Wikibon’s Cube Insights has looked at large customer spending pattern forecasts in a Data Storage 2020: Icebergs Ahead report. Rubrik and Cohesity are looking good with Nutanix and Pure Storage not far behind. But Commvault, IBM, Hitachi (HDS), Veritas and Oracle are trailing.

ETR is a research and analyst agency looking at enterprise tech spending patterns on a monthly basis and producing net scores for vendors. Wikibon has pulled out scores for storage vendors for January, and also past months to check the trends.

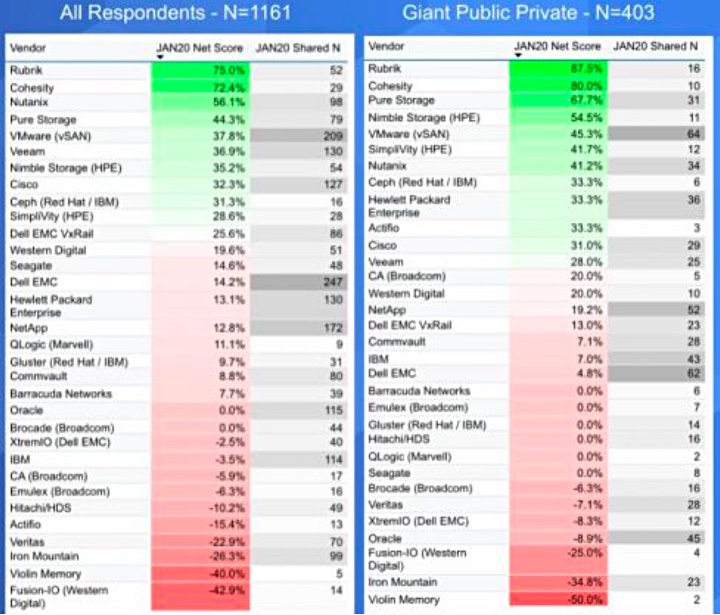

Its chart below covers general ETR survey respondents on the left while the right-hand column is for larger organisations, what ETR calls Giant Public Private ones. ETR adds green and red colouring to indicate the most positive and least positive numbers, which are a measure of spending velocity, according to Wikibon. It says the GPP responses are a good indicator of real world spending patterns.

Looking at all IT buying respondents, 1,161 of them, Rubrik and Cohesity lead the chart with 75 and 72.4 per cent scores respectively. They are followed by Nutanix (56.1 per cent), Pure Storage at 44.3 per cent and VMware (VSAN) at 37.8 per cent. Veeam, Nimble, and Cisco follow behind.

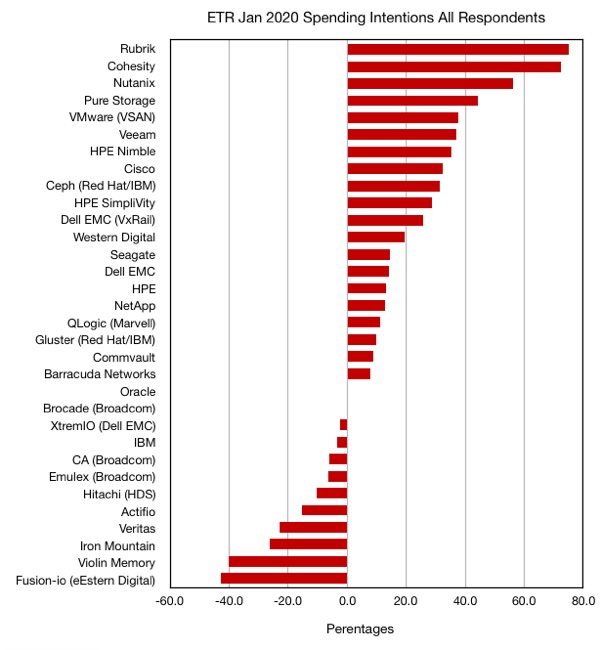

Veritas, XtremIO, Oracle and others are in increasingly negative territory. The table above, screen-grabbed from the Wikibon report, is hard to read. We pored over it and charted the numbers to make it easier and faster to understand – the all respondents table first:

