The flash assault is progressing to the point where disk drives could will disappear from most data centres in a few years. That’s because flash affordability and performance will overcome disk’s advantages. Also recovering from disk failures will take far too long.

These are the views of GigaOm analyst Enrico Signoretti, responding to Western Digital disk capacity increases, and Wells Fargo managing director in equity research, Aaron Rakers, reacting to Western Digital’s latest 3D NAND news.

GigaOM guru

According to Signoretti the hard disk “will disappear from the small datacenter. … No more hard drives in the houses, no more hard drives in small business organisations, no more hard drives in medium enterprises as well. These kinds of organisations will rely on flash and the cloud, or only the cloud probably!”

He said upcoming 18 and 20TB capacity disk drives, going on up to 50TB, will increasingly be designed and built for hyperscalers such as Facebook and eBay, and public cloud service providers like AWS and Azure.

Signoretti thinks it will take weeks to recover data held on a failed high-capacity disk drive: “Large capacity will also mean longer rebuilding times in case of a failure. It can take a week to rebuild a 14TB HDD today, think about rebuilding a 50TB one!”

New disk technologies, such as host-managed shingling, multiple actuators and zoning will require code changes in applications that use current disk drives. These faster plug-in replacements for disk drives will look more attractive as SSDs become cheaper.

Signoretti argues that “all the added complexity will make hard disk drives unpractical for small organisations without enough data to store in them (and we will easily pass the 1PB mark in this case). Think about that: 1PB equals 20 hard drives, with parity and spare drives it will be 24. It provides you throughput, but very few IOPS and the risk of data loss is high due to rebuilding times. Good luck with that!”

He concludes: “Hard disk will disappear from your data centre if you don’t need several petabytes of cold storage installed locally on your premises… The all-flash data centre will become a reality, and you will store more and more of your cold data in the cloud.”

NAND layer cake

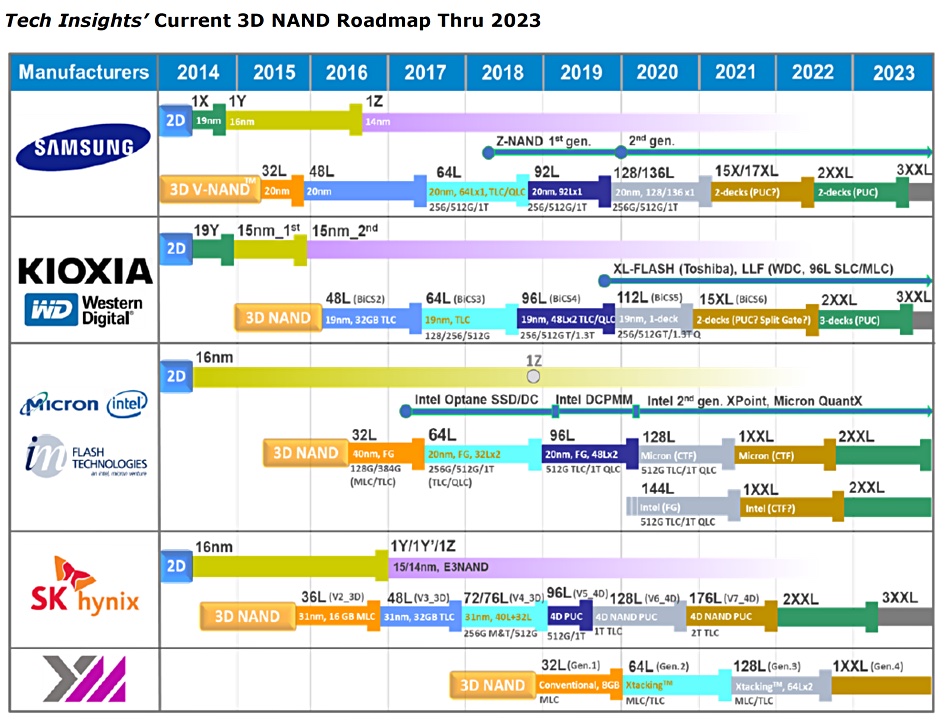

Western Digital and Kioxia’s 112-layer 3D NAND announcement last week has prompted Rakers to dive into product process costing. In a mail to subscribers he said this 112L NAND (the BiCS5 process) is a cost-optimised process which is up to 30 per cent cheaper per bit than the existing 96L product, at mature wafer yield rates.

Rakers notes the 112L product its basically two 56L dies stacked together whereas Samsung’s 128L die is a single stack design. The WD-Kioxia 112L wafer has “a widened bit density advantage vs Samsung” – about 7.8GB per square millimetre vs Samsung’s 6.8GB/square millimetre. He calculates WD-Kioxia has 10-15 per cent bit density advantage over Samsung’s 128L technology, and resulting cost advantage.

