StorageOS supplies software-defined, cloud-native storage — like many other suppliers. It says what sets it apart is its focus on speed, scale and enterprise features.

The company is based in Farringdon, London, UK, and was started up in 2015 by CEO Alex Chircop, Vice President of Engineering Simon Croome, and initial CEO Chris Brandon. The company began with $2 million in seed funding and had an $8 million A-round of VC funding in 2018 plus a $10 million B-round earlier this year. The investors are Bain Capital, Chestnut Street Ventures, Downing, MMC and Uncorrelated Ventures, and the total funding to date is $20 million.

Brandon, now based in New York, had a storage technology and data centre background at EMC then BMC. Later he was at Xsigo (which was acquired by Oracle), then moved to GreenBytes and then Oracle (which promptly acquired GreenBytes). He left StorageOS in late 2019 to become a CTO in residence at AWS.

Chircop and Croome both had experience at Nomura, with Chircop going on to Goldman Sachs (serving as its Global Head of Storage Platform Engineering) and Gazprom. Croome is a specialist in agile delivery of Unix infrastructure and DevOps concepts, and led global engineering teams at Fidelity and Nomura.

StorageOS has about 30 staff, most of whom are engineers.

The container storage problem

Chircop, Croome and Brandon saw that big enterprise’s code development was moving to containers, and that stateful containers needed storage — preferably software-defined and cloud-native storage. That’s what StorageOS has developed: a software-defined, cloud-native storage platform for containers.

Chircop says shared external arrays simply aren’t working in the Kubernetes environment. People want an agnostic storage setup, not lock-in, so StorageOS is platform-agnostic and ships as a container. It’s also faster and more versatile than external arrays. It can run in the cloud, for example. He says “We have some unique IP and features,” and is happy to list them:

- “StorageOS is optimised for performance and latency, being many multiples faster than the competition — 20x in one instance.”

- StorageOS can set up a new Kubernetes cluster in 20–30 seconds — it uses in-memory caching.

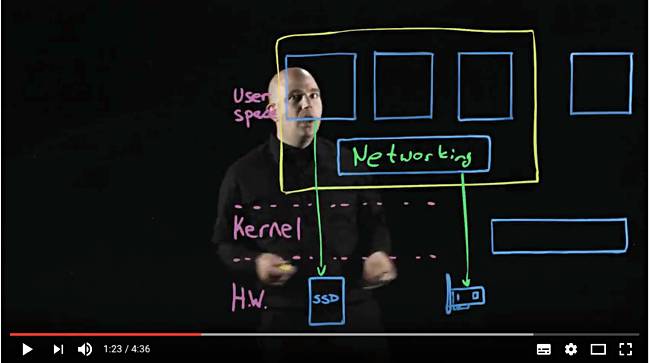

- StorageOS is “one of the only products that deploy storage with no hardware or kernel dependencies.”

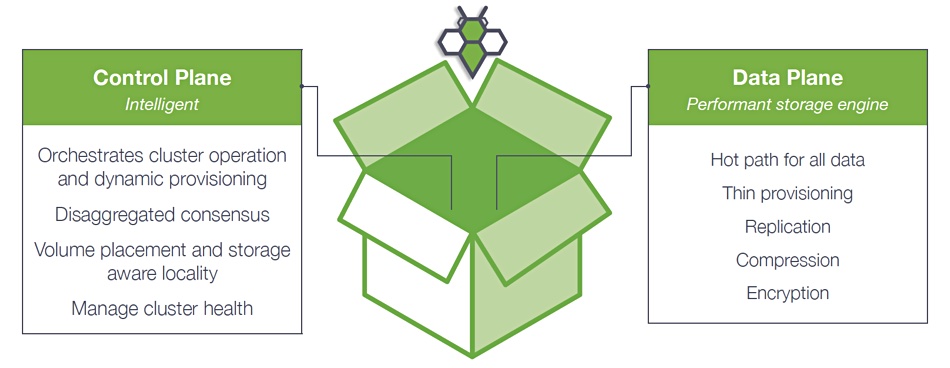

- StorageOS has a great “ability to scale because of its control plane”. This uses a disaggregated consensus algorithm, and every volume can make its own placement decisions, like a self-contained storage array.

- StorageOS can support a high rate of change, creating and deleting tens of thousands of volumes a day.

- “StorageOS helps reliability on Kubernetes clusters. Each volume can make its own recovery decisions. This is very very different — many systems have centralised control in case of transient errors.”

- StorageOS supports AWS, Azure, GCP, IBM, Red Hat, Digital Ocean and other public clouds as well as on-premises environments.