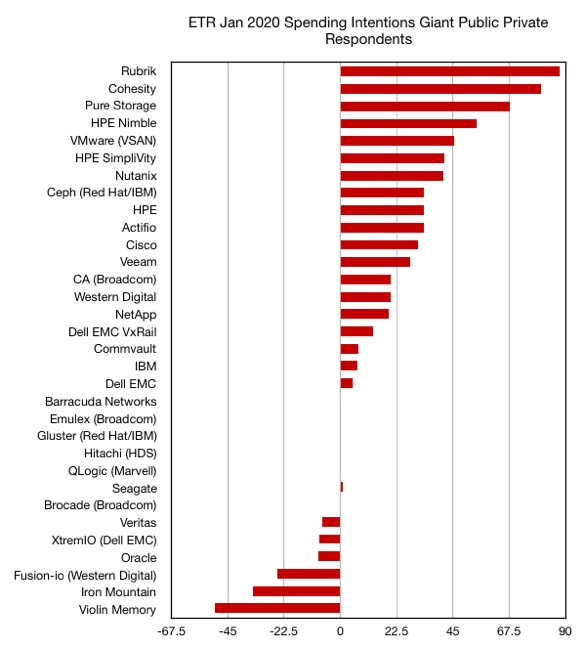

Next is the chart of Giant Public Private respondents:

One thing that jumps out is how much improved Actifio’s rating is, with a -15.1 per cent score for all respondents, but a 33.3 per cent rating on the GPP chart. Actifio does have a large enterprise focus. Oddly, Delphix is not listed by ETR and we would expect it to have a rating similar to that of Actifio. HPE has a similar pattern to Actifio, but not as extreme, being 13.1 per cent in the general chart and 33.3 per cent in the GPP chart.

Another realisation is that the spending force is with secondary storage management and then HCI. Classic primary storage arrays don’t feature well at all, particularly Dell EMC’s XtremIO. IBM is not doing so well either although NetApp is doing better.

Two backup/data protection suppliers have lowly ratings in both charts; Commvault and Veritas.

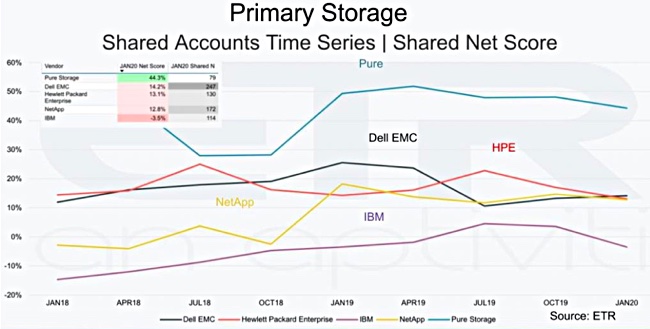

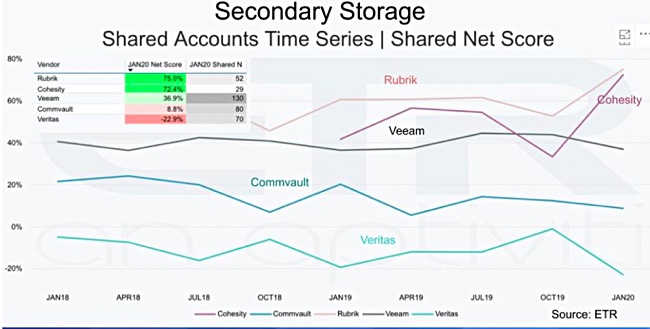

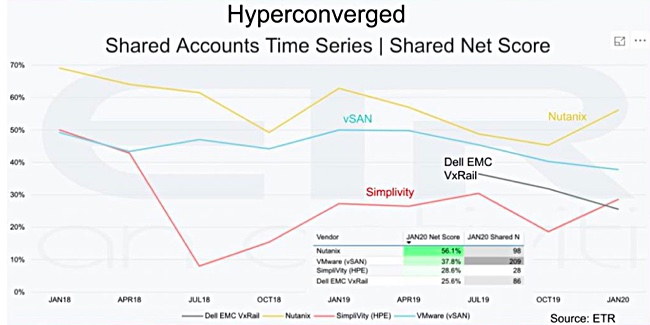

The Wikibon report then looked at the trends for selected primary, secondary and hyperconverged storage vendors.

In primary storage, Pure has maintained a stand-out lead over Dell EMC, HPE and NetApp, who are all ahead of lowly IBM. A secondary storage trends chart confirms Cohesity and Rubrik’s lead, with Veeam third and Commvault languishing, but ahead of poor, and downward-bound, Veritas.

The hyperconverged vendor trends chart shows Nutanix as a clear spending focus favourite, with vSAN second. Dell EMC VxRail was in third place but has dropped down to be overtaken by a resurgent HPE SimpliVity.

We’ll have to keep an eye on coming IDC and Gartner vendor market share numbers to see if these spending intention numbers are reflected accurately.

There’s more information in the Wikibon – Data Storage 2020: Icebergs Ahead – article. For example, it suggests that Rubrik and Cohesity could be gaining escape velocity and becoming self-sustaining (almost) companies like Nutanix and Pure Storage.