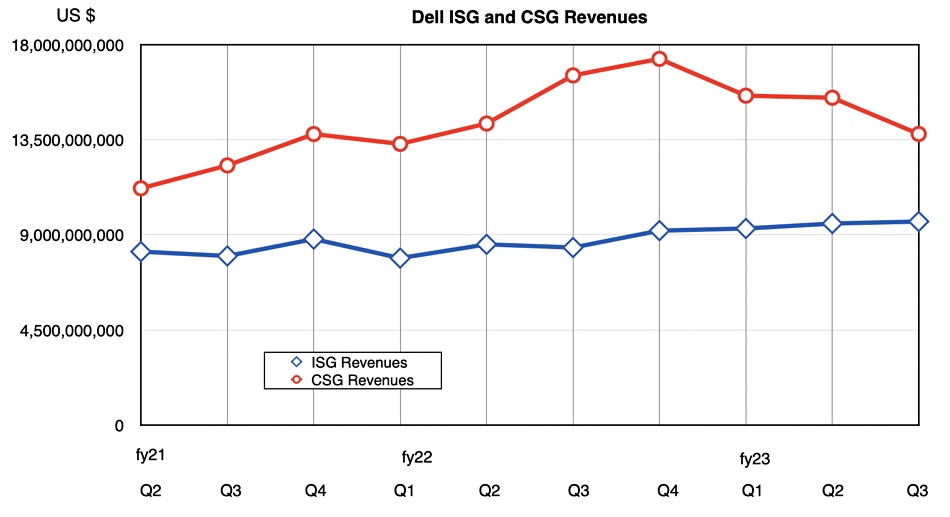

Dell PC sales took a dive in the third 2022 quarter, taking Dell’s overall revenues down with them, although the datacenter business managed to grow.

Client Solutions Group (CSG) revenues dropped 17 percent to $13.8 billion in the fiscal quarter ending October 28, while Infrastructure Solutions Group (ISG) revenues rose 12 percent to $9.6 billion, giving Dell overall revenues of $24.7 billion in the quarter, a 6 percent year-on-year decline. Within CSG commercial revenue was $10.7 billion, down 13 percent, and consumer revenue was $3 billion, down 29 percent. There was a profit of $241 million, down 94 percent annually.

Jeff Clarke, Dell vice chairman and co-COO, was bullish about the results: “We played our hand in Q3 exceptionally well; it’s what we do. We reduced backlog to meet customer needs and deliver record business results, including record third quarter ISG revenue of $9.6 billion. At the same time, our innovation engine is operating at full throttle in strategic areas like edge, multicloud and as-a-Service.”

