In this week’s digest we peek into in-memory technology, then look at application performance management in a hybrid and multi-cloud world and then present you with some NAND shipment data.

BTW, there is no Kubernetes storage news this week – we assume this is a temporary halt.

In-memory InsightEdge

GigaSpaces has launched the InsightEdge portfolio of in-memory computing products, which include AIOps functionality. The range comprises:

- InsightEdge Smart Cache SQL compatible distributed caching tier, optimised for rapidly changing data and multi-criteria queries

- InsightEdge Smart ODS (Operational Data Store) distributed integration hub that aggregates and offloads from multiple back-end systems of record and data stores on premise and on cloud.

- InsightEdge Smart Augmented Transactions which unifies streaming, real-time transactional (ACID compliant) and analytical processing for insights.

GigaSpaces said the products feature in-memory speed, colocation of business logic and data in memory, secondary indexing and server-side aggregations.

Virtana’s AIOps platform goes multi-cloud

Virtana has announced its applications workload optimisation software now supports on-premises and multiple public cloud environments. The AIOps features “know before you go” technology by providing intelligent observability into which workloads to migrate. It also ensures that unexpected costs and performance degradation are avoided once workloads are operating in the cloud.

Virtana claims the hybrid infrastructure optimisation capabilities of the Virtana Platform can deliver a return on investment (ROI) of as much as 145 per cent over a three-year period. Supported clouds include AWS, Azure, Google Cloud Platform, Oracle, and VMware on AWS.

Over time, all Virtana standalone products will be incorporated into the platform. Multiple deployment options will include SaaS, managed service, and on-premises.

Kash Shaikh, CEO of Virtana, said in a statement: “We are still in the early innings of public cloud adoption. Many [enterprises] tell us they moved some of the workloads back. When we ask why, enterprises say they do not know where to start, lack tools and visibility that can help them plan and execute migrations, and find managing workloads across hybrid environments complex.”

He says the Virtana Platform provides the tools to migrate applications and information about which ones to migrate and which not. Insights about workloads include application dependencies, how they will perform in various cloud environments, and their underlying IT infrastructure requirements. Users get real-time application visibility and tools for taking action.

