Solidigm is not an SSD design and manufacturing weakling cast off by parent Intel because it was failing. It went because Intel needed the capital invested in it to develop its more important core manufacturing fab and processor technology capabilities. Solidigm, which was partially acquired by SK hynix, is a multi-billion dollar revenue company, an SSD design and manufacturing powerhouse with a reputation for rock-solid SSD quality.

Blocks and Files was briefed by two Solidigm executives on the company’s situation, scope and aspects of its technology plans. They were Greg Matson, VP for strategic planning and marketing – the datacentre guy – and Avi Shetty, senior director, strategic planning and marketing for client SSDs. We found it had a wide-ranging roadmap, both for enterprise and client drives.

Greg Matson: “We’re a new company, obviously, but we have the backing of a multi-billion-dollar SK group. And so we’re a kind of a billion dollar startup.” There is: “A great [Intel/Solidigm] revenue base that I think over time we’ll be publicly talking about [with] many billions of dollars of existing SSD revenue.”

He spoke of Solidigm having the: “deep technical expertise of coming from the [Intel] platform company. … We haven’t lost that. We’re the same people that grew up, in the platform-based company, both in a client and datacentre [way], and we are not going to lose that array, we’re building that capability out.”

“We are going to be headquartered in the US in San Jose, [with a] very strong presence … across the globe, with 20 global locations, and over 2,000 SSD-focused employees, purely focused on developing solid state drives for client and datacentre [markets]. And then countless thousands more in the factories.”

Parent, manufacturing and customers

Solidigm and SK hynix complement each other. “We have killer client products in the enthusiast and performance segment coming from SK. We have killer mainstream products and value products coming from the historic Intel roadmap. … We have great SSDs in compute, coming from SK and great SSDs in the compute and storage space coming from the Intel perspective.”

The two manufacturing networks are another strength. “We have our SK base factory network. It’s really big in scale. We have our Fab 68 coming from China, again, really big in scale.”

“We’re investing in expanding both of those networks. We have really deep customer understanding, coming from both sides, both the SK as well as the Intel side, and have presence in almost every customer in the world from an SSD perspective, whether it’s top 10 in cloud service providers, whether it’s the the storage OEMs, the traditional enterprise, server OEMs, the enterprise and business and enthusiast client, and we have very strong presence there, across our SSD base.”

“We’re building on kind of the reputation of having kind of world-class quality, reliability, as well as customer support. … [We] aren’t going to lose that history of having rock solid products in the market.”

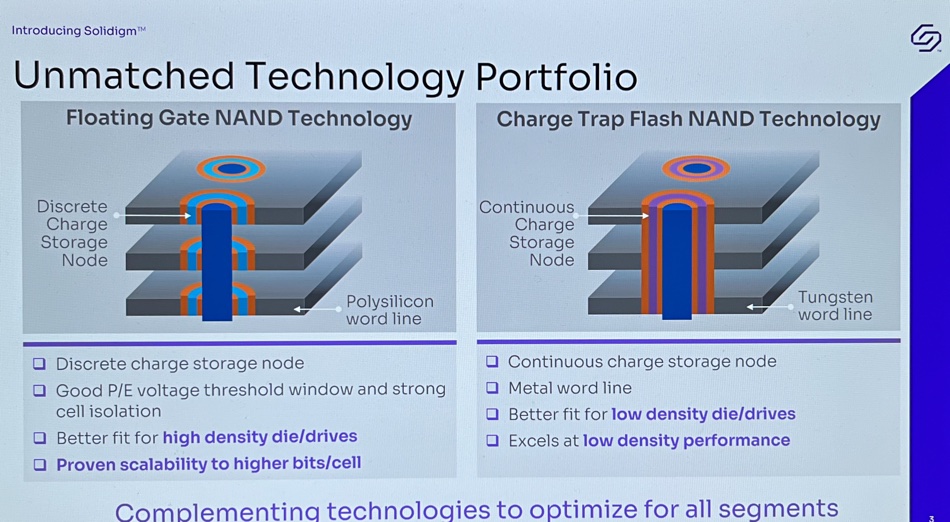

Charge Trap vs Floating Gate

Solidigm and SK hynix have different NAND technologies, with SK hynix using Charge Trap technology but Intel being a Floating Gate hold-out.

