Here’s a digest of recent storage news to help you keep up with what’s going on.

Cohesity

Cohesity is parting with some of the money raised in its recent funding round to expand its reseller program to include service providers. There are differentiated benefits for cloud and managed services providers, with co-design workshops, cloud-ready testing, training programs, premier technical support, and more.

The secondary data converger has updated its training program with free partner training featuring three levels of accreditation for sales, engineering, and post-sales roles. Partners working with large accounts get additional financial incentives.

Cohesity has expanded its field sales coverage to support resellers in North America, Europe, and Asia, and is boosting its partnerships with technology vendors including Cisco, Hewlett Packard Enterprise (HPE), Microsoft, and VMware.

More Cohesity money is being spent across geographies on joint marketing planning, field activities, and demand generation campaigns for pipeline development. Not-for-resale (NFR) demo equipment is available for partners that need Cohesity technology for labs and demo centres. Also, Cohesity appliances and licenses are available for prospect and customer trials.

Last month Cohesity pocketed $93m in E-round funding.

IBM

In the HPC world IBM has notched up

In the entertainment and media HPC arena IBM tells us it has notched up Rhode & Schwarz (R&S) as an OEM of its Spectrum Scale scale-out, parallel file system. The software is included in the R&S SpycerNode array.

The SpycerNode system is a scalable entertainment and media file storage system for complex movie and video workloads which have intricate workflows and may feature detailed special effects components.

It uses GNR (GPFS Native Raid) which uses erasure coding to speed the rebuilding of failed disks. R&S claim this makes the rebuild time in the case of a system failure up to four times shorter than with conventional RAID systems. There can be up to 12GB/sec throughput from a single node and several millions of IOPS, depending upon the configuration.

IBM now has three GNR products on the market – the Lenovo GSS system, its own Elastic Storage Server (ESS) product, and this SpycerNode system from R&S.

Maxta

This hyper-converged software supplier has been awarded a U.S. Patent (No. 10,061,781) for shared data storage leveraging dispersed storage devices.

The IP optimises both the placement of data across the dispersed devices and describes a method for accessing storage data.

The idea is to facilitate high levels of scalability and performance while minimising resource consumption. Maxta’s HCI software uses the IP that’s just been patented.

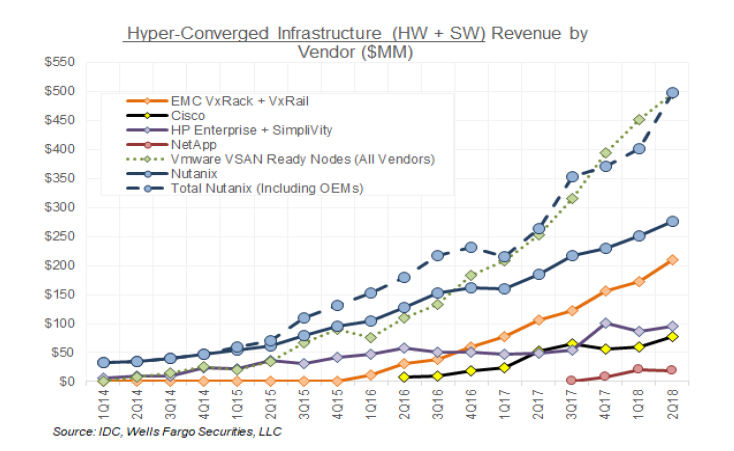

Nutanix

Nutanix’s ability to sell into the USA government sector is improving because its cloud-based Windows desktop and application delivery service, Frame, has achieved a Federal Risk and Authorization Management Program (FedRAMP) Ready designation for its Government platform.

The company acquired Frame in August, with its Frame for Government DaaS platform. This is a government community cloud that provides government customers with an isolated, sovereign US-based region for its sensitive US government workloads.

Nutanix says the FedRAMP Ready designation moves the company closer to achieving a FedRAMP Moderate Authorization, which will provide public sector customers with a secure, compliant, high-performance service for running applications in the AWS and Azure public clouds that have been fully certified by the federal government.

Proscia

Proscia, a startup working in digital pathology, has secured $8.3m in A-round funding from a group of East and West Coast venture capital firms.

It stores cancer patients’ biopsy data in the cloud, and makes it available to clinicians for annotation and collaboration. It was given a million dollars in seed funding in June 2016, and has worked with Samsung on mathematical oncology and deep-learning to determine the likelihood of lymph node metastasis in breast cancer.

It will use the new cash to expand the deployment of the company’s digital pathology software and accelerate the use of artificial intelligence (AI) applications to increase accuracy and efficiency in cancer diagnosis. It says the cash will fuel the development and commercialisation of clinical AI-enabled workflows targeting high-volume, high-impact cancers, the first of which will be available later this year.

Proscia will also use the funds to ramp up sales and marketing of its existing cloud-based digital pathology platform, which will serve as the foundation for Proscia’s AI-based applications.

It declares that pathologists, and their ability to diagnose cancer, are largely dependent on the microscope, a device that has been in place for 150 years. The limitations of the microscope and the subjectivity involved in assessing tumours contribute to diagnostic error, resulting in negative patient outcomes and economic burden to the healthcare system.

For Proscia, digital pathology and AI represent a joint and long overdue way forward for cancer biopsy diagnoses that are stuck in the microscope’s eye-piece.

Rubrik

Rubrik says it’s won data protection business from a Scottish government agency handing out public money in subsidy form. The agency is the Agriculture and Rural Economy (ARE) Directorate which pays out £750m in subsidies a year, based on EU regulations.

SwiftStack

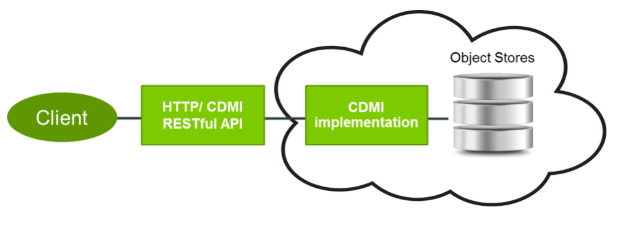

Object storage supplier SwiftStack has announced support for the new Splunk Enterprise 7.2 with SmartStore, an optimised data management model which separates storage resources from compute nodes. SwiftStack can be a SmartStore storage target. Warm Splunk data is accessed via the S3 API.

It says users can keep all Splunk data online, in one or more data centres and/or clouds, search across months or years instead of days or weeks, and meet data governance objectives for long-term retention and protection. SwiftStack has the storage of machine-generated data in mind, for business intelligence and analytics work.

Zadara

Zadara has added deduplication and compression to the all-flash arrays which it places in customer’s IT centres and operates on their behalf. These are called Virtual Private Arrays. Zadara says the added technology will lower customers’ TCO as its usage-based pricing model means that they only pay for the storage they consume.