NAND capacity ship rises and price fall rates slow

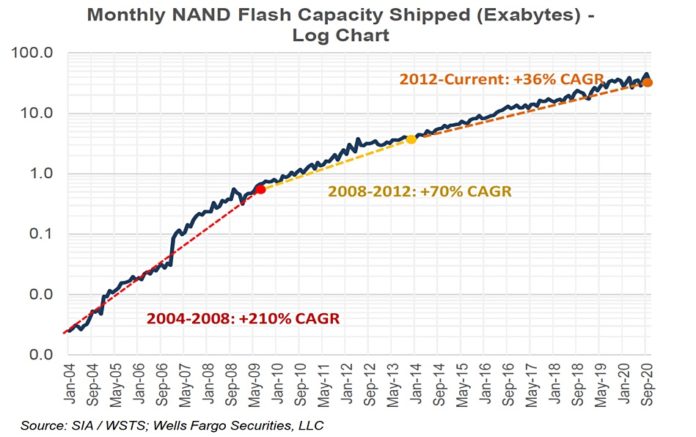

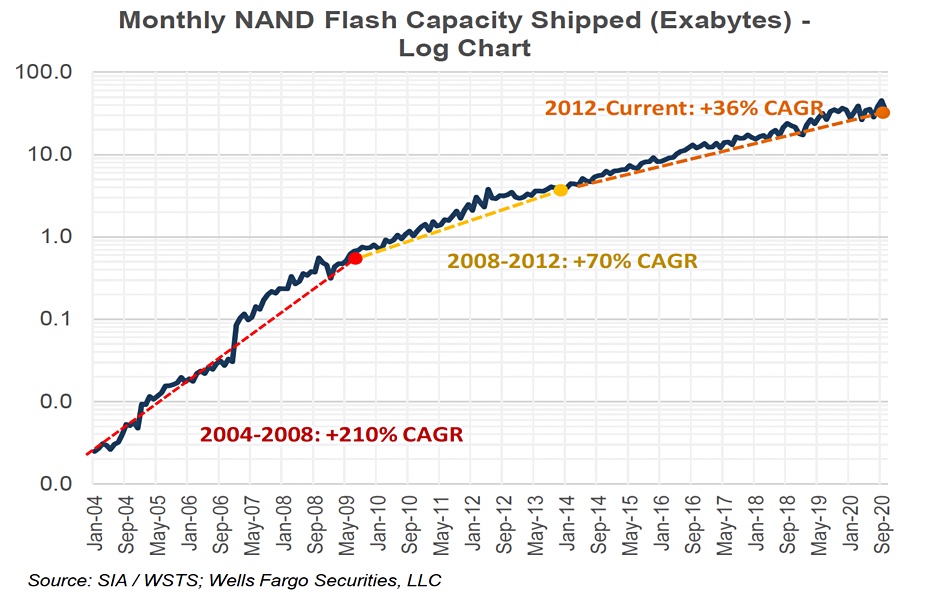

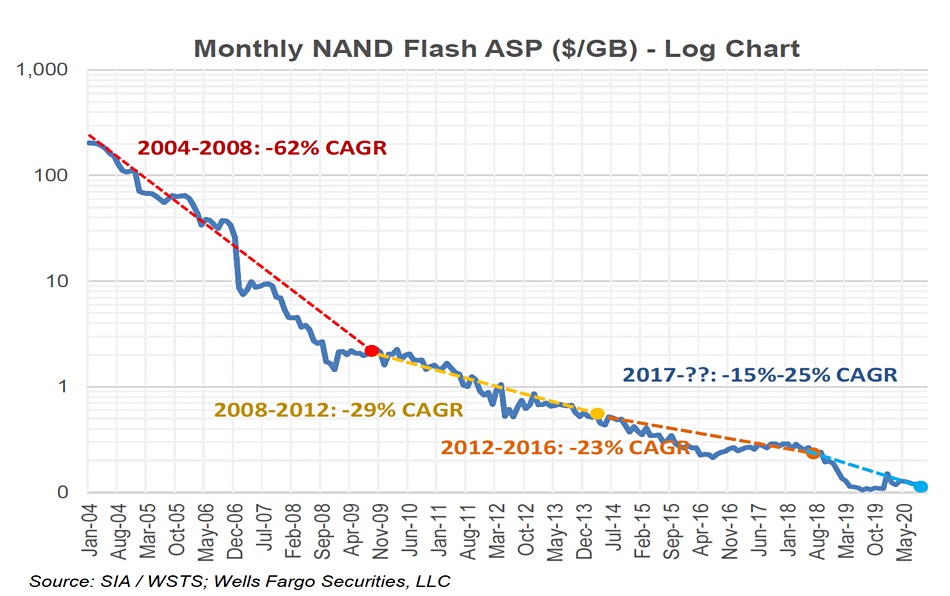

NAND exabyte shipment growth rate and average selling price (ASP) falls are slowing, according to the Semiconductor Industry Association, as reported by Wells Fargo senior analyst Aaron Rakers to his subscribers. Two of his charts show this:

The Compound Annual Growth Rate (CAGR) is slowing but a 36 per cent CAGR is still healthy. Next up, a price chart:

N.B. the log chart above is measured in $/GB and that make it look like as if the ASP is bottoming out to near zero. But if the units of measurement were $/TB we could see that continued price declines are still feasible.

To conclude, shipments are rising but not as fast as before. Prices are falling but not as fast as before. The NAND industry is maturing.

Shorts

Micron reported a two hour-plus production halt due to a power outage at its wafer fab in Taoyuanone, Taiwan, on December 3. UPS facilities couldn’t cover for the lost power. The power supply has been restored and production will return to normal over the next few days, meaning up to a week of lost production. Wells Fargo analyst Aaron Rakers said: “Fab outages can be disruptive as it can result in the scrapping of in-process wafers, as well as equipment damage (e.g., furnace tubes, pumps, etc.) and time needed for equipment cleaning.” The loss could be ~3 per cent of total industry monthly wafer capacity and ~12 per cent of Micron’s total estimated DRAM wafer capacity.

The U.S. Department of Defense has announced the latest sanctions against four Chinese companies. This includes SMIC, the leading foundry in China, which is now placed on the DoD list of Chinese military companies. The move will threaten SMIC’s upstream supply of semiconductor equipment and materials, its R&D of advanced processes, and China’s attempt at semiconductor independence.

Seagate shipped its first HAMR-based 20TB nearline HDDs for revenue in late November, but made no public announcement. The news came out at an investor conference. Seagate said it can make 20TB HDDs with PMR technology.

SUSE has closed its acquisition of Rancher Labs, bringing together Linux, a Kubernetes management platform, and edge capabilities. SUSE reckons it and Rancher’s combined strengths position the company to win the $5bn embedded market, making it a threat to Red Hat’s market share. SUSE says its competitors’ lack of independence means their customers are locked into heavy and monolithic tech stacks – whereas SUSE and Rancher can take a more modular approach and adapt to customers’ changing needs.

Veeam Software has announced general availability of the latest version of Veeam Backup for Microsoft Office 365, its fastest-growing product. V5.0 adds purpose-built backup and recovery for Microsoft Teams, so users can find and restore Teams data, including entire groups, specific channels and settings.

With Intel selling its NAND and SSD business to SK hynix what happens to Rob Crooke, GM of the now-being dismantled Intel Non-volatile Solutions Group (NSG)? On completion of the deal (probably 2H 2021) He will join SK hynix, where he will manage the NAND division that SK hynix is acquiring from Intel. In the meantime he continues to be Intel GM of NSG, which now hold Intel NAND products only. Alper Ilkbahar is GM of the Optane Group.

Acronis has released the 2020 Acronis Cyberthreats Report, a review of the current threat landscape and projections for the coming year. It predicts 2021 will be the “year of extortion”. Remote workers and managed service providers will be targeted by cyberattackers, and data exfiltration will outpace data encryption.

Materialize, a streaming SQL database startup, has raised $32m in B-series funding to build its engineering team, prepare the business for growth and extend product rollout. Kleiner Perkins led the round and Lightspeed Venture Partners also participated in the B round after it led the earlier $8m Series A round in 2019. Additional investors include executives from Cockroach Labs, Datadog and Rubrik.

Iguazio says it is now AWS Outposts-ready. The startup makes data science platform software to accelerate storage IO workflows for machine learning, AWS SageMaker customers can use it to develop and deploy complex ML pipelines in weeks instead of months, the company says.

Pure Storage‘s Portworx has also achieved the AWS Outposts Ready designation.

Spectra Logic and Aveco, have announced a fully integrated media asset management (MAM) and archiving system. This is based on the Aveco ASTRA MAM and Spectra BlackPearl Converged Storage System. Users can manage and protect their content from ingest to production to archive and distribution with lifecycle management, automated tiering and cloud connectivity.

Varada, a small Israel-based startup, will make its Data Virtualization Platform available from December 8. It offers simplified data ops management and the ability to prioritise query acceleration by each query’s business value. The platform allows Varada to attack Snowflake and Athena). Compared to Snowflake, Varada said it eliminates lock-in and does not require users to move their data into a proprietary format. Varada also claims it is much less expensive to operate at scale.