Trendforce forecasts a five per cent or greater fall in DRAM contract prices in 2018’s fourth quarter, following 1 to 2 per cent rise in the third quarter. The expected price fall will bring to an end to nine consecutive quarters of price rises. NAND prices are expected to fall even more steeply.

Trendforce notes soft demand for server DRAM and thinks average DRAM prices could drop 15-20 per cent in 2019. The price drop could be even steeper if demand for servers and smartphones weakens further, the market research firm says.

It attributes the DRAM to weak smartphone shipments, low server demand and PC and notebook demand squeezed by Intel CPU shortages. These three factors could lead to DRAM over-supply in 2019.

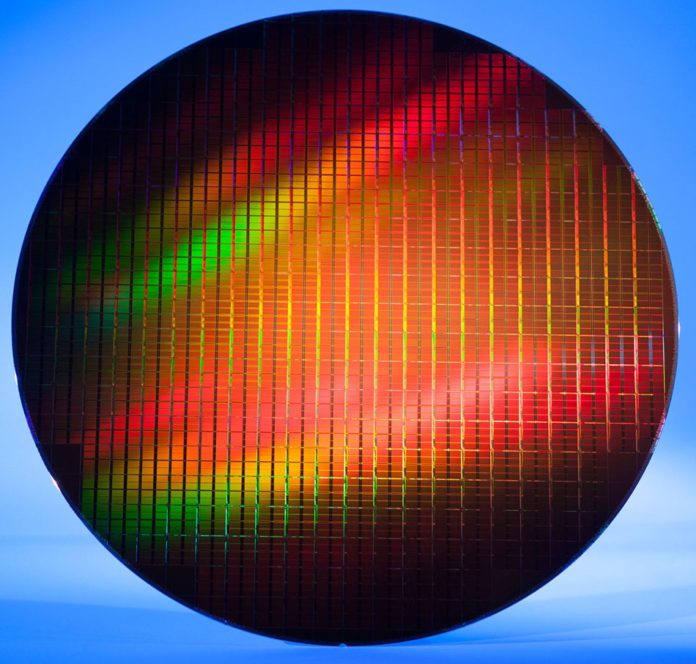

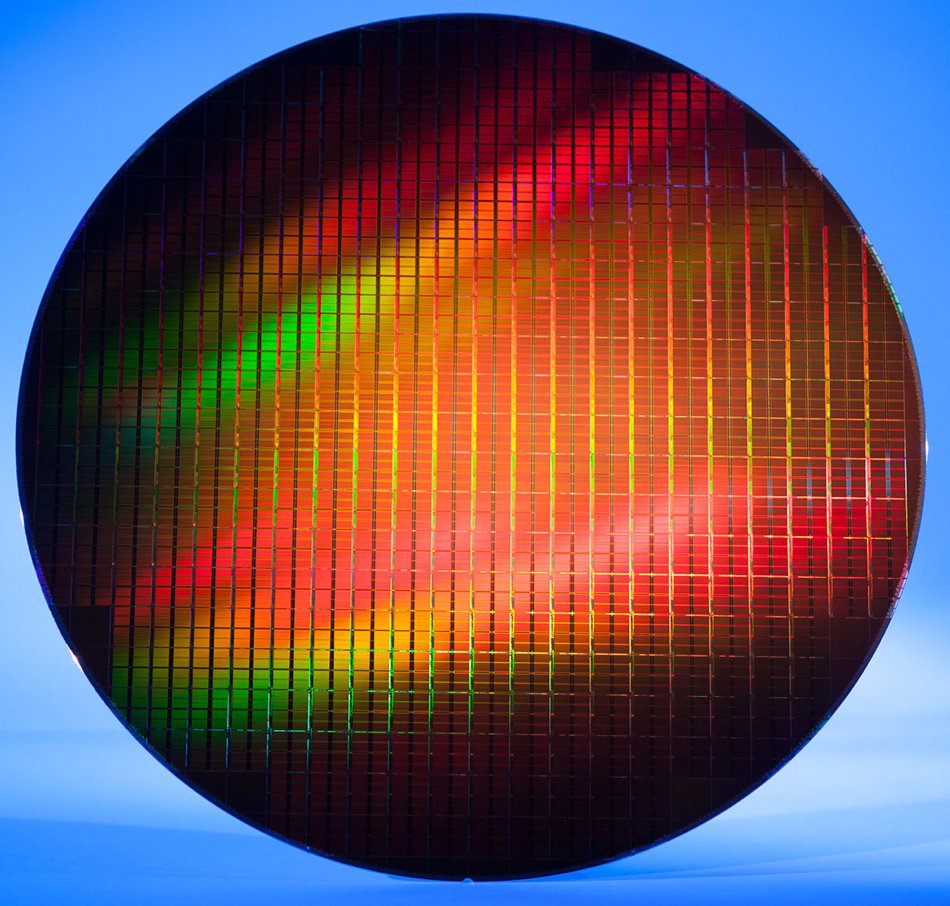

Trendforce expects 2019 annual bit output to increase by nearly 22 per cent, with the 1X/1Y nm processes becoming mature and wafer starts increasing, although manufacturers have become more conservative in capacity expansion.

NAND

NAND prices have already started falling, with a 10 per cent decline in the third quarter and a further 10 -15 per cent fall is expected in the fourth quarter. 3D TLC (3 bits/cell) chip contract prices may fall even more steeply in the fourth quarter.

For 2019 a potential 25-30 per cent price fall is on the cards due to increased 3D NAND production capacity. Trendforce notes sluggish demand for flash in the consumer electronics sector and strong demand for enterprise SSDs. In the latter case, vendor competition and improved yield of 64-layer and 72-layer 3D NAND chips from wafer starts will put a crimp in prices.

Demand in the first half of 2019 will be seasonally weak and could be affected by the US-China trade war. Trendforce said suppliers could moderate their transition to higher output 96-layer and estimates overall NAND production capacity of NAND will grow 5 per cent annually by the fourth 2019 quarter. It expects memory makers to cut output spending budgets.