HPE recorded strong quarterly revenues with little sign of any slowdown affecting the next quarter’s business, unlike NetApp. Storage did moderately well but there was a 70 percent rise in Alletra array sales.

Revenues in the fourth fiscal 2022 quarter ended October 31 were $7.87 billion, 7 percent higher than a year ago, above guidance, and the second-highest quarterly revenue on record for the company on a continuing operations basis. There was a loss of $304 million, a major turnaround from the year-ago $2.55 billion profit. Full year revenues were $28.5 billion, 3 percent higher than a year ago, with$868 million profit, well down on the year-ago $3.4 billion profit, 74 percent lower in fact.

President and CEO Antonio Neri said in a statement: “HPE had an impressive fourth quarter, generating an outstanding performance across our key performance metrics. We are producing strong financial results.”

EVP and CFO Tarek Robbiati said: “Our differentiated edge-to-cloud portfolio is driving sustained demand, which is translating to record or near-record results for HPE… We are now entering a very different phase of the company, one where the combination of our rightsized cost structure and substantial order book is expected to deliver profitable growth that is increasingly recurring at higher margins as our as-a-service transformation continues to unfold.”

Supply chain issues are improving but the supply environment is not yet back to pre-pandemic levels. Robbiati said in the earnings call: “We now also have improving supply as supply capacity in the consumer electronics markets is redirected towards enterprise markets where demand for digital transformation continues unabated.”

Q4 financial summary

- Gross margin: 32.9 percent, same as last year, down 0.16 percent sequentially

- EPS: -$0.23 down 112 percent from the prior-year period and down 174 percent sequentially

- Operating cash flow: $3.0 billion, same as a year ago

- Free cash flow: $2 billion, up $1.9 billion from last year and a record

- Cash and investments: $4.16 billion vs $3.76 billion last quarter

Fiscal 2022 financial summary

- Gross margin: 33.4 percent, down 0.03 percent year-on-year

- EPS: $0.66 down 74 percent from the prior-year period

- Operating cash flow: $4.6 billion, down $1.3 billion from a year ago

- Free cash flow: $1.8 billion, up $0.2 billion from last year

HPE says it is delivering revenue growth and higher earnings/share with a resilient gross margin based on an improved (higher-margin) product mix and pricing discipline. It has tripled free cash flow since 2020.

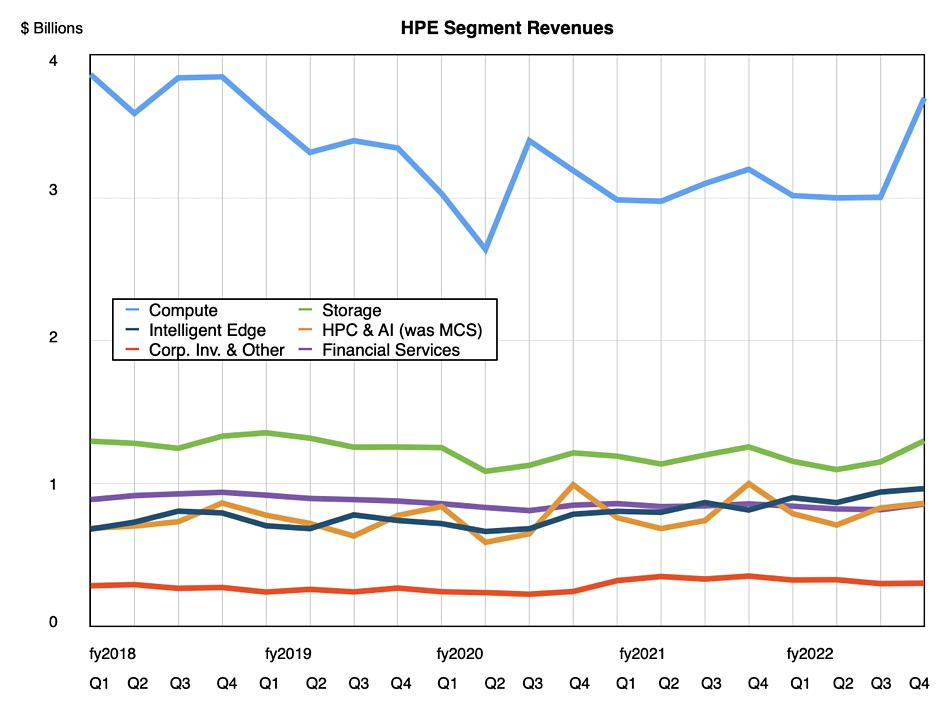

HPE product sales did well, apart from the HPC and AI sector which declined 14 percent. The product segment revenues were:

- Compute: $3.7 billion, up 16 percent year-on-year and 23.2 percent sequentially

- Storage: $1.3 billion, up 4 percent

- Intelligent Edge: $965 million, up 18 percent

- HPC & AI: $862 million, down 14 percent

- Corporate Investments & Other: $303 million, down 14.2 percent

- Financial Services: $857 million, flat.

The HPC revenue fall was attributed to timing issues with the Frontier supercomputer, delaying revenue recognition until next quarter.

HPE GreenLake orders were up 33 percent in the quarter and 68 percent in the full year. The company said supply constraints limited installations, otherwise the numbers would have been higher.