Most of the NAND industry, except Intel/Solidigm, has adopted Charge Trap. For example, Micron used Floating Gate technology up until its 4th generation 3D NAND which went to Charge Trap and 128 layers in 2019.

Greg Matson said SK has been shipping Charge Trap “to mobile client datacentre markets for quite a while. … We’re [Solidigm] unique from a supplier perspective that we have both of these technologies to bring to market to allow us to optimise our product portfolio for all the different segments in both cloud and datacentre.”

Shetty told us: “The client world has segmented and you need unique technologies to address your segments which you’re going after. Floating Gate with its ability to scale and offer high densities allows us to go aggressively after the value, cost-focused, high density required segments, which allows us to offer 1TB, 2TB, and maybe on a 3TB to 4TB basis, at a very attractive price point.

“Charge Trap with its fundamental performance benefits allows us to focus on the high-end workstation, enthusiast-related product markets. So this is a complementary business, complementary technologies with the two coming together to give us the ability to address the full portfolio on both the datacentre and client, which individually we’ve been maybe missing but collectively we now are a much stronger force.”

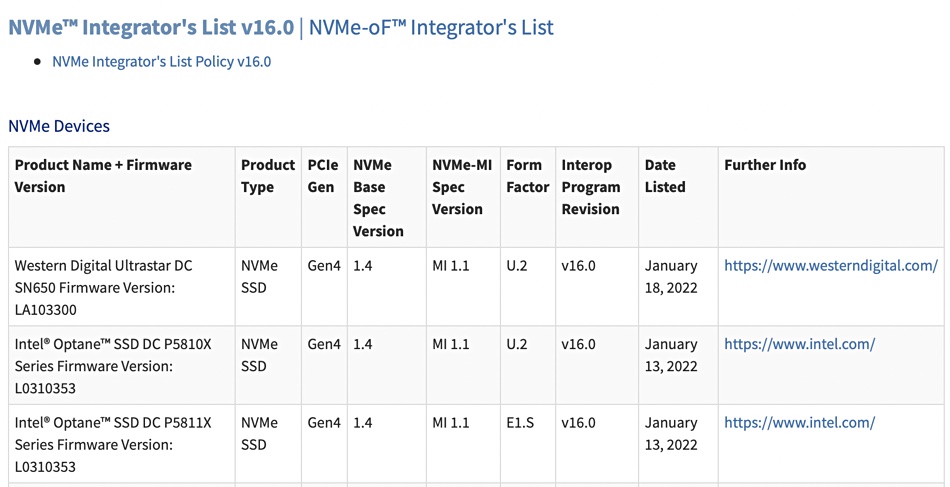

Matson agreed. “Some of the compute applications … in cloud hosting, for example, require very high amounts of IOPS, like high-capacity and … small capacity drives to get the most bandwidth and the highest most IOPS out of the system. … Charge Trap excels at that. … that’s an area of focus [where] the historic Intel hasn’t excelled.

“Where we’ve [Intel] excelled is kind of that mid-capacity and high-capacity range in … more moderate performance compute usages, and then the very high-capacity storage use cases.

“We have … what we think now is the best of best of breed, to be able to serve all your classes, cloud compute, and storage, focused enterprise storage, focused workloads on the enterprise side.”

It’s not a case of going all-in on Charge Trap or Floating gate, according to Matson. “We dive deep with our top service providers, for example, to understand their exact workloads. And we’ve been able to tune our drives to perform better than competitors’ drives. In those workloads where they actually use the drive in some cases, you know, our datasheet doesn’t look as good as our competition. And in the four corners type, random read performance, for example, there you might see a competitor having higher random read IOPS and kind of corner case workload.

