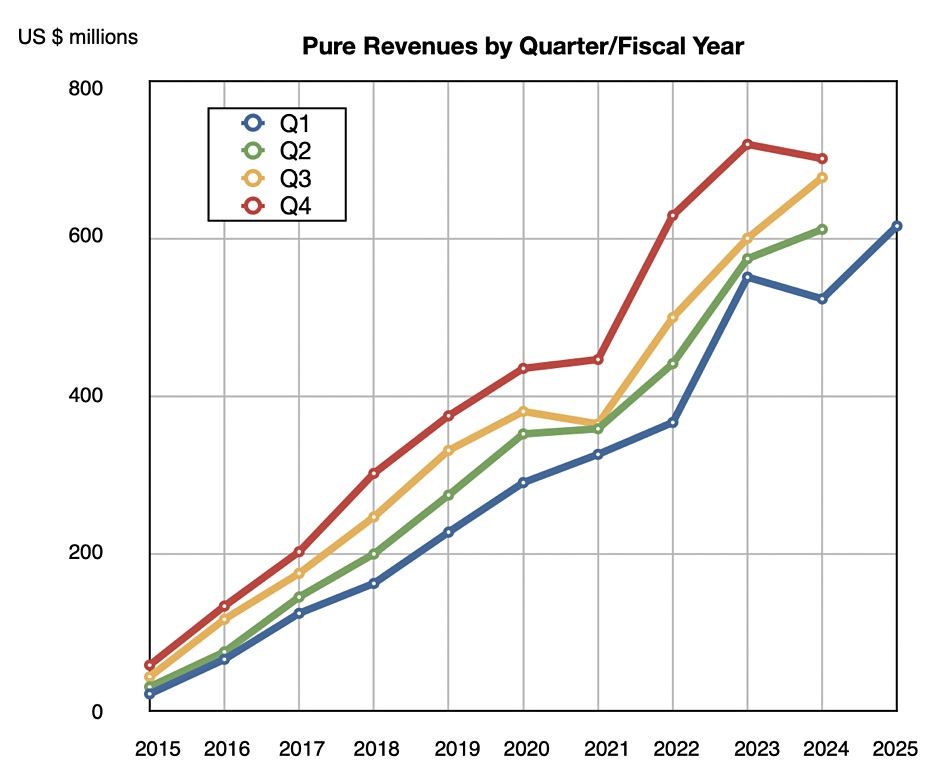

Pure substantially beat its own first fiscal 2024 quarter revenue estimates and is getting more confident about winning a future hyperscaler customer.

The $693.5 million revenue in the quarter ended May 5 was up by nearly 20 percent year-on-year and way past the $680 million outlook predicted in the prior quarter’s earnings report. There was a loss of $35 million, better than the year-ago $67.4 million loss.

Charlie Giancarlo, Pure’s CEO, said: “We are pleased with our Q1 performance, returning to double-digit revenue growth for the quarter.”

According to CFO Kevan Krysler said: “revenue growth of 18 percent and profitability both outperformed.” Why the surprise revenue jump this quarter? Krysler said: ‘Two key drivers of our revenue growth this quarter were: one, sales to new and existing enterprise customers across our entire data storage platform; and two, strong customer demand for our FlashBlade solutions, including FlashBlade//E. … we are aggressively competing and winning customers’ secondary and lower storage tiers with our //E family solutions and FlashArray//C.”

There were 262 new customers in the quarter with the total customer count being more than 12,500. The subscription annual recurring revenue (ARR) of $1.45 billion was up 25 percent year-on-year. Product revenues were $347.4 million, an increase of 12.5 percent Y/Y. There were record first quarter sales of the FlashBlade product.

Quarterly financial summary

- Gross margin: 73.9 percent, up from year-ago 72.2 percent

- Free cash flow: $173 million vs year-ago $122 million

- Operating cash flow: $221.5 million vs year-ago $173 million

- Total cash, cash equivalents and marketable securities: $1.72 billion

- Remaining Performance Obligations: $2.29 billion vs year-ago $1.8 billion.

Pure won a Meta (Facebook) deal a couple of years ago but little has been heard abut that recently. However Giancarlo was bullish about future hyperscaler business in his prepared remarks: ”Our //E family continues its strong growth and was also a key enabler in our discussions with hyperscalers. …The quantity and quality of our discussions with hyperscalers have advanced considerably this past quarter.”

He explained: “Hyperscalers have a broad range of storage environments. These include high-performance storage based on SSDs, multiple levels of lower-cost HDD-based nearline storage, and tape-based offline storage. We are in a unique position to provide our Purity and DirectFlash technology for both their high performance and their nearline environments, which make up the majority of their storage purchases. Our most advanced engagements now include both testing and commercial discussions. As such, we continue to believe we will see a design win this year.”

Krysler talked about Pure’s “pursuit of replacing the vast majority of data storage with Pure Flash, for all customer workloads, including hyperscalers’ bulk [disk] storage.” He means the public cloud and Meta-like hyperscalers, the FAANGs-type companies: Meta(Facebook), Amazon, Apple, Netflix, and Alphabet (formerly known as Google). Pure is looking at their general purpose bulk storage – 80 to 90 percent of their total storage buildouts sitting on disk.” CTO Rob Lee said in the earnings call “that’s really the opportunity that we see as we refer to the hyperscalers.”

A win there would be a landmark deal.

Giancarlo sees three other opportunities ahead: “The recent advances in AI have opened up multiple opportunities for Pure in several market segments. Of greatest interest to the media and financial analysts has been the high-performance data storage market for large public or private GPU farms. A second opportunity is providing specialized storage for enterprise inference engine or RAG environments. The third opportunity, which we believe to be the largest in the long term, is upgrading all enterprise storage to perform as a storage cloud, simplifying data access and management, and eliminating data silos, enabling easier data access for AI.”

He asserted: “We also believe that long-term secular trends for data storage are no longer based on the expectation of commoditized storage, but rather on high-technology data storage systems, and run very much in our favor.”

Next quarter’s revenues are expected to be $755 million, 9.6 percent up on the year-ago quarter. Pure is looking for 2025 revenues to be around $3.1 billion, meaning a 10.5 percent rise on 2024.

Giancarlo teased future announcements, saying: “At our June Accelerate conference, global customers will see how our latest innovations enable enterprises to adapt to rapid technological change with a platform that fuses data centers and cloud environments.” It sounds like Cloud Block Store is getting a big boost. Maybe we’ll see the Purity OS ported to the public cloud and and a cloud version of FlashBlade.