SSDs, which are predicted to render hard disk drives obsolete by within four years, are set to increasingly grow capacity shipped faster than nearline disk drives between now and 2027, with their cost/GB falling faster than HDDs as well.

Disk drives, with a single set of read-write heads and seek time data access delays, are slower to access data than SSDs. They can stream data about as fast and are a fifth of the cost of SSDs on a per-TB basis. They are, however, smaller in capacity than SSDs with the latest 24-28 TB HDDs comparing unfavorably to the newest 30.7 TB TLC and 61.4 TB QLC SSDs.

Disk drive markets outside the enterprise mass-capacity nearline storage sector are seeing increased cannibalization by SSDs. Thus notebook and PC workstation storage is increasingly moving to SSDs, and mission-critical 10,000 rpm 2.5-inch drives are being replaced by SSDs as well. Mass-capacity nearline drives are the holdout area, with capacities set to rise to 40 TB and beyond as HAMR technology is deployed.

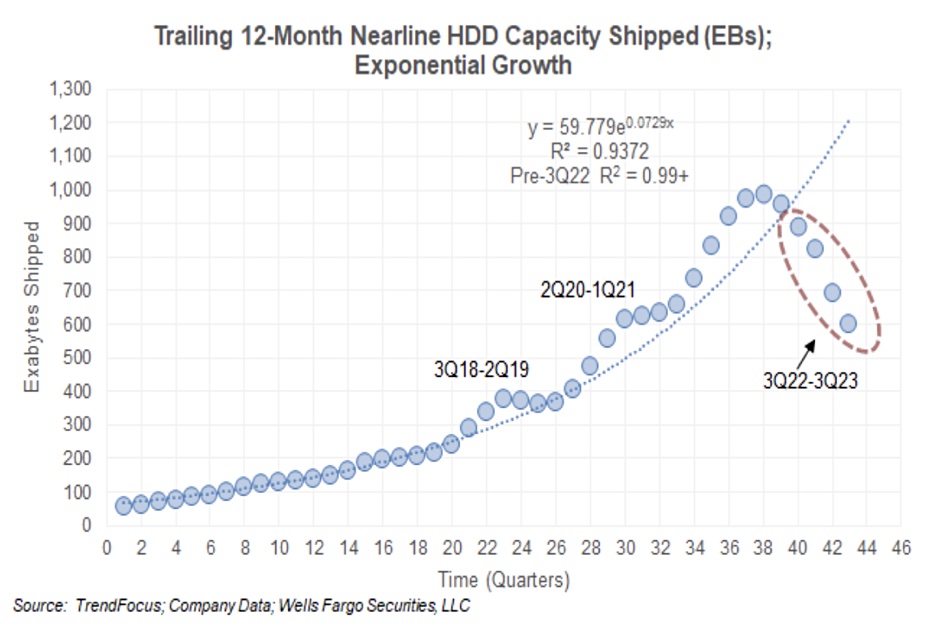

These nearline drives are the main HDD product now, according to Wells Fargo’s Aaron Rakers, who says they account for approximately 70-75 percent of total HDD exabytes shipped, and an estimated 60 percent-plus of total HDD industry revenue. Sales have slumped in recent quarters as the hyperscalers, Chinese customers, and large enterprises slowed purchases due to the general economic situation.

However, Rakers detects signs that nearline disk shipments are going to rise. He writes: “Reports from TrendFocus indicate that C1Q24 supply has been sold out with a macroeconomic-driven tightening taking place at the end of 2023 / early 2024 vs. prior expectations of 2H24.” Disk drive manufacturer Western Digital says it’s seeing signs of a nearline demand pick up.

Rakers expects a strong recovery in the nearline HDD market in 2024 as hyperscale demand returns in the second half. Gartner forecasts that the nearline HDD market will see capacity increase 22 percent year-on-year in 2024.

Nearline is also expected to continue to rise as a share of total HDD revenue, Rakers said, again citing Gartner figures. Nearline are tipped to account for around 72 percent of HDD revenues this year and grow to 93 percent in 2027 as consumer goods move to SSDs and enterprises continue to shift away from SSDs outside the nearline storage sector.

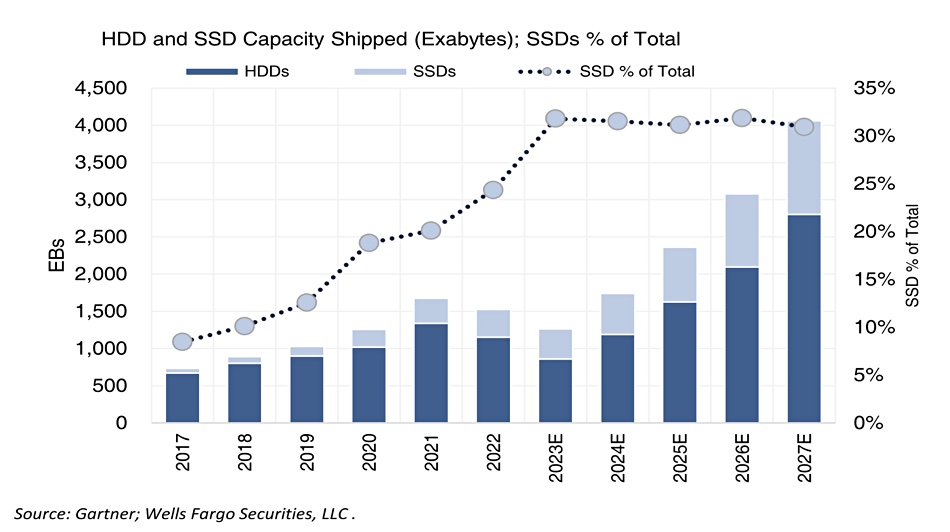

SSD capacity shipped is touted to grow at a 21 percent CAGR from 2022 to 2027, while nearline HDD capacity shipped is calclated to grow at 19 percent CAGR in that period.

Tellingly SSD cost/GB, we’re told, will fall 13 percent from 2022 to 2027 while nearline Cost/GB will decrease less, 8 percent in the same period. That means the SSD 5x price premium over HDDs should fall.

While the disk drive slump has been taking place, Rakers has seen no sign of increased SSD cannibalization in the enterprise storage market. He writes: “We see SSD capacity shipped as accounting for approximately 12 percent of total enterprise storage (HDD + SSD) capacity shipped. This has remained relatively unchanged over the past few years, or rather not reflected any signs of a materializing inflection despite the severe price declines seen in NAND Flash over the past several quarters.”

He does think that SSD enterprise storage sales could rise in the future and will be watching out for it: “We will be focused on whether we see any signs of an inflection in SSD/flash capacity deployment elasticity in the enterprise market.”

He points out that he now thinks $/GB SSD pricing will increase during 2024, which would deter further SSD cannibalization of HDDs, but three factors could encourage it:

- AI-optimized accelerated compute requires scale-out flash-based storage.

- The power consumption and datacenter footprint of all-flash is a long-term advantage versus traditional HDD-based architectures.

- Increasing flash/SSD density such as Pure Storage Direct Flash Modules (DFMs) “moving from today’s 48 TB DFMs to 75 TB and a target of 150 TB DFMs in 2024 and then to 300 TB capacities by 2026.”

Overall, we think Rakers is detecting signals that the SSD shipment share of enterprise storage could rise as we progress to 2027. Whether it will rise enough to prevent new HDD sales after 2028, though, is another matter entirely.