“But you get down into an elastic block store workload at the biggest cloud service providers in the world and we offer better quality of service and better … read latency profiles. And we’ve been able to do that in Floating Gate.

“We’re going to work on Charge Trap solutions and get those things tuned for the … best killer performance and compute workloads as well. And so I think there’s advantages for both.”

Shetty said Floating Gate has a role on the client front too. But products using it have to meet two goals. “There are essentially two vectors in which we define our product. … One[ is] cost-focus, we have to get into PCs, where we have to fit into system price points, with an affordability index within our OEM PCs, anywhere from $399 all the way up [to] $22,000.”

The other vector, as we understand it, is optimally balancing performance, endurance, and reliability, as well as cost.

Shetty explained: “It’s not just about speeds and feeds all the time. Yes, there is a market where speeds and feeds are really important. But it’s all about … having a drive, which is optimally balancing performance, endurance, reliability, as well as cost. Because in the end … you don’t want to have provided an SSD, which gives you the best performance, but it sucks in battery life, maybe one hour battery life, right?”

Matson has this view of Floating gate advantages: “That kind of discreet charge storage node on Floating Gate we think gives us the best in class both voltage threshold window and strong cell isolation really allowing us to have the highest P/E cycles with a densest flash memory. It easily enables us to scale to three, four and even five layers per cell … while still meeting industry standard data retention and reliability metrics. That’s different than we’ve seen in competitors’ QLC flash for example.”

PLC NAND

Five bits per cell is penta-level cell (PLC) NAND, with a 25 per cent per-cell capacity advantage over QLC (4 bits/cell) NAND. It is inherently slower than QLC NAND because of the additional voltage levels, and also has lower native endurance than QLC.

Matson said “This technology we think is best for high-capacity storage-focused drives that gives us the the best bit density you know, meaning technology cost and as well as overall capacity scaling.”

PLC development at Solidigm “is going really well. In fact, we’re already demonstrating silicon in the labs, and are working on the best intercept for PLC SSDs and the enterprise side. I can’t comment on timing for that. I can tell you that we’re very bullish on the technology, and do not see any deviation from our ability to deliver the kind of industry standard JEDEC, standard daily [use] type specs that deviate at all from TLC or QLC.

“We have strong customer interest in that. It’s going to come with compromises on performance, like QLC does as well. But it will definitely have its place in the market. We think that plays a big role over over time. It’s a very promising kind of long term technology.”

We mentioned that suppliers such as VAST Data might be interested in enterprise-class PLC SSDs and Matson replied “You can imagine that companies like that are extremely interested.”