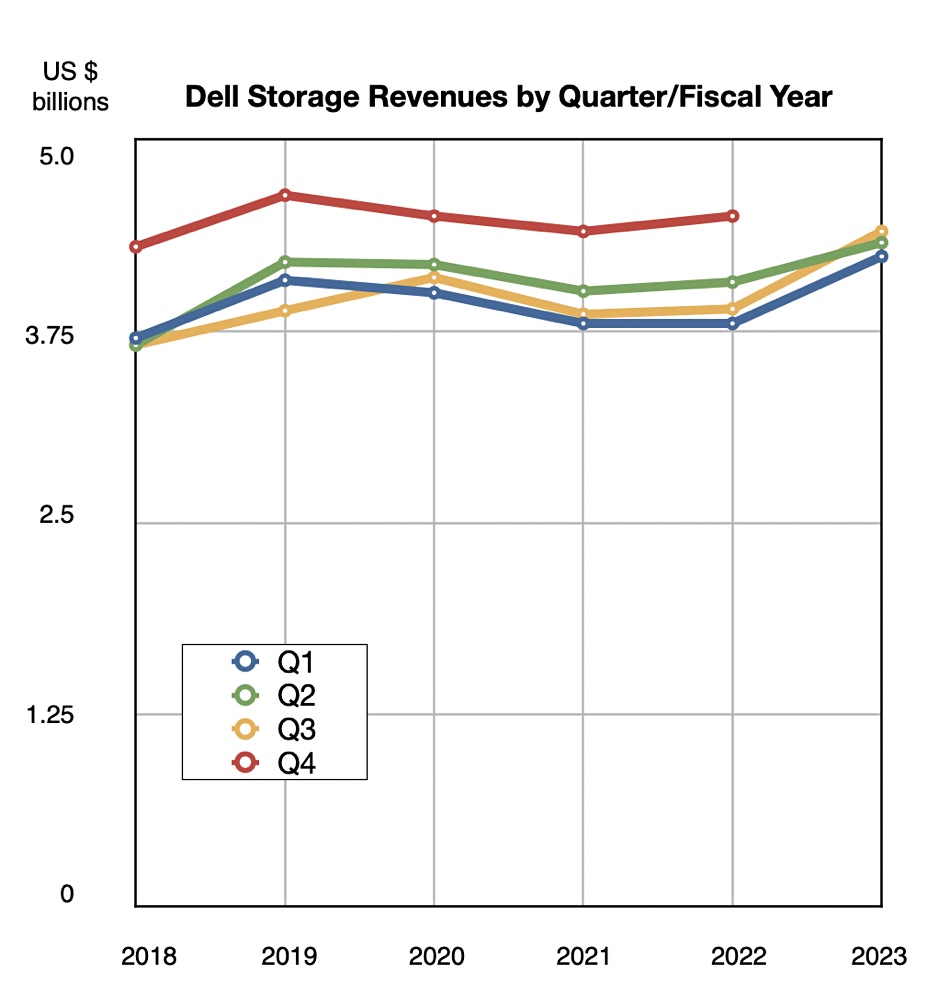

Within ISG, storage revenues were $4.43 billion, up 11 percent on the year, with server and networking revenues of $5.2 billion, 14 percent higher than a year ago.

Dell had expected revenues in the quarter to be in the $23.8 billion to $25 billion range, and it was in the area of that: $24.7 billion. It had foreseen CSG declining in the high teens and ISG growing in the low teens. Both met expectations.

Financial summary

- Operating income: $1.8 billion, up 68 percent y/y

- Gross margin: $5.9 billion, up 2 percent y/y and 23.7 percent of revenue

- Diluted EPS: $0.33

- Operating cash flow: $0.4 billion, down 82 percent y/y

- Adjusted free cash flow: $0.1 billion, down 94 percent y/y

- Recurring revenue: $5.4 billion, up 11 percent y/y

- Cash and investments: $6.5 billion

Dell said it gained commercial PC market share in units shipped terms, with co-COO Chuck Whitten saying in the earnings call: “We continued to gain commercial PC unit share in Q3 and have now gained share in 35 of the last 39 quarters.”

“We delivered very good results including strong ISG revenue with record profitability and good CSG profitability, despite the difficult demand environment that we highlighted in our last earnings call. … Q3 played out as we previewed last quarter, soft underlying PC demand and slowing infrastructure demand, though storage did hold up fairly well relative to servers.”

This was the 3rd consecutive quarter of ISG revenue growth, with demand increasing across multiple storage types, notably the high end (PowerMax) and PowerStore. CFO Tom Sweet said: “In storage, we are bigger than two and three combined, and with our refreshed storage portfolio, we have added to our number one position, gaining share over the last two quarters.”

We understand the number 2 and 3 players are HPE and NetApp. Dell says it already has the leading market share in several storage categories; external storage (29.9 percent), HCI (36.6 percent), high-end (44.5 percent), and all-flash arrays (31.6 percent) quoting IDC numbers. The mid-range and low-end areas look to be the missing categories here.

The servers and networking segment reported its eighth consecutive quarter of Y/Y growth. With that Dell expects market share gains across both storage and servers when Q3 IDC results are announced in December. It highlighted its rate of new product and service introductions, such as PowerFlex being ported to AWS, implying that it was developing its product set faster than its competitors and leaving them behind.

Outlook

Whitten said: “The near-term market remains challenged and uncertain.” Dell’s fourth quarter outlook is for revenue of $23.0B -$24.0B, down 16 percent y/y at the midpoint, and with ISG to be roughly flat and, therefore, CSG down again. There could be an FX headwind of ~500 bps.

But storage could shine again, with Whitten saying: “Clearly, right now, data is exploding. The world needs more storage. And so, when we flash forward to what’s implicit in our guidance, we’re anticipating a seasonally strong storage quarter in Q4.” That has positive implications for storage revenues from HPE, NetApp and Pure Storage.

At the $23.5 billion mid-point Dell’s full fy23 revenues will be $100.8 billion, slightly lower than fy22’s $101.2 billion, but they would be $101.3 billion at the high-point. It’s possible if Dell really goes for it and the global economy doesn’t worsen unexpectedly.

Sweet discussed Dell’s preliminary – and somewhat gloomy – views of the next financial year, fy24: “We expect ongoing global macroeconomic factors including slowing economic growth, inflation, rising interest rates and currency pressure to weigh on our customers, and as a result, their IT spending intentions even as they continue to digitize their businesses. These dynamics are creating a broader range of financial outcomes for our upcoming fiscal year, particularly as we think about the second half of the year.” This prepares analysts for fy24 revenues to be lower than fy23 revenues.

In fact Wells Fargo analyst is modelling it at $88.7 billion, 12 percent less than fy 22’s $101.2 billion.