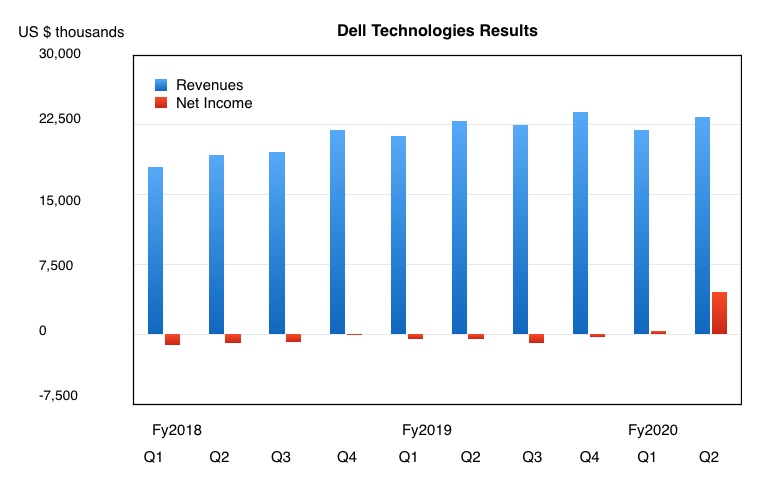

Dell Technologies pulled in £23.4bn revenues in the second fiscal 2020 quarter, up 2 per cent, and eked a massive $4.5bn profit, thanks to an income tax provision.

In a statement Jeff Clarke, Dell Technologies vice chairman, said: “We are in the early stages of a technology-led investment cycle. IT spending remains healthy and our business drivers remain strong.”

No macroeconomic enterprise buying slowdown here – yet, so take that, HPE and NetApp.

Wells Fargo senior analyst Aaron Rakers pointed out Dell experienced “softer enterprise IT demand, though orders, ex-China, grew +4 per cent Y/Y.”

Analyst Patrick Moorhead of Moor Insights and Strategy, said: “Any growth in enterprise spend was good in this environment.” Yes, there was a “12 per cent decrease in servers and networking. [But] competitively, many companies were down so I’m not concerned. Overall storage was flat, but judging by the NetApp train wreck and Dell’s growth in all-flash, the company may have increased overall storage unit market share.”

Some headline numbers:

- Cash flow from operations – $3.3bn

- Cash and investments balance – $10bn

- Diluted EPS – $4.83

- $2.0bn of gross debt paid down in Q2 ($2.4bn year to date)

- $17.0bn of gross debt paid since the EMC merger – leaving $36.4bn gross core debt.

CFO Tom Sweet said: “Operating income, gross margin and deferred revenue are up double digits, our PC business produced record results, and we saw record cash flow.” He also mentioned “growing operating income and EPS faster than revenue”.

Turning to that outrageous profit; Dell made a loss before income tax of $111m and then along comes a negative $4.62bn income tax benefit and, hey presto, we have a $4.5bn profit. Without that there would have been a loss.

Segment strengths

The main Dell businesses are:

- Infrastructure Solutions Group (ISG) – revenues dipped 7 per cent to $8.6bn

- Client Solutions Group (CSG) – PC revenues grew 6 per cent to a record $11.7bn

- VMware – revenues rose 12 per cent to $2.5bn

- Other businesses (Pivotal, Secureworks, RSA, virtustream, Boomi) saw $619m revenues up 8 per cent.

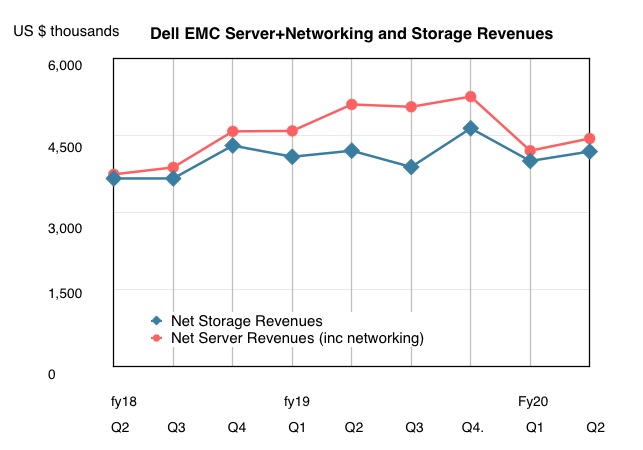

Within ISG, server+networking revenues were $4.4bn, down 12 per cent on the year, while storage was flat at $4.2bn. A chart shows how revenues for the two product lines are tracking each other closely after a gap when storage revenues fell back. But that period of storage weakness is over. In fact Dell is seeing slightly rising storage demand with orders up one per cent.

There was operating income of $1.1bn, up 4 per cent Y/Y to 12.2 per cent driven by better component costs and a higher storage mix. Dell reported strength in Isilon filers and its Unity XT midrange storage array. Hyperconverged VxRail orders grew an outstanding 77 per cent – as Dell basically slaughtered most of its HCI competitors.

It also saw growth in converged infrastructure.

Number one boasts

Dell said it is growing faster than competitors and cites IDC numbers which show it is the leader in external enterprise storage with 34.4 per cent share; leads in storage software (17.5 per cent); ranks first in all-flash arrays (34.2 per cent), and is first in hyperconverged systems (32.2 per cent).

It’s also number 1 in servers in revenues and units terms.

Earnings call

There was enterprise softness but not an enterprise buying slowdown.

In the earnings call Clark said: “We’re seeing a clear split between enterprise infrastructure and PC spending globally. In enterprise infrastructure the market is softer than we and the industry anticipated.”

“We expect to remain soft through the balance of the year, particularly in China. We feel really good about our ISG execution in Q2 given the market context. In the first half, we acquired approximately 21,000 ISG customers, up 11 per cent from the prior year.”

The storage side of ISG looks good: “Our storage business remains healthy in Q2 with orders up 1 per cent and first half orders up 4 per cent. Our sales team remain optimistic about our portfolio and positioning as we head into the second half of the year.”

ISG servers were less good this quarter; “Outside of China, our server orders were up 1 per cent and we expect to gain share this quarter in North America and EMEA, when IDC publish its results next week. Our server ASPs remain strong, up high single digits, as customers are increasingly buying higher end system support for their … high value workloads.”

Enterprise sales softness was more apparent in servers than storage. A revenue weakness in China was due to Dell withdrawing from some hyperscaler business that wouldn’t be profitable.

Comment

Dell has turned EMC into a solid partner of ISG’s storage and server businesses. The combination of VMware’s software and Dell servers in hyperconverged systems plus the coming MidRange.NEXT product line should strengthen and consolidate the overall storage offer further.

Dell’s hyperconverged systems performance outstrips the competition by so much that distant competitors, such as Cisco, could walk away from this market.

Overall, Dell dominates the storage industry and is set to dominate it more. Some relative weaknesses include:

- All-flash array HW/SW versus Pure Storage and others,

- Data protection software vs Acronis, Commvault, Druva, Rubrik, Veeam, etc.

- High performance computing, where Qumulo, DDN, HPE (Cray ClusterStor) and WekaIO look stronger

- Hybrid cloud – where NetApp’s Data Fabric looks good

- Metadata management versus Hammerspace

- File lifecycle management and tiering (InfiniteIO, Komprise),

- Secondary storage management vs Actifio, Cohesity, Delphix and others

- Tape.

But these are largely outliers, as seen from Dell’s mainstream market’s viewpoint. Why bother when it can make bigger returns by extending core products and taking share from everyone else?