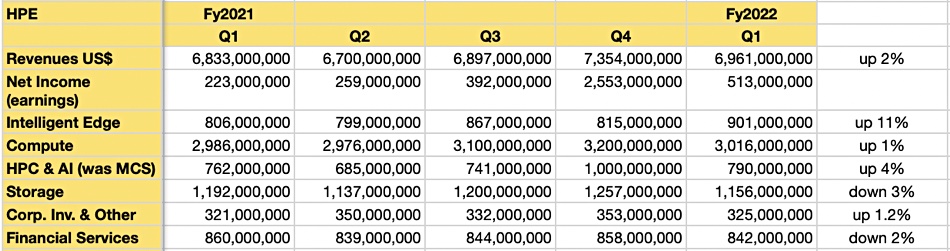

Revenues rose just 2 per cent in HPE’s first fiscal 2022 quarter, but order growth was up 20 per cent with as-a-service up 136 per cent. Supply constraints affecting virtually all IT system suppliers caused backlogs to build-up further and storage revenues slipped 3 per cent year-on-year.

HPE reported $6.96bn in revenues for the quarter ending 31 January 2022, compared to $6.83bn a year ago. There was a net profit of $513m, up 130 per cent year-on-year.

Antonio Neri, HPE’s president and CEO, said in the earnings call: “Hewlett Packard Enterprise delivered a solid performance. The quarter was characterised by robust customer demand and profitability… Our business pivot is… strengthening our gross and operating margins.”

The “pivot” refers to the GreenLake as-a-service business model. But there were “continued industry-wide supply constraints, which slowed our ability to convert orders” and contributed to a “record-breaking backlog,” Neri said. Both NetApp and Dell said the same dynamics had shaped their recent results.

Wells Fargo analyst Aaron Rakers told subscribers: “HPE noted that orders showed no signs of double ordering or noticeable cancelations and highlighted its belief that backlog hasn’t peaked.”

Financial summary

- As-a-Service annualised revenue run-rate (ARR): $798m, up 23 per cent from the prior year period, and orders up 136 per cent

- Gross margin: 33.7 per cent

- Cash flow from operations: -$76m as end-of-year bonuses were paid to sales

- Free cash flow: -$577m, reflecting normal seasonality and strategic working capital actions due to strong customer demand

- Diluted earnings per share (EPS): $0.39 compared to year-ago $0.17

HPE splits its results across six segments, which all saw increased revenues except storage and financial services, as the table illustrates:

Storage

Storage revenues declined 3 per cent year-on-year to $1.192bn due, HPE said, to supply constraints on more complex owned-IP offerings – possibly its storage array ASIC hardware. Primera revenues grew 20 per cent annually based on constant currency. We note that HPE did not say if Alletra 9000 revenues were up, the Alletra 9000 being the Primera follow-on array.

There was a storage segment operating profit margin of 14.5 per cent, down 0.51 per cent due to higher supply chain costs and an unfavourable shift in product mix, meaning HPE shipped more lower-margin products than it expected.

But storage product orders were up more than 15 per cent for the fourth consecutive quarter with a record backlog. So storage revenues were more affected by supply constraints than the Compute, Intelligent Edge, and HPC segments.

Dell reported flat storage earnings growth in its most recent quarter while NetApp revenues grew 9.8 per cent year-on-year. HPE is doing least well out of these three.

In the earnings call Neri said: “In Q1, nearly 10 per cent of computer storage orders were sold as a service.” The GreenLake services story is good news for HPE and it added more than 100 as-a-service customers in the quarter, taking the total past 1,350.

Outlook

CFO Tarek Robbiati said: “We are off to a strong start delivering against our FY22 commitments with our third quarter in a row of more than 20 per cent year-over-year order growth bolstering our confidence for sustained revenue growth.” HPE is generating “better quality of earnings demonstrated by our improved gross margin despite ongoing supply chain constraints that enabled us to deliver Q1 EPS well above our outlook range and raise our outlook for the full year.”

HPE forecasts diluted net EPS rather than revenue, with Q2 2022 EPS expected to be $0.18 to $0.26/share.