3D NAND Layer counts

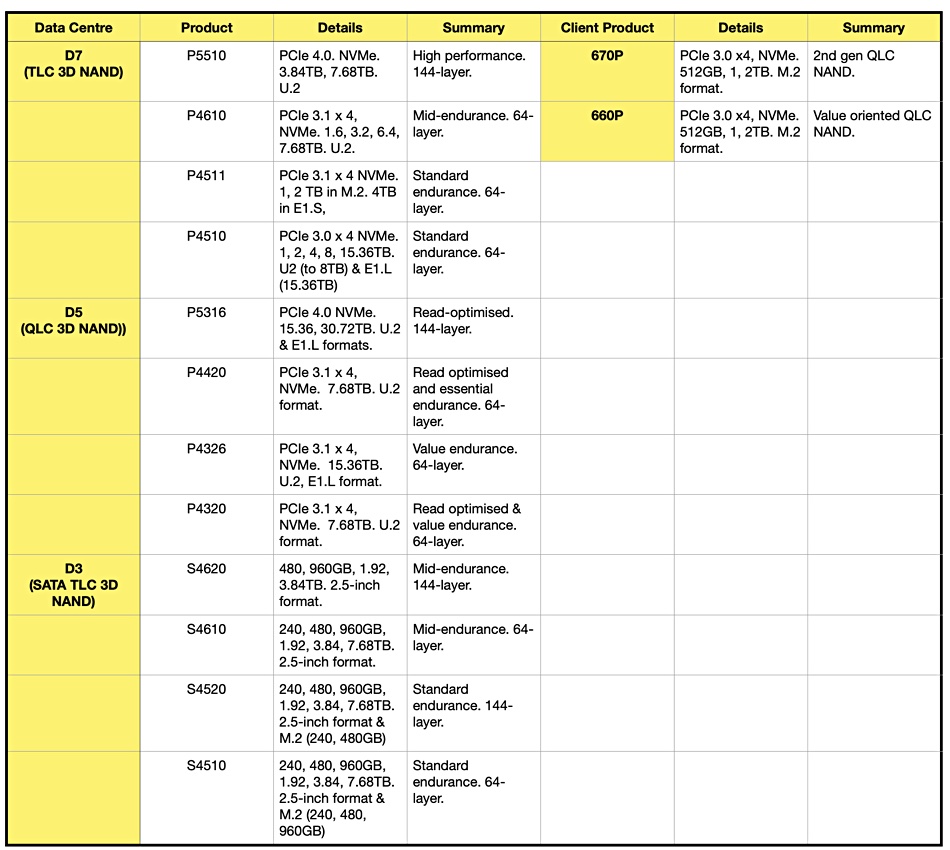

Intel is currently introducing its 144-layer 3D NAND technology. Matson said “We’ll be expanding that 144 layer to essentially all of our products by the end of calendar 2022.”

Avi Shetty said “We went from 128 to 144 and we are going to go scale up in future. That also coincides with die size – basically the NAND die is growing.” That causes him potential problems in space-limited client systems.

PCIe 4 and 5 and CXL

Solidigm will roll out PCIe 4 to all of its enterprise SDS this year, probably by the mid-point. Avi Shetty said “We have products from the SK side addressing the Gen 4 market today, which is coming top to bottom … going into performance segment, then into mainstream, and then eventually into full value.”

Avi Shetty said that moving to PCIe 4 on the client side would mean a cost increase – “A non-media BOM (Bill of Materials) increase.”

“But we expect innovations in other areas, to introduce Gen 4 to the majority of the customers. For example, to effectively produce a Gen 4 SSD at equivalent or pretty close pricing as Gen 3 … we need to invest in DRAM-less. You will see innovation on our end to effectively give more performance to the end user at the same system price points. So you’ll see all of those showing up in our roadmaps in future.”

Avi Shetty said that on the client side it wasn’t just a case of adding PCIe 4 connectivity to the drives. The overall platform adoption of PCIe 4 drives, such as M.2 form factor drives, has to be considered. That means being DRAM-less, connectivity bandwidth and thermal management, where desktops have more scope for cooling than notebooks, and so tend to get things like PCIe 4 before notebook products.

B&F: “Do you have plans for PCI Gen 5?”

Greg Matson: “Absolutely. And we’re aligning our Gen 5 timing with when we see a broad adoption of Gen 5. Just to give you a little bit of flavour, a lot of our top 10 cloud service providers are just getting to Gen 4 this year, and some not even until 2023. And we see the bulk of the market [and] it’s in that transition from Gen 3 to Gen 4. And then we think that the Gen 5 timeframe will start in 2023 and ramp even more heavily in 2024 from a customer adoption perspective. Our products are right in line with that timeframe.”

Solidigm is investigating client PCIe 5 use but wide industry ecosystem co-operation will be needed to cope with things like PCIe 5 drive thermal, power and bandwidth management. PCIe 5 could be used to halve the equivalent PCIe 4 system’s lane count, from four to two, say, offer the same performance and also free up PCIe slots for other peripherals.

