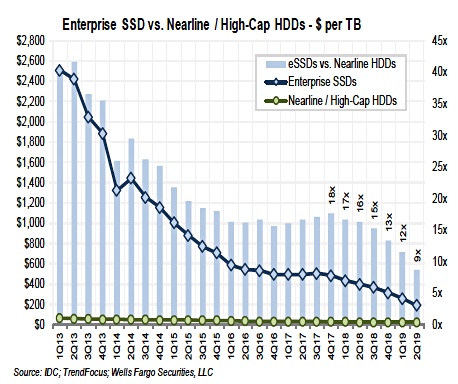

A Seagate analysts’ day last week showed the company thinks the $/TB cost advantage of disk over SSDs will last for 15 years.

As reported by Wells Fargo senior analyst Aaron Rakers, Seagate said it can increase disk area density to maintain the $/TB cost differential with SSDs. The company is also introducing twin read/write heads, known as multi-actuator technology, to increase data IO speed.

Some technology analysts argue buyers will move from disk drives to SSDs when the $/TB cost of SSDs falls to five times or less that of disk. If disk drive makers can put more bits on a platter their $/TB cost goes down.

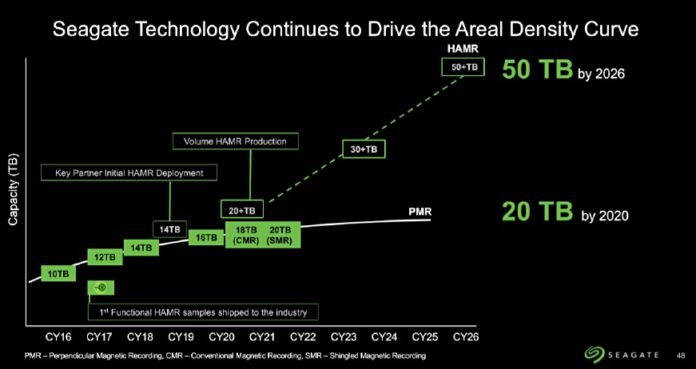

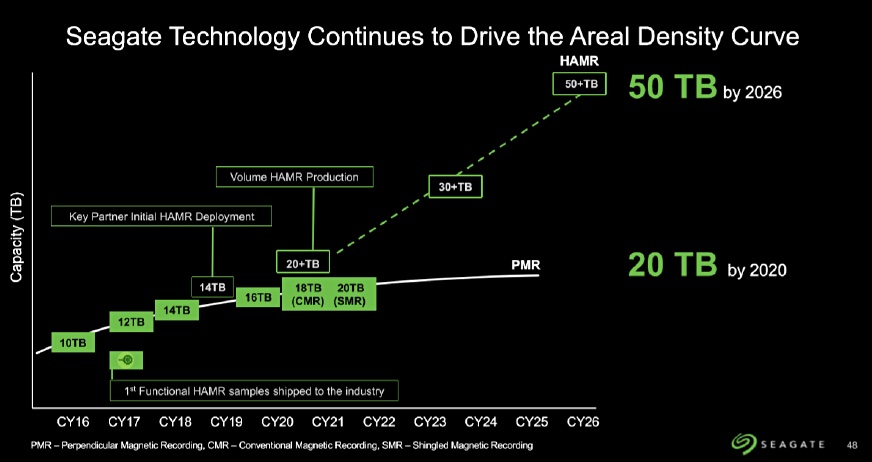

Seagate is introducing HAMR (Heat-Assisted Magnetic Recording) to cram more bits on a disk’s surface, and anticipates 20 per cent compound annual growth in areal density out to 2034. At the analyst briefing it provided a chart that shows the growth out to 2026:

Accordingly, Seagate thinks it can match the reduction on $/TB of SSDs coming from QLC flash (4 bits/cell) and increased 3D NAND layer counts. The NAND industry is introducing 96-layer NAND and plans to move to 128-layers after that. It is also looking at PLC penta-level cell (5bits/cell) technology.

All of which means Seagate opposes the idea that SSDs will kill disk drives.

Hammering down on details

Seagate CTO Dr John Morris told analysts that Seagate has built 55,000 HAMR drives and aims to get disks ready for customer sampling by the end of 2020. Some customers are already testing early samples.

A few HAMR tech details emerged at the briefing. The drives use glass platters with Iron Platinum (FePt) media, the heads use a Near-Field Transducer design and the bits are oriented perpendicularly to the surface of the drive. The writing process completes in about two nanoseconds and involves heating the bit area using a laser and then cooling it (which is a passive part of the process).

Seagate’s disk drive roadmap sees nearline 7,200rpm 18TB conventional HAMR drives and 20TB shingled magnetic recording (SMR) HAMR drives ramping to mass production in the first half of 2020. These will be helium-filled and have 9 platters. Capacities will grow to 30TB+ in 2023 and 50TB+ in 2025.

OEMs are qualifying the multi-actuator heads which are shipping to customers now in 14TB and 16TB drives. The 14TB drive’s sequential bandwidth is up to 520MB/sec with twin heads.

Single head drives operate at up to 250MB/sec. SSDs operate up to 2.5GB/sec with four PCIe v3 lanes and well beyond that with more lanes. With PCIe 4.0 we can expect the SSD speed advantage over disk to increase.

Market size

In his presentation Seagate CEO Dave Mosley categorised IT history into four phases, with the number of connected devices increasing in each phase.

- IT 1.0: Centralized architectural with mainframes in 1960-1980; ~10 million connected devices

- IT 2.0: Distributed compute client-server phase 1980-2010; 2bn connected devices,

- IT 3.0: Centralized phase 2005-2025; ~7bn connected devices; mobile-cloud

- IT 4.0: Distributed edge compute 2020+; trend to 42 billion connected devices.

These connected devices will need storage. The total capacity needed in 2025 will be around 17 zettabytes – 17 million PB. Generally speaking, half of that data will be stored in the public cloud and half on-premises.

Mosley reckons the total addressable market for disk drives will grow from $21.8bn in 2019 to $24bn in 2025. Some 80 per cent of storage will be mass capacity, which is where nearline disk drives slot in.

Comment

Seagate’s management is betting the company’s future on disk drives, unlike its rival Toshiba and Western Digital which make SSDs too.

Seagate has no NAND chip-making interest and a small SSD selling business. Any migration away from disk drives will hit it severely.