Micron had a great third fiscal 2021 quarter, with large increases in both revenues and profits driven mostly by DRAM — although the Storage business unit let the side down. It also announced its Lehi fabrication plant is being sold to Texas Instruments for $1.5 billion.

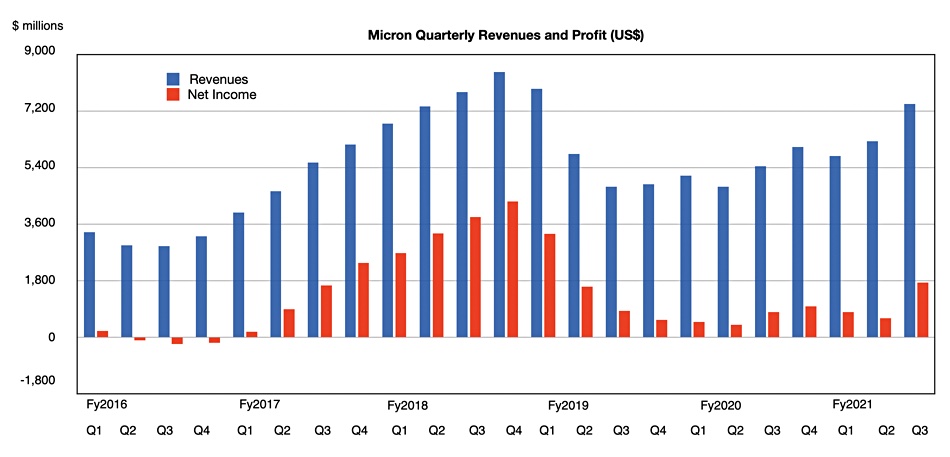

Revenues for the third fiscal 2021 quarter were $7.42B, a 36.5 per cent year-on-year increase. It earned profits of $1.74B which compares to the year-ago $803M — a 116.7 per cent jump. The profits represented 23.5 per cent of Micron’s revenues, implying a supplier-friendly pricing environment, with demand higher than supply.

President and CEO Sanjay Mehrotra issued a quote: “Micron set multiple market and product revenue records in our third quarter and achieved the largest sequential earnings improvement in our history.”

Financial summary:

- Gross margin — 43 per cent vs 33 per cent a year ago;

- Cash and cash equivalents — $9.8 billion vs $9.3 billion a year ago;

- Operating cash flow — $3.6 billion, 48 per cent of revenue;

- Positive free cash flow — $1.5 billion;

- Diluted earnings per share — $1.88 ($0.82 a year ago).

Storage lets the side down

Summary of results for each business unit:

- Compute and networking (DRAM products) — $3.3 billion, up 49 per cent year-on-year;

- Mobile (Phone DRAM and NAND) — $1.9 billion, up 31 per cent year-on-year;

- Storage (NAND) — $1.1 billion, zero growth year-on-year;

- Embedded (DRAM and NAND) — $1.1 billion, up 64 per cent year-on-year.

The Storage BU stands out, with zero per cent growth compared to the 31 to 64 per cent growth rate from the three other BUs. The Storage BU sells SSD and NAND products into the cloud, enterprise and client computing markets.

Mehrotra’s prepared remarks included this point: ”NAND hit record revenue, propelled by record mobile MCP, consumer SSD, and client SSD revenues.” In other words, cloud and data centre NAND revenues did not hit a record number, although there was sequential growth over the quarter, and these look to be the weak points in the storage BU markets.

He said: “Propelled by the transition to DDR5, strong capabilities in graphics memory and the introduction of HBM and NVMe SSD product offerings, Micron’s strong product roadmap across DRAM and NAND positions us for success in the data centre.”

Micron said it will introduce new data centre NVMe SSD products in the next few months, with internally-developed controllers.

Wells Fargo senior analyst Aaron Rakers told subscribers ”We continue to consider MU’s improved positioning in enterprise SSDs via next-gen NVMe drives (with MU internal controllers) as being a 2H2022/2023 story.” That’s a year away then, as the drives will have to be qualified before being adopted and sold by OEMs.

DRAM and NAND revenue details

DRAM represented 73 per cent of Micron’s revenues in the quarter and was up 52 per cent year-on-year with average selling prices rising 20 per cent. NAND provided 24 per cent of its revenues and increased nine per cent year-on-year. Average selling prices for NAND rose in the high single-digit per cent range — less than half of the ASP increase in DRAM.

Micron’s earnings presentation noted that NAND hit record revenue, propelled by record mobile MCP, consumer SSD, and client SSD revenues. Its embedded business exceeded $1 billion for the first time, with record revenue across automotive and industrial markets. Both its 1α DRAM and 176-layer NAND reached a meaningful portion of its overall bit production, and QLC NAND accounted for a majority of its client SSD bit shipments.

Although there has been a drought in Taiwan, where it has manufacturing facilities, it worked around this with no reduction in production output.

It expects DRAM and NAND supply to remain tight into CY22, meaning prices should be high.

Both memory and SSD demand is high in data centre servers and client PCs, graphics workstations and games consoles. Micron achieved record multi-chip package quarterly revenues in the mobile phone market. Mobile unit sales are expected to grow this year, with an an expected doubling of 5G units in calendar year 2021 to more than 500 million units.

Micron said it had a third consecutive record quarter in the automobile market, driven by continued manufacturing recovery and increased LPDDR4 memory and embedded multi-media card (eMMC) content for in-vehicle-infotainment and driver assistance systems.

Lehi fab

The Lehi fabrication plant, which made 3D XPoint chips, is being sold to Texas Instruments for $900 million in cash and about $600 million from select tools and other assets. Some of the assets have been sold, and Micron will retain the remainder to redeploy to its other manufacturing sites or sell to other buyers.

TI will offer jobs to all the Lehi employees upon the closing of the sale, and intends to deploy its own technologies at the site. The sale should close later this year.

Back in March, Micron said it would end 3D XPoint chip production and pursue CXL-based memory technology development. Mehrotra said: “We are developing exciting CXL-enabled products and will have more to share on our roadmap in the future.”

Outlook

CFO Dave Zinsner said: “Both DRAM and NAND markets are tight, and we expect pricing increases for both markets in Q4 … Despite cost headwinds, we expect strong improvement in our financial performance in Q4. Our growth opportunity is healthy, and market momentum heading into FY22 is strong.”

Micron is guiding $8.2 billion +/- $200 million revenues for the next quarter — a 35.3 per cent increase on the year-ago $6.1 billion revenues at the mid-point. This would mean $27.63 billion revenues for the full fiscal 2021 year — a 28.9 per cent year-on-year increase, and near Micron’s previous highest-ever annual revenues of $30.4 billion in its fiscal 2018.

Comment

If Micron’s Storage BU had exhibited the same growth as its Mobile BU, then its quarterly revenues would have been approximately $310 million higher. The weak sales of SSDs and NAND products into the cloud (hyperscaler) and enterprise markets is costing Micron dearly. We can hope that Micron will introduce excellent NVMe SSDs as it tries to grow enterprise SSD sales.

We may also expect Micron to become visibly active in the zoned namespace SSD area, where Western Digital is making the running. Samsung recently introduced its zoned namespace SSD, the PM1731a, for enterprises and hyperscaler customers. Zoning can improve both an SSD’s endurance and performance, and Micron needs to get aboard that train.