Here’s the speed read version: Delphix has picked up a UK TV broadcaster as a customer; a somewhat limited cloud backup market report appears; Mimecast is losing its CFO; and Samsung and SK Hynix are expanding their semiconductor fab lines.

Delphix

Channel 4, the UK TV broadcaster, has become a Delphix customer, and says its application release cycles will shorten as a result.

Delphix, a database virtualizer, will be involved with Channel 4’s broadcast management and advertising scheduling platforms. Channel 4 makes regular updates to these systems, and its test and dev people need test data to check the changes out.

It says the time taken to refresh the 18TB or so of data in test environments was slowing down system and business development.

The company started using Delphix Dynamic Data Platform software to automate data delivery to test and dev, taking advantage of Delphix Data Pods to connect database administrators to developers to ensure faster delivery of data. What used to take days now takes just minutes, Delphix says, enabling Channel 4 to release applications more quickly.

The broadcaster also has a suite of data warehouses to provide insights into business performance and indicate future opportunities. Its using Delphix software to refresh this information and manage volume sizes better.

Delphix digression

Delphix founder and exec chairman Jedidiah Yueh, has written a book, Disrupt or Die, about the need for disruptive startups and the effects and characteristics of Silicon Valley funding, assumptions and development on them.

Before starting up Delphix he founded, developed and sold deduplicating backup supplier Avamar to EMC, for $165m in November 2006.

According to Yeah, Avamar, based in Orange County, was not in an optimum location, in comparison to Silicon Valley-based Data Domain, its main competitor. That made it harder get top engineering and executive talent and: “our engineering team shipped product too late. We had a commanding two-year lead, but a Silicon Valley competitor ran us down.”

That was Data Domain.

“In the end we sold for $165m, and our competitor sold for $2.4bn.”

Lesson learnt; Delphix moved to Silicon Valley in 2009.

Yueh’s book is full of interesting insights and viewpoints and is available on Amazon.

Global cloud backup market report

A report by HTF Market Intelligence said: “The global cloud backup market size was $1.2bn in 2017 and is expected to reach $6.82bn by the end of 2025, with a CAGR of 23.4 per cent during 2018-2025.”

HFT Market Intelligence is not highly-specialised from an IT market point of view and has produced report on t global table and kitchen glassware, the global zipper market and a global yoga mat study.

The cloud backup report looks at Acronis, Asigra, Barracuda Networks, Carbonite, Code42, Datto, Druva, Efolder, IBM, Iron Mountain, Microsoft and Veeam Software.

Missing vendors include Arcserve, Commvault, Dell EMC, HPE, Kaseya, Rubrik, and Veritas.

The cloud storage report costs $3,300 for a single user and $6,600 for an enterprise copy.

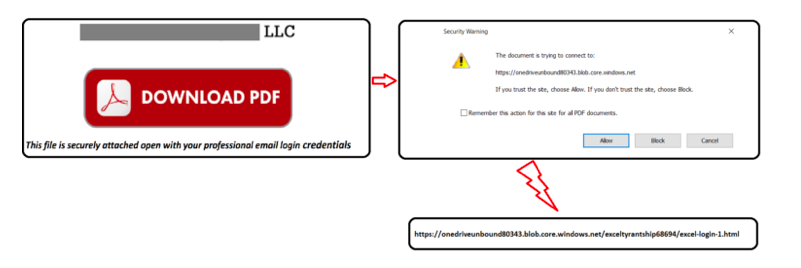

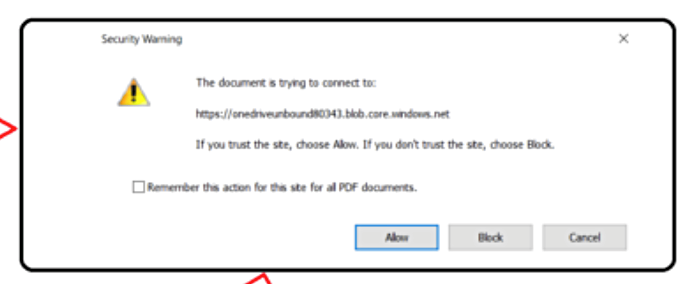

If you request a PDF sample copy you get a reply message saying: ”Thank you for your enquiry. Our Executive will contact you soon.”

And they will. I was phoned within five minutes on a Saturday morning. The sample copy offer seems to be a sales lead generation exercise, containing next to no useful supplier information at all. Bargepoles and long spoons come to mind.

Mimecast losing CFO

Peter Campbell, the CFO of email security and backup and archiving supplier Mimecast, is resigning, effective March 31, 2019. There will be a se-month transition period in which he stays on while Mimecast looks for a successor. An SEC filing revealing this was made last month.

Mimecast co-founder and CEO Peter Bauer, issued a warm canned quote about what seems to be an amicable departure.

“Peter has been an exceptional leader at Mimecast for the last 12 years, overseeing the company in its early years, leading the company’s global expansion, and guiding the company through its initial public offering and life as a public company. He built a world-class, global finance organization, and played a critical role in developing and executing the company’s growth strategy. We thank him for his countless contributions and his assistance throughout the upcoming transition process.”

There is no word on why Campbell is leaving or where he is going.

Samsung and SK Hynix fab build-out

Samsung and SK Hynix are building at least five new fab lines, Wells Fargo senior analyst Aaron Rakers reports.

- Samsung is expanding its production capacity in Pyeongtaek with a second line for its next-generation 64-Layer V-NAND. That should be ready in 2020.

- It’s adding another line to its Xian, China, fab, with mass production starting in 2019.

- Samsung is deploying EUV tooling in its Hwaseong (Gyeonggi Provice), South Korea facility, with mass production also slated for 2019.

SK Hynix is adding new semi-conductor fab lines to three facilities:

- Its M15 fab in Cheongju, South Korea, with a budget of 2.2 trillion Won ($1.96bn)

- Building a new facility in Wuxi, China, ready for the end of this year

- Building an M16 fab in Icheon, South Korea, with completion by October 2020.

We should see expanded DRAM and NAND production next year with a further increase in 2020. This lends credence to fears of an impending NAND (and DRAM) over-supply and consequent price collapse.