The Tape Storage Council has released the TSC 2020 Outlook, containing its thoughts on the year and projections for the future.

Update: detail added on LTO-7 Type M and IBM and Oracle enterprise tape shipments; 8 Dec 2020.

To summarise, the industry body reckons magnetic tape storage has a good future. It is great for archive data, beating disk and public cloud, But dig a little deeper, the number of tape users will like shrink.

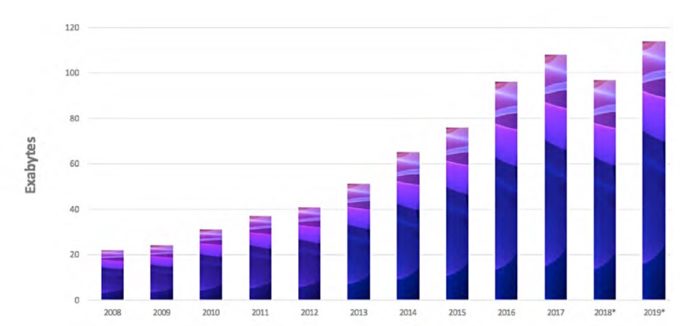

The TSC report cites the annual tape media shipment report for 2019, released by the three LTO Program technology providers – HPE, IBM and Quantum. Capacity shipments rose to record amounts in 2019 and more than 225 million LTO cartridges and 4.4 million drives have shipped since LTO’s introduction. Here is the LTO providers chart.

The report showed a record 114,079 PB of total LTO tape capacity (compressed) shipped in 2019. Aggregate capacities in 2018 and 2019 do not include the enhanced capacity of LTO-7 Type M shipments.

The TSC explained that, because the implementation of LTO-7 Type M at a higher capacity of 9.0 TB can be implemented at the end user level, the exact number of LTO-7 cartridges that have been initialised to deliver 9.0 TB is unknown to the Technology Provider Companies. Rather than estimate this, all LTO-7 cartridge shipments are assumed at 6.0 TB capacity.

The capacity shipments for IBM and Oracle enterprise tape shipments are not included as they are not reported by IBM or Oracle.

Cheaper than disk

The TSC report cites an Information Storage Industry Consortium (INSIC) roadmap. This indicates the current areal density scaling rate of HDDs to be about 16 per cent CAGR and tape to be at 33 per cent CAGR.

INSIC, is basically a tape drive and library suppliers’ group, with Oracle. owner of the proprietary StorageTek tape format, joining HPE, IBM and Quantum. The INSIC roadmap indicates the current cost advantage of tape systems over HDDs will grow wider.

Tape’s areal density is much lower than HDD but contains a much larger total recording surface area in a cartridge, with about 1000X the area of a 3-5-inch disk platter. Tape doesn’t need as high an areal density as disks to continue its $/TB advantage.

Cloud archives use tape

The TSC outlook features charts and comparisons saying how well tape compares to disk and to the costs of public cloud archive stores. It also points out that several public cloud deep archives use tape, such as AWS’s Glacier.

The larger the archive data set the greater tape’s cost-saving advantages become. Tape is storage for large archive data set organisations and hyperscalers and becoming history in other enterprise data centres.

