action.

But when will the enterprise buying slowdown end? The China-US trade tensions could well affect the next quarter and the one after that. Trumponomics are unpredictable.