This means WD-Kioxia has substantially advanced the affordability of NAND especially when the 112L is formatted with QLC flash.

Most of today’s NAND is TLC (3bits/cell) and QLC has a shorter endurance, at around 1,000 cycles, than TLC, with its 3,000 cycles. It also has a read time of 100μs readvs TLCs 25μs. But it is still faster than disk, which is hobbled by seek time in the 8 – 12ms area.

Today’s high-capacity disk drives are increasingly used for nearline storage, which require medium to low write access rates. QLC 112L NAND can compete better in this market than TLC 96L, using wear-levelling and over-provisioning techniques.

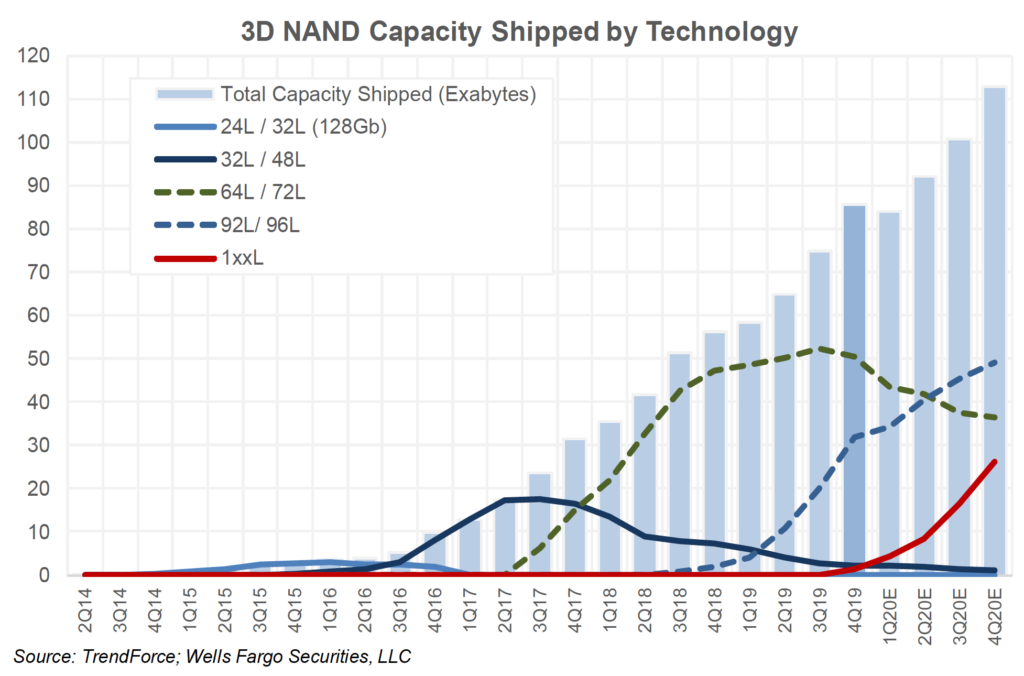

This leads Rakers to conclude that 100+ layer 3D NAND will become a dominant technology in terms of capacity shipped.

He writes: “The continued advancement in controller technology and software enhancements that improve upon raw NAND’s characteristics, is one of the main reasons we believe QLC adoption will accelerate and broaden its adoption over the coming years.”

Rakers has reproduced this 3D NAND roadmap;

SDD technology will be awash with 200-300 layer 3D NAND SSDs in 2022 and 2023, and consequently even lower cost per bit. He concludes: “We have… continued to see the price gap ($/GB) between enterprise SSDs and nearline HDDs shrink… In 3Q19 enterprise$/GB was approximately 8x higher than high-capacity/nearline HDDS, or down from about 9x and 15x in the prior and year-ago quarters.

“Our discussions with industry contacts have suggested that a decline into the 5x premium range could make a strong competitive case for the beginning of enterprise SSD replacement of nearline HDDs in select workloads.”

Further: “This could be the beginning of an inflexion in high-capacity enterprise SSD adoption.”

Background

Blocks & Files has covered the topic of HDDs vs SSDs in enterprise data centres in several articles, including these three below.

- How long before SSDs replace nearline disk drives

- Seagate: our disk drives are safe from SSDs for at least 15 years

- Infinidat: All-flash arrays don’t do hyperscale – use disk drives instead

In common with Signoretti and Rakers, we think enterprise QLC SSDs with >100 layers will start to replace nearline disk drives in data centres outside the hyperscalers and public cloud operators. 200L and >300L NAND flash will reinforce this trend.

But hyperscalers will stick with HDDs because they can use massive numbers with requisite software and system architectures to render them cost-effective against the flash assault – a point that Seagate and Infinidat forcefully make.