Although Dell Technologies announced a more than healthy 15 per cent rise year-on-year in its second fiscal quarter revenues, storage let the side down with a one per cent decline.

In summary, Dell revenues were $26.1 billion in the quarter ended July 30 — a record — and it made a $900 million profit, which sounds a lot but was actually down 18 per cent year-on-year. Our sister pub, The Register, covered the overall results and we’re going to dive deeper into the storage side here.

CFO Tom Sweet’s results announcement statement said: “We had strong results again this quarter, with all business units growing. We are creating long-term value by taking share, pursuing high-value growth opportunities and profitably growing and modernising our core business.”

The company makes its money from VMware, and two large business units: the Client Solutions Group (CSG) selling PCs and associated kit; and the Infrastructure Solutions Group (ISG) which supplies servers, networking and storage. VMware pulled in $3.1 billion, up eight per cent on the annual compare. CSG raked in $14.3 billion, rising 27 per cent, with ISG earning $8.4 billion, up just three per cent.

Why was ISG growth so low? Servers and networking revenue was $4.5 billion, up six per cent on the year, while storage declined one per cent to $4 billion. This in a market that saw Pure’s revenues rise 23 per cent and NetApp’s 12 per cent. Something went awry.

Charts and shares

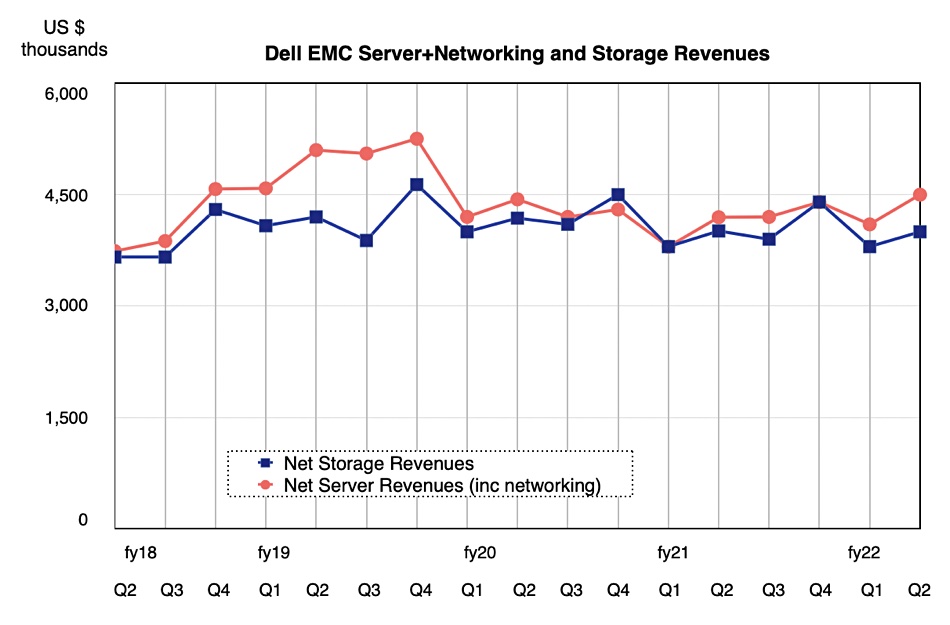

Two charts help set the context. Here is one looking at Dell’s server and networking revenues vs its storage revenues over the past few years:

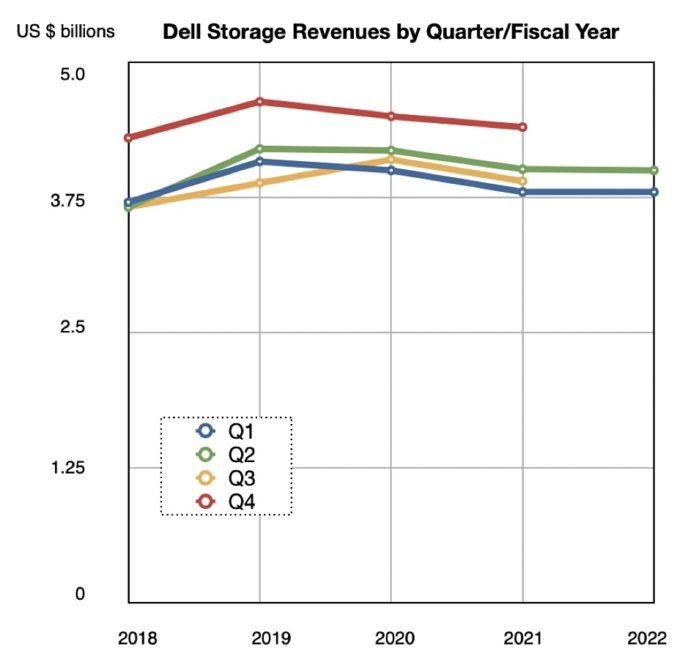

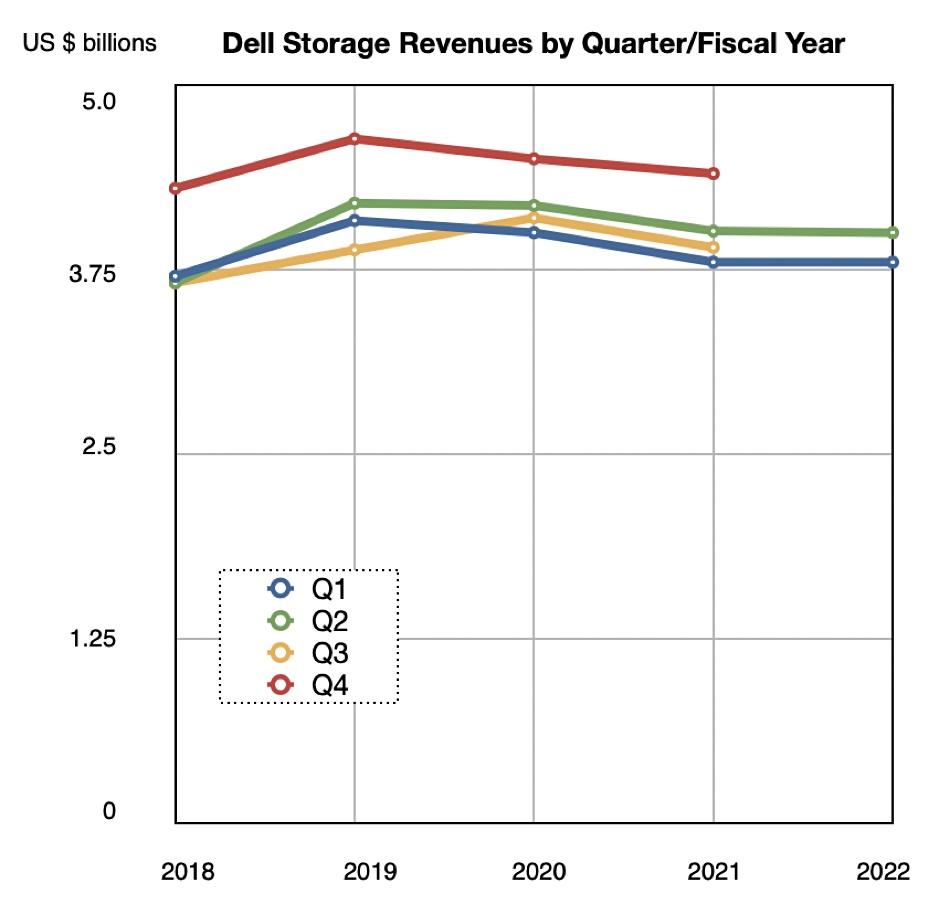

There was a quarter-on-quarter storage rise this quarter but, overall, storage revenues have been lagging server+networking revenues since the start of fiscal 2021. A look at the quarterly storage revenues by fiscal year brings out a pattern of low or no growth since fiscal 2019:

Of course, Dell is huge in storage. According to IDC it has leading shares in:

- External enterprise storage — 32.3 per cent;

- Storage software — 13.6 per cent;

- All-flash arrays — 36.8 per cent;

- Hyperconverged systems — 33.1 per cent;

- Converged systems — 42.1 per cent;

- Purpose-Built Backup Appliances — 50.7 per cent.

Yet its storage revenues sank this quarter while its competitors’ revenues rose.

Earnings call

Sweet supplied an explanation in the earnings call. “On an orders basis, we were encouraged to see positive overall storage growth of two per cent, with ongoing demand in high-growth areas like hyperconverged infrastructure, where VxRail’s orders were up 34 per cent, and in midrange storage, where orders were up 17 per cent. PowerStore continues to ramp nicely, making up approximately 38 per cent of our mid-range storage portfolio. Twenty-three per cent of PowerStore customers in Q2 were new to Dell storage.”

Co-COO and Vice-Chairman Jeff Clarke said: “PowerStore, our microservices-based mid-range storage solution … is ramping faster than any new architecture we’ve released, with double-digit increases in net new storage buyers for both Q1 and Q2. We are focused on the mid-range segment of storage and are pleased with the momentum we are seeing, but we know we still have work to do.”

Unfortunately the high-end PowerMax arrays let the side down, with Clarke saying: “we have a very large high-end business. That large high-end business is cyclical in nature. It was down year-over-year, and that’s down year-over-year after a very solid first half of last year.”

He added: “We have the privileged position of having a share position of in excess of 42 per cent [in the high end]. that market is declining. It’s cyclical in nature. Last first half, it grew. This first half, it’s not growing. That business, we’re obviously exposed to a large percentage of that business being the market share leader with 42-plus per cent share, is declining and we’re declining like the market is declining.”

Clarke said Dell was focussed on the storage mid-range, and it looks as if it has taken its eye off the high-end ball. Its competitors VAST Data and Infinidat are both growing, and so appear to be taking high-end share from Dell.

Although Dell’s mid-range storage and hyperconverged sales are growing at a healthy clip, they haven’t been able to compensate for PowerMax revenues slip slip sliding away.