NetApp’s latest quarterly revenues swelled higher led by all-flash array demand.

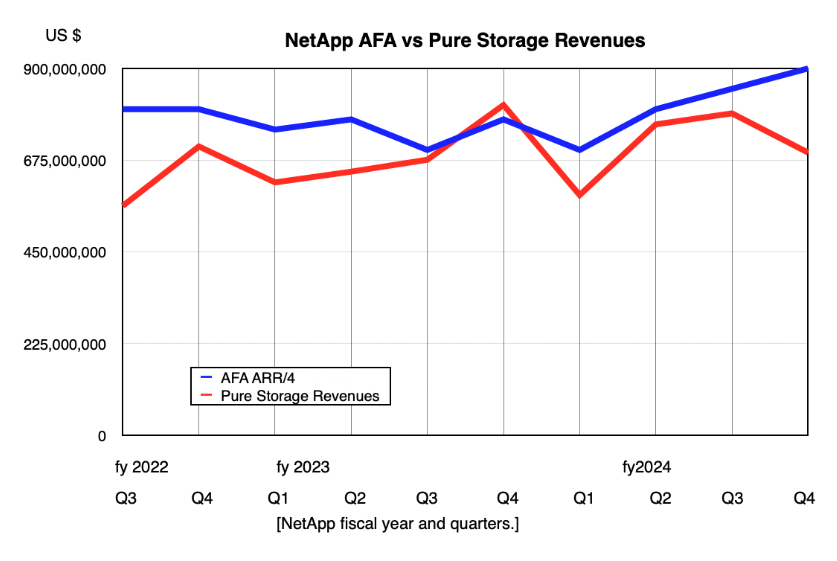

Revenues rose for the third successive time to $1.67 billion in the fourth quarter of NetApp’s fiscal 2024, ended April 26, 2024, up 6 percent and exceeding its guidance mid-point. There was a $291 million profit, up 18.8 percent annually, and NetApp’s 25th successive profitable quarter. This Kurian-led cash machine is so consistent. The all-flash array annual run rate (ARR) beat last quarter’s record to reach $3.6 billion, with $850 million AFA revenues in the quarter.

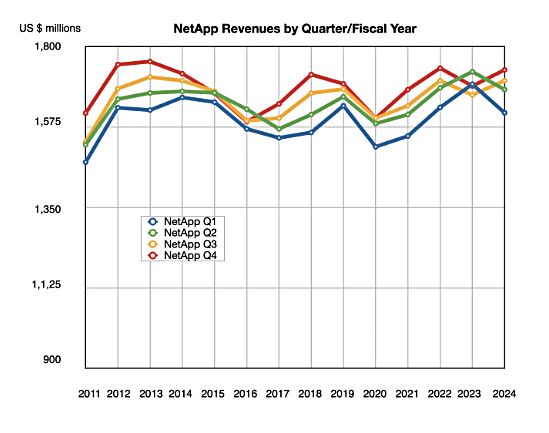

Full fy2024 revenues of $6.27 billion were 1 percent down Y/Y with profits of $986 million down 2.2 percent Y/Y.

Hybrid cloud revenues of $1.52 billion in the quarter rose 6.3 percent, basically driving the business. Cloud revenues, meaning public cloud, remain depressingly low at $152 million, a miniscule 0.7 percent higher Y/Y as the Anthony Lye-led buying spree still fails to deliver meaningful revenue increases.

CEO George Kurian’s results quote said: ”We concluded fiscal year 2024 on a high note, delivering company records for annual gross margin, operating margin, EPS, operating cash flow, and free cash flow and building positive momentum. … In fiscal year 2025, we will remain laser focused on our top priorities of driving growth in all-flash and cloud storage services while maintaining our operational discipline.”