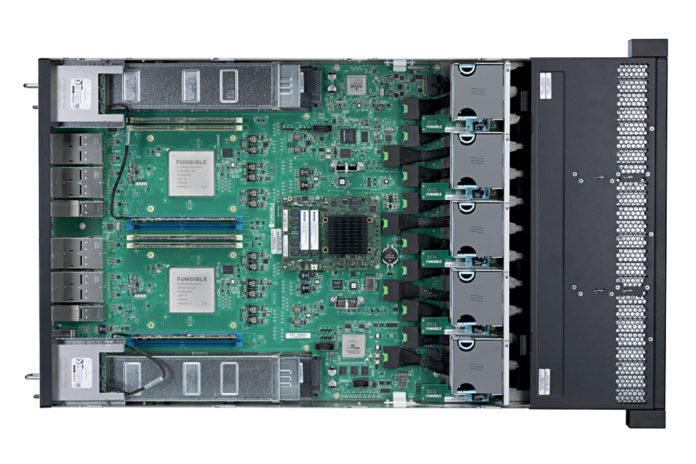

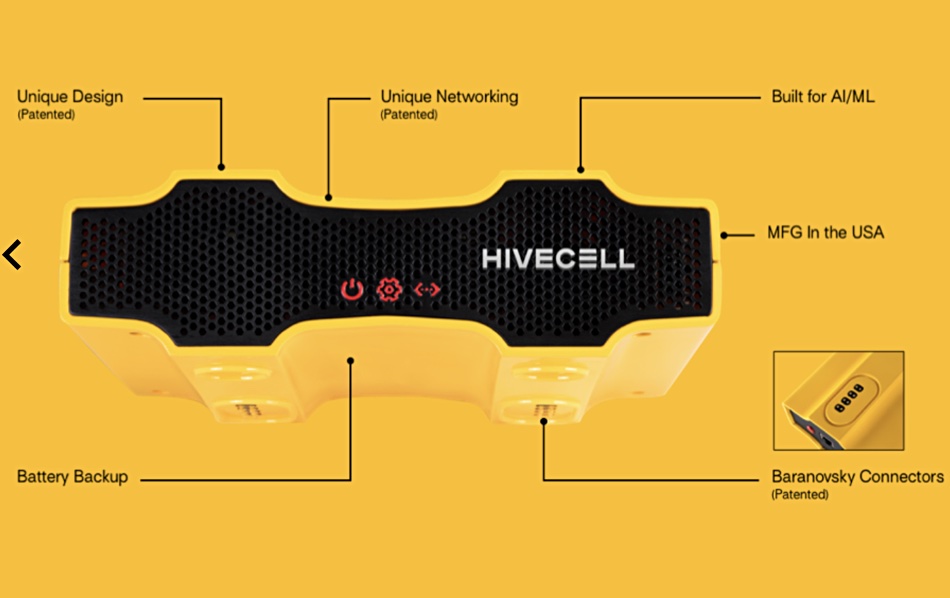

- Most CSPs have have ephemeral NVMe SSD storage installed on a node, but “We can virtualise these ephemeral instances … We make them enterprise-class.”

- “CSPs can’t replicate across availability zones — we can. CSPs can’t apply high availability to ephemeral NVMe storage — we can. CSPs can’t encrypt without having the encryption keys — we can.”

- “We use in-built functionality in the Linux kernel and have no dependencies on non-kernel features.”

- “We’ve effectively been sold through the Red Hat marketplace and have integration with the OpenShift Catalogue and the Rancher Catalogue.”