And any plans for CXL?

Greg Matson: “From a Solidigm perspective, we are not developing any CXL products right now … the SK Hynix side of the DRAM side of the house … probably have some plans but [we’re] not up to speed on those plans.”

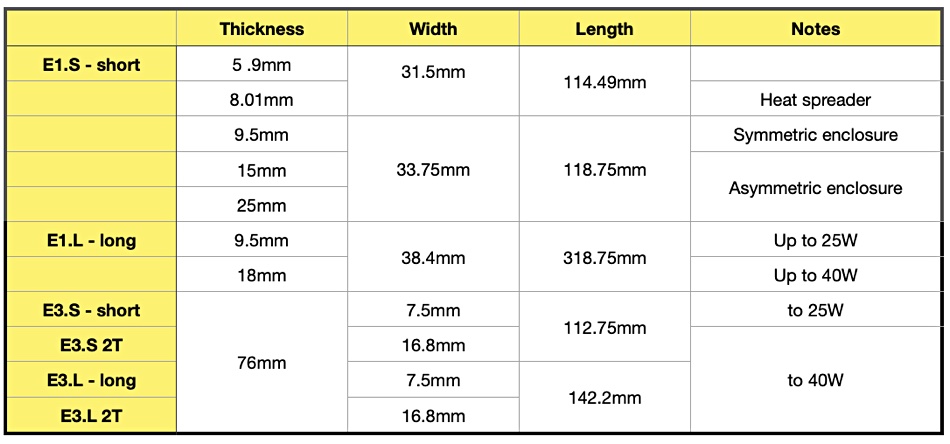

EDSFF

Any plans for EDSFF, the new ruler-format drive form factors?

Matson is sentimental. “My team actually invented EDSFF and launched the first one in 2017. So we love EDSFF, because it’s our little baby. … We see pretty broad adoption happening. It’s been a slow to come out. E1.Ss are coming out as the emerging agenda, especially at the US cloud service providers. There we see the E3.S starting to come out in the PCIe 5 timeframe, very late this year and 2023. We’re very committed to that form factor.”

Matson thinks it will become “the state of the art for datacentre.”

Shetty’s attitude was quite different. The M.2 form factor is a fact of life in client systems. The E1 form factors are too thick, in Z-height sense, for laptops. ”If you’re asking EDSFF form factor and notebook, no way.

“My honest recommendation [is it] will be very limited to a very niche – maybe a workstation – kind of segment, which wants that form factor for a certain use case.”

Storage Class Memory

B&F: “Will Solidigm develop its own storage class memory technology?”

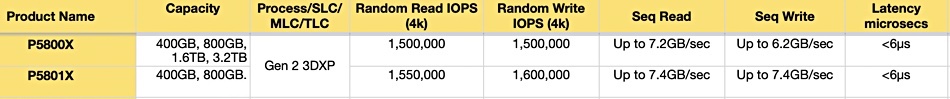

Matson: “We’ve been looking at it.” Optane (3D XPoint) “is still the only true storage class memory that’s ever been launched. Everyone else is doing NAND-based products. Yes, we are. We are strongly and carefully looking at the NAND-based versions of those products.”

We got specific. “Would you be looking at introducing specific product to compete with Samsung’s Z-SSD or the Kioxia equivalent?”

Matson did not get more specific. “I can say we’re looking at it and I can’t comment on product with future product plans. But of course, we’re looking at external customers. Our customers want us to serve all the [market] segments.”

No immediate plans then. But Solidigm products to compete with the Samsung and Kioxia Z-SDD-type technology could be coming in the future.

It’s possible that Solidigm, in its Intel NAND and SSD business unit period, was held back by its parent. Could we be seeing the start of a rejuvenation, with this billion dollar startup, freed of intel shackles, finding its wings and starting to fly? It’s a nice idea. Let’s hope it has substance.