Micron is reining in capital spending in the face of a glut in the DRAM and NAND memory markets.

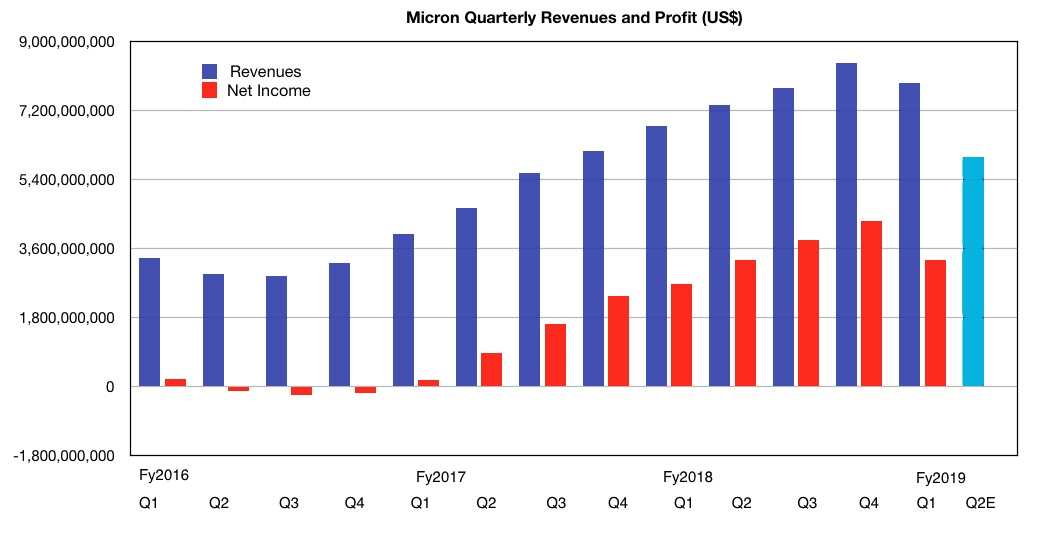

The chip giant yesterday reported $7.91bn revenues Q1FY2019, missing estimates of $8.02bn and sending shares down seven per cent on the day. Net income was a healthy $3.29bn, slightly above analyst estimates.

The results mark the end of nine quarters of sequential revenue growth.

Worse is to come. On the earnings call Sanjay Mehrotra, CEO, talked of “revenue headwinds from the inventory adjustments at several customers and industrywide CPU shortage”.

Even so Mehrotra said the company is “well-positioned to deliver healthy profitability throughout the year. We remain bullish on the long-term secular growth trends driving the memory and storage industry.”

He thinks the market will pick up again in the second half of 2019 but few industry watchers share his optimism on this score.

And Micron is certainly taking no chances. The company is scaling back capital spending from $10.25bn-$10.75bn to $9.bn- $9.5bn.

On the earnings call CFO Dave Zisner also talked of implementing OPEX controls such as limiting headcount growth, lower discretionary spending and holiday work schedule slowdowns.

My memory isn’t what it was

DRAM accounted for 68 per cent of overall revenue in the quarter.

- Revenue down 9 per cent Q/Q and up 18 per cent Y/Y

- Average selling prices (ASPs) down high single digits percent range Q/Q

- Shipment quantities flat Q/Q

NAND contributed 28 per cent of overall company revenue in the quarter.

- Revenue down 2 per cent Q/Q and up 17 per cent Y/Y

- ASPs down low to mid-teens per cent range Q/Q

- Shipments up low to mid-teens per cent range Q/Q

Mehrotra said this about the NAND business:

The transition from Planar to 3D NAND in the industry and successful ramp of 64-layer across the NAND manufacturers has resulted in oversupply in the market over the last several quarters.

DRAM is in a bad situation as well:

In data centre markets, we saw reduced revenue coming off a record setting fiscal fourth quarter, due primarily to inventory adjustments at our customers. We expect this headwind will persist for a couple of quarters. We are seeing some cloud customers go through a digestion period following very strong growth over the last two years.”

