Infinidat will strengthen its products with access to a wider range of client protocols, as it sticks to its on-premises high-end storage focus – but not to the extent of adding a mainframe connector or porting its software to the public cloud.

Update; NVMe-oF support timescales added. 13 April 2022.

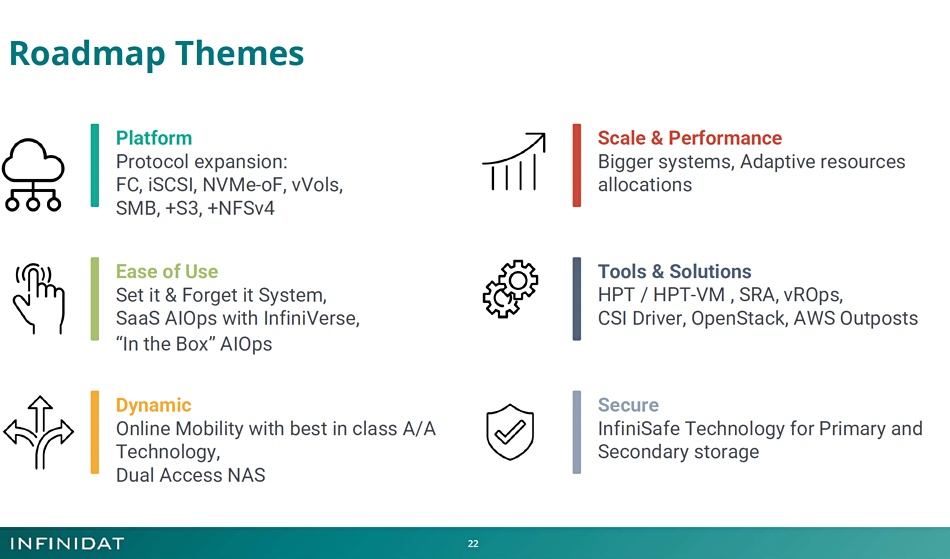

The company presented its roadmap at an IT Press Tour event in Tel Aviv. A large element of its strategy is to add extra front-end protocol access methods to widen the pool of client systems that can use the Infinibox array. SMB access is being developed for servers using that protocol. Version 4 NFS will be added and so too will be S3, AWS’s object storage protocol.

CEO Phil Bullinger said: “We now have a laser focus on selling the right product to the right customer.”

Bullinger became CEO in January 2021 and set about replenishing the executive team with a focus on execution rather than changing the world through product development, but retaining a strong focus on engineering.

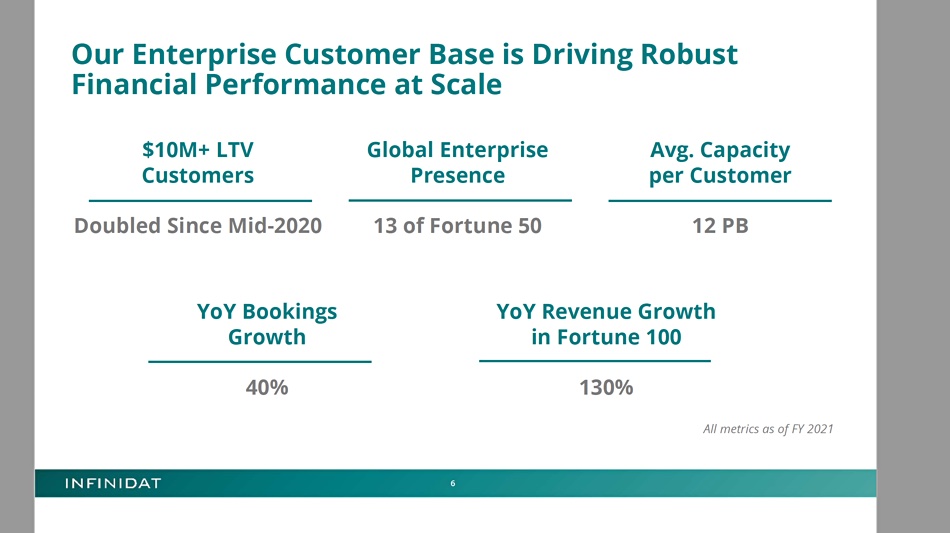

The results have been dramatic – with increased growth as the disk-based array’s bullet-proof reliability and consistent high performance through memory caching have been extended to an all-flash product and a purpose-built backup appliance with cyber-resiliency. Highly appreciative customers have helped spread the word as well.

The stronger growth means Infinidat is profitable and reinvesting in the business.

With the extended access protocol options, Infinidat will offer concurrent block, file, and object storage access via S3. Bullinger believes that performant object storage will become much more important – that object will become primary storage for some applications in the high-end enterprise storage space.

The block access area will be enhanced further by adding both iSCSI and NVMe-oF. NVME-oF/RoCE and NVME-oF/FC will be added to the existing NVMe/TCP. With NVMe access added inside the array, Infinidat will have end-to-end NVMe capability.

Timetable:

- NVMe/TCP – now

- NVMe-oF RoCE – Q3/2023

- NVMe/FC – Q3/2023

Infinidat will look to add more AI and ML features to its AIOps management and to the ransomware attack detection area.

What’s not on the roadmap

Infinidat does not plan to port its InfiniBox OS to the public cloud, nor to provide mainframe connectivity. Replicating Infinidat’s memory caching would be an issue, as available public cloud instances don’t support the concept.

Mainframe connectivity was attempted when Moshe Yanai was CEO, but it foundered because of cost and time issues – far more technology was needed than just adding a FICON network pipe to the array. This sucked up engineering dollars and, at the same time, the problem of getting IBM certification – a mandatory requirement – was hindered by bureaucracy, with a year-plus timescale being mentioned.

The overall development cost became too high and Infinidat abandoned the attempt.

Future

Bullinger’s view is that there are three doors ahead of Infinidat: IPO, acquisition, or funding for more growth. On joining, he oversaw a 40 per cent bookings growth from 2020 to 2021 and wants to do better still.

In his view, Infinidat has plenty of potential growth in the high-performance, enterprise, mission-critical storage array market without having to enter the mainframe market or port the software to the three main public clouds. Infinidat can stick to its knitting with growth possibilities enhanced because its main competitors – Dell EMC, Hitachi Vantara, HPE, and NetApp – have taken their eyes off the ball in the Infinidat market.

PowerMax is not as successful as Dell might have hoped. Hitachi Vantara is like a flywheel that has lost its motive power – still spinning but slowing down. This is so even though GigaOm rates its SAN storage highly. A recent refresh could change its market situation.

HPE storage is, market-wise, weak. It has its XP, with Hitachi Japan as an OEM, but we hear less and less about it. It is architecturally different from the 3PAR-Primera-Alletra 9000 line which is not setting the world on fire and is, again, architecturally different from the Nimble-Alletra 6000 line. NetApp is perceived as not really having PowerMax, DS8000, VSP, or XP-class machines. Newcomer Pure is not in this space either.

So Infinidat has this particular market wide open to its persuasive sales reps and partners.

With that basic growth prospect, Bullinger might pursue funding to gain technology through an acquisition/acquihire exercise – but only to strengthen the core InfiniBox line, not to enter a completely new market. He might ask for funding to build out Infinidat’s business infrastructure and have more presence in the market so that Infinidat could grow even faster.

Our feeling is that he will do just that: request funding for a growth-related initiative.