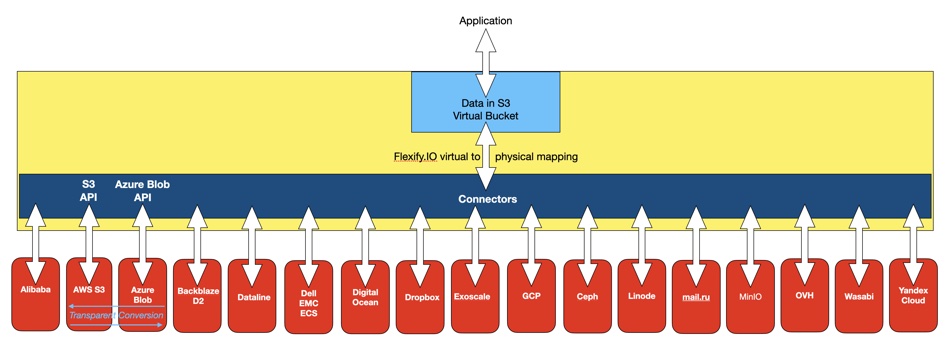

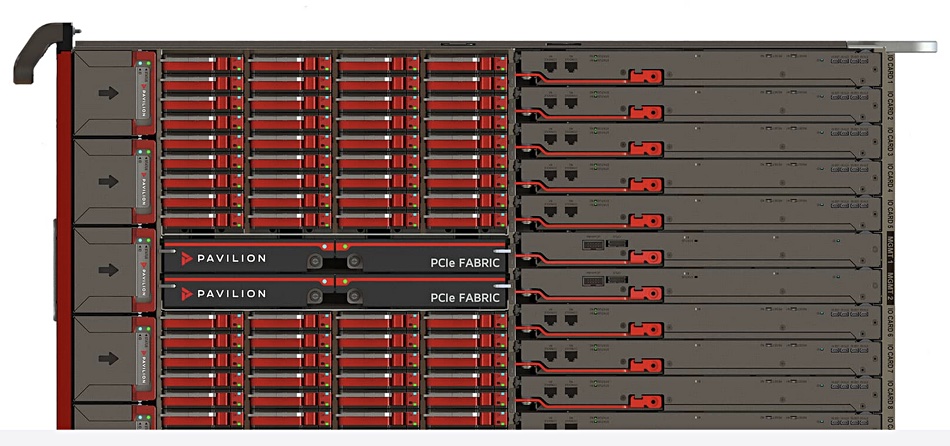

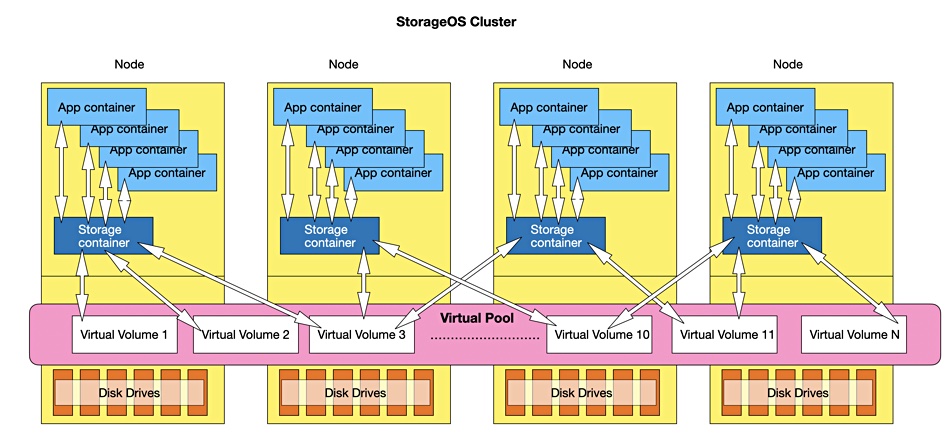

StorageOS provides a storage container presenting a pool of virtual volumes to application containers. These volumes are mapped onto physical drives — NVMe SSDs for example. You can download a platform architecture document to look deeper into the product’s design.

Customers

StorageOS wouldn’t disclose its customer count, but says that more than 5500 StorageOS clusters are installed globally. Example customers include Accenture, DHL, Lloyds Bank and T-Systems.

One UK ISP customer is building an IaaS offering based on Kubernetes and Storage OS. Virtual machines are launched with Kubernetes, with Chircop pointing out that Kubernetes is agnostic about what it launches.

Roadmap

Chircop says there are two big trends:

- Organisations are deploying larger numbers of smaller Kubernetes clusters — “So we build the ability to consume and replicate storage across these clusters.”

- There is a bridge to traditional infrastructure. Organisations are going through transformation to Kubernetes. New programs have downstream dependencies to traditional software components. He said: “We need to expose traditional file (NFS or SMB) and block code to Kubernetes.”

For example, a traditional app could produce a bunch of files. A new Kubernetes app could provide analytics routines, and they need to process the data in these files. There needs to be some kind of bridge facilitating that access.

Chircop also revealed that “StorageOS is planning to launch commercial and technical products later this year”.

Competition

StorageOS is competing with a whole string of suppliers producing storage software for Kubernetes-orchestrated containers: Commvault’s Hedvig, Dell EMC’s Project Karavi, HPE Ezmeral, Ionir, MayaData’s OpenEBS Mayastor, NetApp Astra, Pure Storage’s Portworx, Robin.IO with its $86 million in funding, SUSE Rancher and others.

StorageOS is making progress with sales to enterprise customers. It has to hope that the enterprise IT infrastructure development coalface experience of its founders — which is guiding its development and business strategy — outweighs the attractions of competitors who lack it.