The Commitments

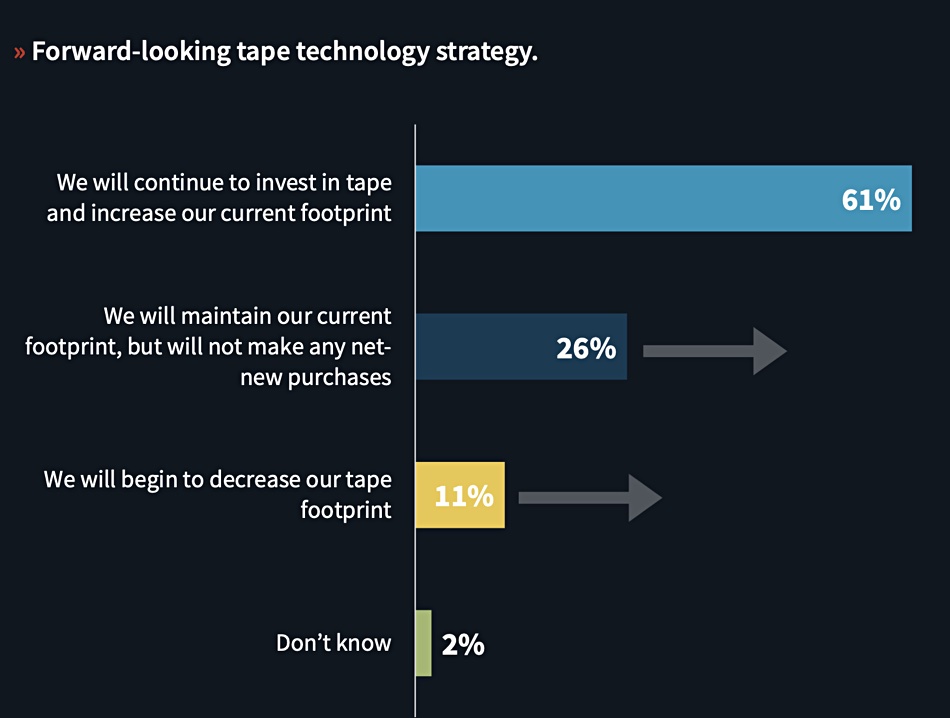

The TSC cites an Enterprise Strategy Group report, 2020 Tape Landscape, which contains this chart looking at tape users’ commitment to tape;

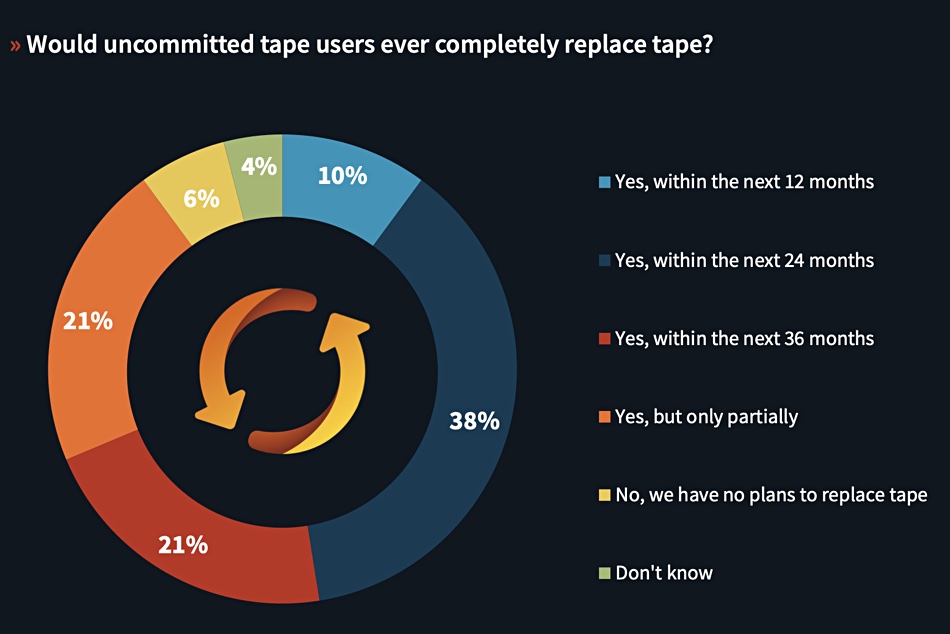

ESG found a majority increasing their commitment to tape, but 39 per cent were not. A second chart looking at the intentions of the uncommitted.

A majority, 69 per cent, intend to replace their tape storage in three years. This indicates that tape storage ownership will become concentrated in fewer customers’ hands over the next three years.

You’re not in a hurry, are you?

Tape’s two big advantages are low cost and longevity. The big drawback is its lengthy file access time as a tape cartridge has to be mounted in a drive and the reel unwound. This two-stage operation can take many seconds, an age for today’s users accustomed to instant access to data.

Disk offers millisecond-level access but is more expensive, while SSDs offer microsecond-level access but are more expensive still. Neither have tape’s reliability over time, according to the TSC.