DRAM demands weakened through the course of our fiscal first quarter. Since the start of this fiscal second quarter, the weakening demand trend has continued and our near-term visibility is limited. Due to a lengthy period of rising DRAM prices, we believe some of our customers had decided to carry higher than normal inventory levels and as DRAM supply caught up with demand, these customers are bringing down their inventory levels.

Micron will produce more DRAM and NAND bits in FY2019 than in FY2018. The company forecasts 35 percent NAND bit growth and 15-16 per cent for DRAM in FY2019.

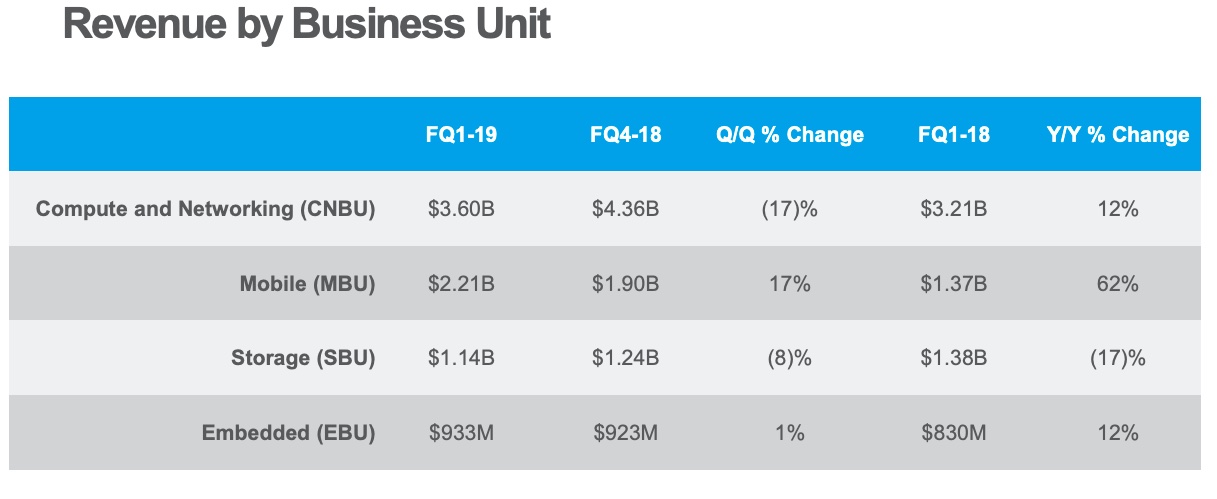

Business unit performance

Not all of Micron’s four business units were hit, as this Micron chart shows.

Zisner said the CNBU’s sequential decline was “driven by the impact of inventory adjustments at some of our customers in the graphics, enterprise, and cloud markets”.

Mehrotra said smartphone unit demand continued to “weaken, particularly at the high end, in what is seasonally a slow quarter for mobile”.

Zisner attributed the slowdown in the storage business unit to “weaker pricing and the ongoing transition from SATA to NVMe SSDs. The impact of this transition will continue through calendar 2019. Our strategy to move bits from SBU components to high-value solutions in mobile is also contributing to a decline in revenue for SBU.”

The automotive part of the embedded business did well, with increasing demand for in-vehicle infotainment and ADAS (Advanced Driver Assistance Systems.)

More earnings call info

Mehrotra dropped some hints about what was coming during the earnings call.

- “We strengthened our No. 1 share position in SATA enterprise SSDs, gaining about three percentage points of market share sequentially according to industry reports.”

- “We are working to further expand our NVMe product portfolio and plan to introduce SSDs targeting client, enterprise, and cloud markets through the course of calendar 2019.”

- “We expect the SSD market opportunity will continue to shift from SATA to NVMe.”

- “Fiscal 2019 will be a year of transition for our SSD portfolio and we expect our SSD share gains to resume in fiscal 2020.”

- “The growth of our high-value NAND solutions in fiscal 2019 will be driven by our mobile managed NAND products, where we believe we have significant opportunity to increase share.”

- “Our engagement with our customers … now includes collaboration on our 3D XPoint product roadmap.”

Micron expects to introduce 3D Xpoint memory products towards the end of 2019.