NetApp probably has the best public cloud storage service offerings of all the storage suppliers, with its data fabric spanning the on-prem ONTAP world, and SW instantiations on AWS, Azure and GCP, and Blue XP hybrid cloud storage monitoring and management services. Yet significant demand has proved almost illusory and its competitors, notably, Dell, HPE and Pure are slowly but steadily catching up. Indeed Pure has a big announcement coming in this area next month.

Kurian pointed out NetApp’s public cloud progress in the earnings call, saying: “In Q4, we had a good number of takeouts of competitors’ on-premises infrastructure with cloud storage services based on NetApp ONTAP technology, which helped drive our best quarter for cloud storage services with each of our hyperscaler partners. We are well ahead of the competition in cloud storage services and we are innovating to further extend our leadership position.”

He referred to expected public cloud revenue growth, saying: ‘We expect that cloud first-party and marketplace cloud storage should continue to ramp strongly, which will deliver overall growth in cloud, consistent revenue growth in cloud in fiscal year ’25, stronger in the second half than in the first half.”

Quarterly financial summary

- Consolidated gross margin: 71.5 percent vs 68 percent a year ago

- Operating cash flow: $613 million vs $235 million a year ago

- Free cash flow: $567 million vs $196 million last year

- Cash, cash equivalents, and investments: $3.25 billion

- EPS: $1.37 vs $1.13 a year ago

- Share repurchases& dividends: $204 million in stock repurchases

NetApp widened the gap between its own all-flash array revenues and Pure Storage:

The AFA revenues were singled out by Kurian saying: “Strong customer demand for our broad portfolio of modern all-flash arrays, particularly the C-series capacity flash and ASA block optimized flash, was again ahead of our expectations.”

A look at NetApp’s quarterly revenue history shows that it reversed the lower Q1 and Q2 revenues this fiscal year with higher ones in Q3 and Q4 to end the year pretty much level pegging with the previous one:

Just like its competitors NetApp is seizing the AI opportunity in front of it, positioning itself as a provider of the data infrastructure foundation for enterprise AI.

Kurian said: “Customers choose NetApp to support them at every phase of the AI lifecycle due to our high performance all-flash storage complemented by comprehensive data management capabilities that support requirements from data preparation, model training and tuning, retrieval-augmented generation or RAG, and inferencing, as well as requirements for responsible AI including model and data versioning, data governance and privacy. We continue to strengthen our position in enterprise AI, focusing on making it easier for customers to derive value from their AI investments.”

He then said: “We had about more than 50 AI wins in Q4 across all elements of the AI landscape I talked about, both in data foundations like data lakes as well as model training and inferencing across all of the geographies. I would tell you that in the AI market, the ramp on AI servers will be much ahead of storage because what clients our doing is they’re building new computing stacks but using their existing data. And so we expect that over time there will be a lot more data created and unified to continue to feed the model. But at this stage, we are in proof of concept. We think that there’s a strong opportunity over time for us and all of the AI growth is factored into our guidance for next year.”

He reckons that: “AI … is the opportunity that will become much more meaningful over time. We are well positioned with the huge installed base of unstructured data, which is the fuel for GenAI, and we are focused on helping customers do in-place RAG and inferencing of that data.”

Next quarter’s revenue outlook is $1.455 to $1.605 billion, a $1.53 billion mid-point which would be a 7.0 percent annual rise. The full fiscal 2025 revenue outlook is $6.45 to $6.65 billion, with the $6.5 billion mid-point representing a 4.5 percent Y/Y increase and NetApp’s highest ever annual revenue.

This would end NetApp’s 11-year failure to beat its fy2013 $6.332 billion highpoint. George Kurian became CEO in 2015 and reaching a record revenue highpoint in fy2025, after 10 years in office would be quite a satisfying feat.

Wedbush analyst Maat Bryson told subscribers: “Q1 and FY’25 guidance both presented upside vs. prior Street expectations, while management’s tendency towards conservatism, likely means that NTAP will eventually deliver results closer to the high end of the new forecast.”