On pricing discipline, HPE said it drove near record compute revenues and operating margins. Compute units shipments rose more than 4 percent but price/unit went up in the high teens due to price rises and a better product mix.

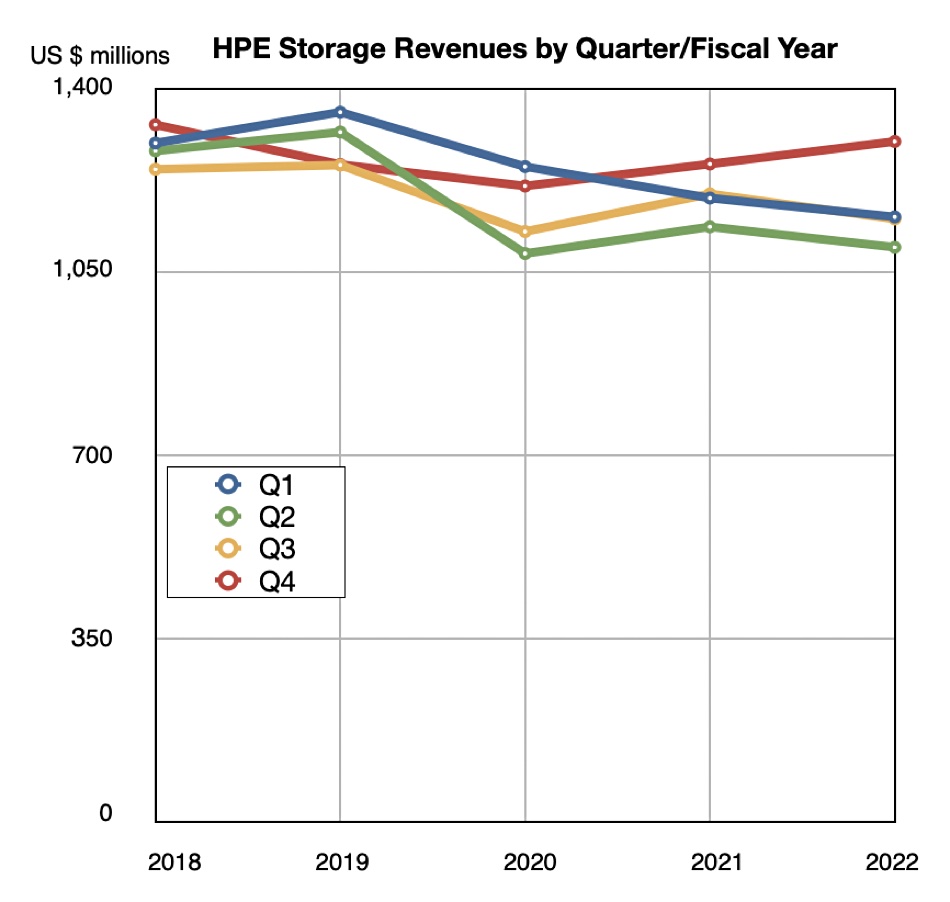

The storage sector grew just 4 percent, a lower rate than Dell’s 11 percent. There was double-digit growth in HPE’s own storage products (owned IP) but not in revenues from third-party storage sold by HPE. In fact there was greater than 70 percent growth in Alletra array revenues and orders, up 100 percent sequentially according to Robbiati. All-flash arrays did well too.

The Alletra product line grew in marked contrast to other HPE storage products, since they dragged overall storage growth down to just 4 percent in the quarter. But this overall uplift was welcome after three quarters of HPE storage revenue decline:

Robbiati said: “Our storage transformation is now in full swing, as you can see. And we expect our storage business to deliver revenue growth in line with market, with our own IP products growing above market.”

Neri amplified this, saying: “What excites Tarek and me is the fact that in 2023, you’re going to see an acceleration of that portfolio to HPE Alletra, which… had 100 percent growth sequentially. And obviously, that comes also with an incredible attach of Pointnext OS [services]. And also, as we drive that data protection strategy, the incremental value comes from backup and recovery and disaster recovery and ransomware offers. We have now those offers integrated into HPE GreenLake.”

HPE outlook

Looking back to the start of the pandemic, Neri said: “When the pandemic started, we came here, to the call, and we told you we’re going to enact a program to reallocate resources to high-growth, high-margin areas and rightsize the company. We believe we are rightsized going forward. And those actions are paying off, not only because we delivered $175 million net savings to shareholders but because we have now different talent in different locations that give us the confidence that we can execute the strategy.”

Next quarter revenues are expected to be between $7.2 billion and $7.6 billion, meaning a 6.3 percent increase year-on-year at the mid-point. Neri said this guidance ”includes the recognition of the remaining part of Frontier.”

Fiscal year 2023 revenues are expected to grow 2 to 4 percent at constant currency.

HPE is not seeing a coming slowdown, unlike NetApp. It is not experiencing, for example, any meaningful cancellations in its backlogged orders. Robbiati said: “Our view remains one of enduring market demand given the mega trends of digital transformation and the explosion of data. We also believe our own portfolio differentiation will allow market share gains.”

Neri said HPE closed this fiscal year with a significantly larger order book than it had at the start of the year. “Our fourth quarter and year-end results position us for continued, durable, profitable growth in fiscal year 2023.”