Qumulo has added end-to-end encryption to Hybrid File Software in an upgrade that also adds role-based access control and integrated backup.

The scale out filer startup said customers of Hybrid File Software version 3 can avoid the need for separate backup products. In other words, Qumulo wants to store all of a customer’s files and unstructured data, and bridge the on-premises and public cloud environments.

Ben Gitenstein, VP of product at Qumulo, said in a statement: “The release of Qumulo’s Hybrid File Software v3 makes it simple to consolidate an entire organisation’s unstructured data, gain visibility into the information, and move data to the applications that will leverage it, wherever it resides, on-prem or in the cloud.”

Its software delivers faster IO for small file data sets and adds extra management analytic data, such as snapshot capacity usage and latency by IP address. Qumulos has extended API functionality to automate all the new v3 feature capabilities.

Qumulo P-368T

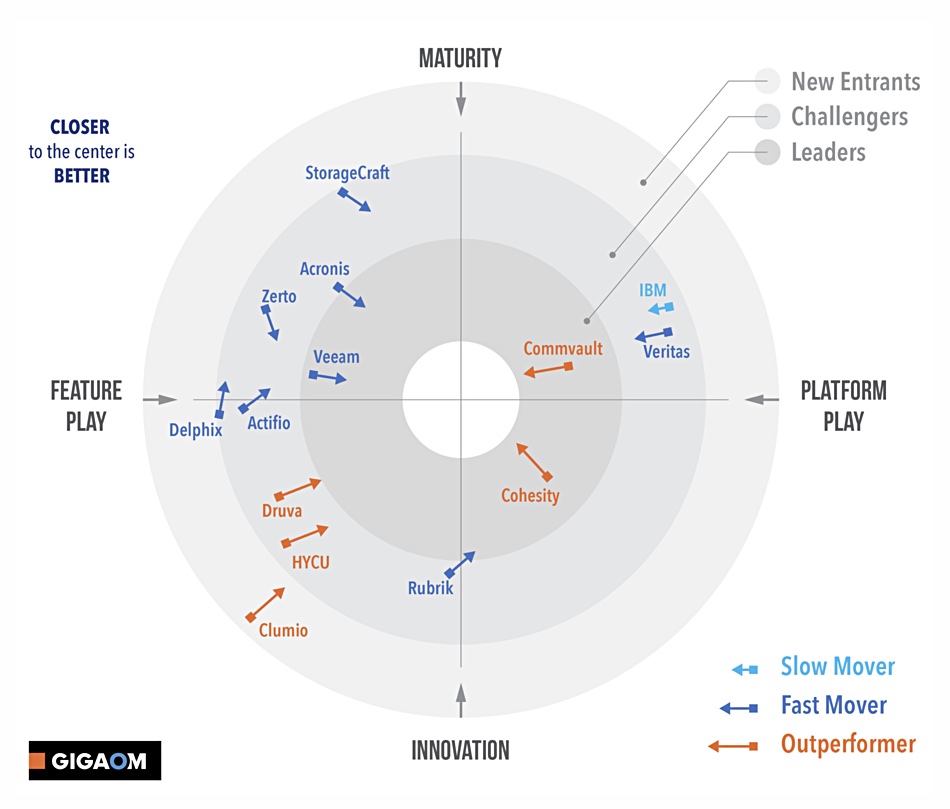

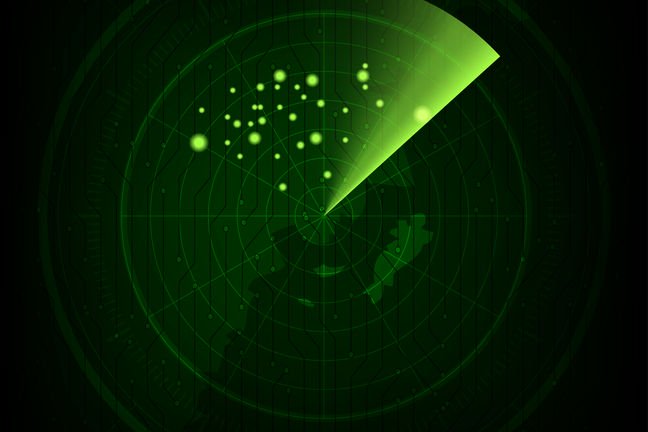

Qumulo was founded in 2012 by former Isilon execs and Dell EMC’s Isilon remains its nearest technology competitor. The venture-backed startup has received $223m in funding to date and Coldago Research has put the company on its roll-call of data storage unicorns.

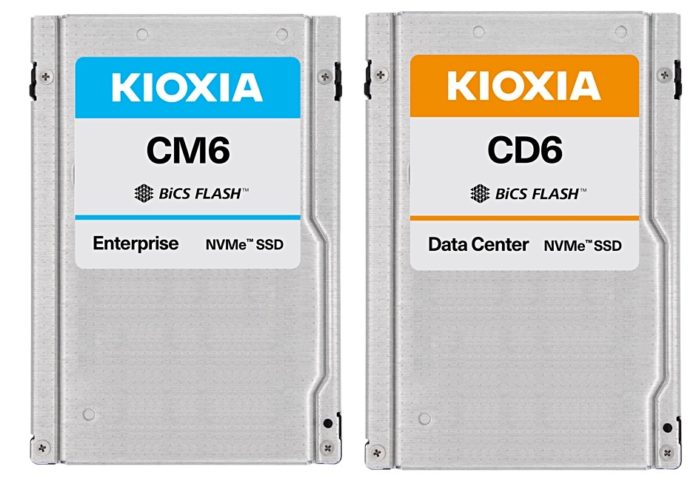

Qumulo today announced the P368T, a top-end all-NVMe flash system with 368TB raw capacity in its 2U x 24 drive bay chassis. It doubles the current high-end P184T’s capacity by using 15.36TB drives instead of 7.68TB SSDs. The CPU, memory and IO ports are the same as those for the P184T. A Qumulo cluster can now scale out past 36PB with 100 nodes in the cluster.

In comparison, the Isilon F800 all-flash filer has 60 drives in its 4 node x 4U chassis with up to 924TB capacity using 15.36TB drives. The maximum Isilon all-flash cluster size is 252 nodes and 58PB capacity.

Channel boost

Qumulo has also increased its channel partner presence. HPE sells Qumulo software running on Apollo servers and Qumulo today announced that it now provides encryption of data in-flight via SMBv3 and encryption at-rest on HPE’s Apollo appliances.HPE GreenLake subscription services now includes Qumulo Hybrid Cloud File software as an as-a-Service offering.

Fujitsu resells Qumulo software as part of its storage product set. This deal was signed in January.

Finally, Arrow Electronics and Global Distribution have signed agreements with distribute Qumulo product.