Pure Storage shrugged off emerging macroeconomic woes with a sound growth quarter and positive outlook for its all-flash arrays.

Revenues for Q3 fiscal 2023 ended 6 November were $676 million, 20 percent higher than a year ago, helped by Pure shipping FlashBlade and FlashArray//C in the second phase of Meta’s research super cluster (RSC) system. Despite this, there was a $787,000 loss, but a considerable improvement on the $28.7 million loss a year ago.

CEO Charlie Giancarlo said in the earnings call: “We are once again pleased with our quarterly results, showing a year-over-year revenue growth of 20 percent and subscription ARR growth of 30 percent, surpassing $1 billion for the first time.”

CFO Kevan Krysler said in a statement the “declining cost of flash is accelerating our progress in replacing traditional disk solutions and substantially reducing data center energy consumption.” Giancarlo amplified this with a comment that “Pure’s QLC-based systems are now competitive with hybrid disk based systems on a price per bit level years ahead of the commodity crossover point.” That’s because of Pure’s proprietary flash module technology and avoidance of commodity SSDs.

In fact, Giancarlo said he thinks “that the currently anticipated improvements in Pure’s NAND economics this coming year will enable Pure to deliver our QLC-based products at prices competitive with most nearline disk arrays on a total cost of ownership basis. We believe strongly that the days of the hard disk in the data center are over.”

He would say that, and both Seagate and Western Digital are forecasting growing nearline disk sales.

Giancarlo gave a nod to the global economic situation: “Looking ahead to world economic conditions, we continue to see instances of longer sales cycles in the enterprise segment, and expect that enterprises will continue to exercise caution in spending over the next year… We plan to thoughtfully invest in our expansion, while continuing to deliver strong operating results. Despite the challenges and uncertainties of the current business environment, we remain confident in our ability to take share and outpace the market.”

Financial summary

- Subscription Services revenue $244.8 million, up 30 percent year-over-year

- Subscription Annual Recurring Revenue (ARR) $1.0 billion, up 30 percent

- Remaining Performance Obligations (RPO) $1.6 billion, up 26 percent

- Gross margin 69.0 percent;

- Operating income $9.1 million

- Operating margin 1.4 percent

- Operating cash flow $154.7 million

- Free cash flow $114.8 million

- Total cash, cash equivalents, and marketable securities $1.5 billion

- Returned approximately $24.5 million stockholders, repurchased 888,000 shares

Pure won about 390 new customers in the quarter, compared to the prior quarter’s 350, taking its total customer count past to 11,562, according to Wells Fargo analyst Aaron Rakers. It has now penetrated 58 percent of the Fortune 500; it was 56 percent in the previous quarter.

Sales of the QLC-based FlashBlade//S product were higher than expected, with customers choosing higher-capacity systems than anticipated. Sales of the high-end FlashArray//XL product were also strong.

In the subscription revenues area, Giancarlo said: “Our portfolio of subscription products had a strong quarter with Evergreen//One achieving record results… Evergreen’s flexible approach to both consumption and pricing is helping customers of every size, deal with the uncertainties that businesses and organizations face in the current environment.”

Krysler added a couple of extra points: “Product revenue grew 15 percent… Subscription services comprise 36 percent of total revenue for the quarter.”

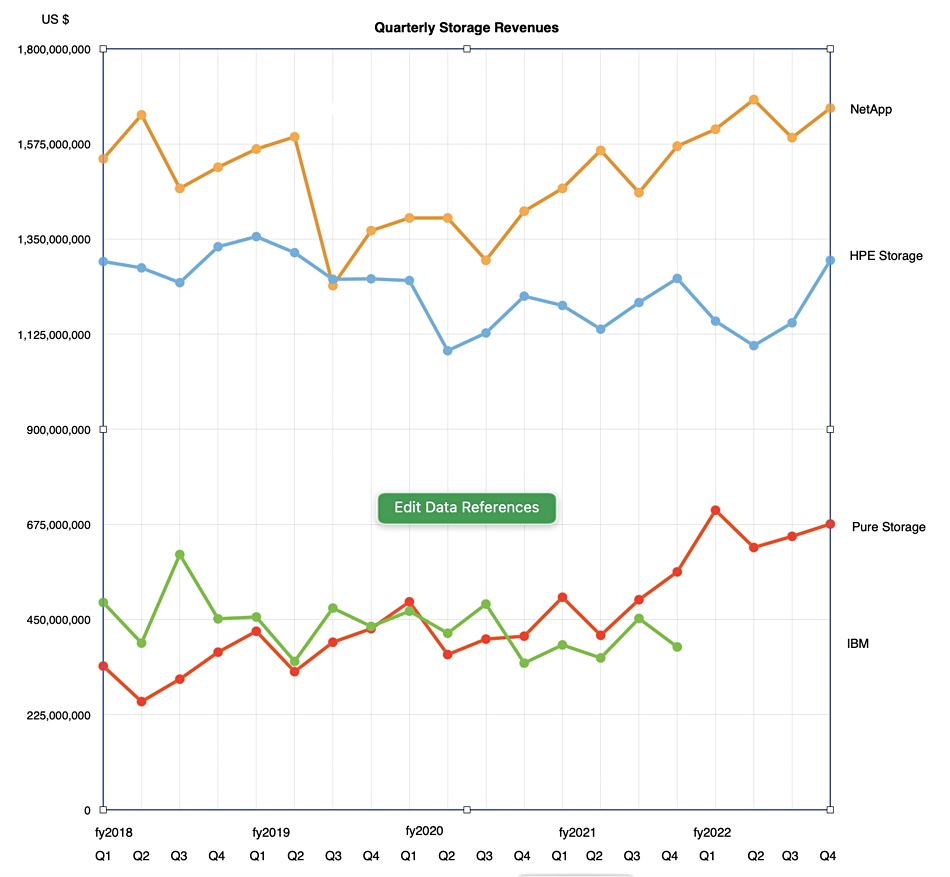

How is Pure doing in comparison to NetApp and HPE’s storage revenues:

It had been steadily catching up with HPE but that company has outgrown Pure in the last couple of quarters. NetApp has been generally keeping pace with Pure in terms of growth since 2020.

Outlook

Pure issued guidance for the next quarter, its seasonally strong Q4, with revenues expected to be approximately $810 million, 20 percent higher than the Q3, and 14.3 percent more than a year ago. That would mean $2.75 billion revenues for the full fiscal 2023, 26 percent higher than a year ago. It previously predicted $2.6 billion in 2023 revenues.

This continued growth differs from NetApp’s forecasted revenue decline. Like Pure, HPE is also forecasting growth in its next quarter but not as much. Giancarlo is quite optimistic: “We’re still coming up upon $3 billion in terms of our total revenue. So lots of growth opportunities in the future.”