Pure Storage’s Portworx product is ahead of other suppliers of storage for Kubernetes-orchestrated container apps, at least according to research house GigaOm.

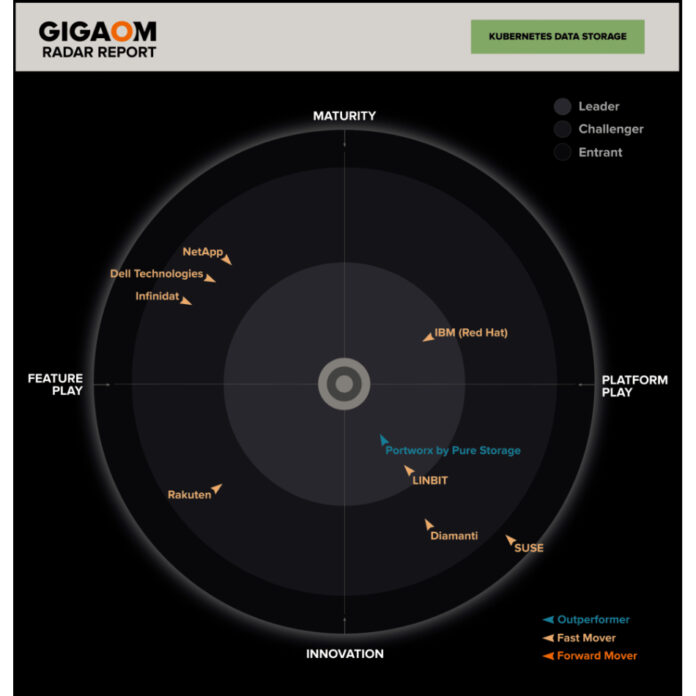

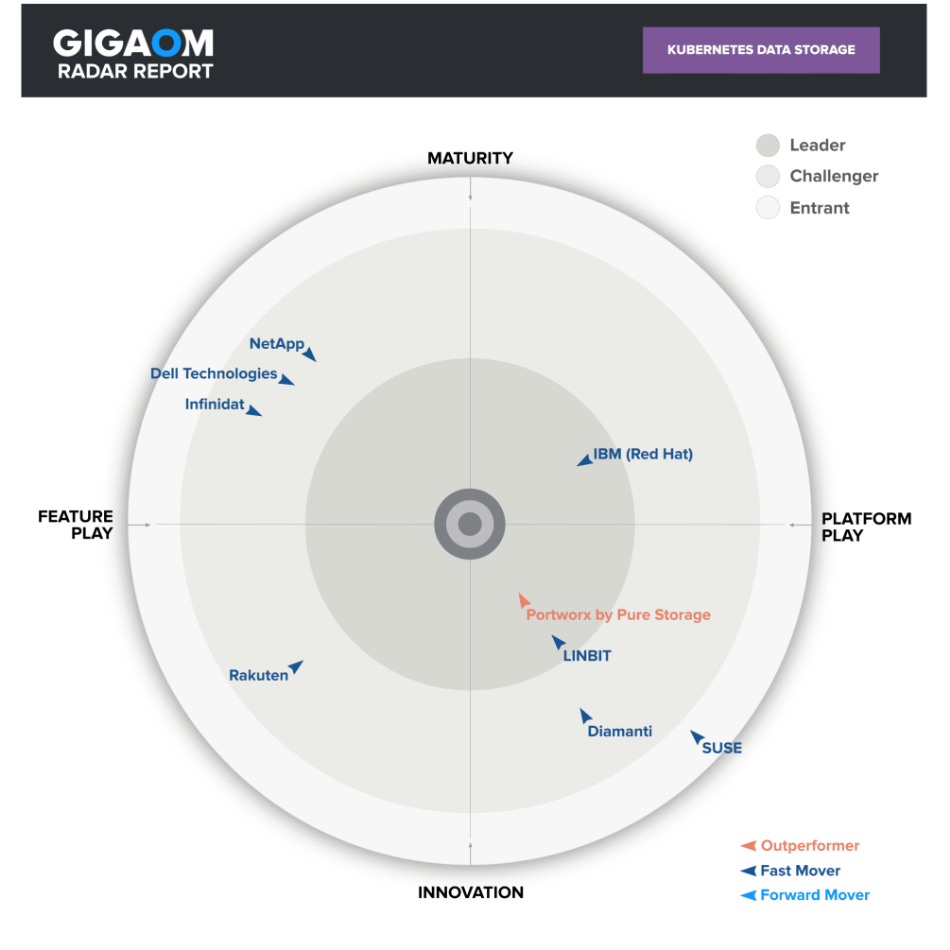

The GigaOm Radar for Kubernetes Data Storage report looks at nine vendors, down from 22 rated in separate cloud-native and enterprise reports previously. These include Dell, Diamanti, IBM (Red Hat), Infinidat, LINBIT, NetApp, Pure’s Portworx, Rakuten and SUSE. Their products are either traditional enterprise storage re-used for Kubernetes referring to Dell, Infinidat and NetApp, or Kubernetes-native storage, which covers the other six suppliers.

Analyst Joep Piscaer describes Kubernetes-native storage this way: “The storage system itself runs as a set of containers on a Kubernetes cluster, exposing storage via container storage interface (CSI) to the cluster to be consumed by workloads. These distributed storage solutions are tightly coupled with the container orchestrator and are container-aware so that when the orchestrator spins up or destroys a container, it also handles storage provisioning and de-provisioning operations. Storage operations are automated and invisible to the user and scale up and down based on cluster size.”

The traditional enterprise players are grouped together, with “feature parity” according to Piscaer, in the mature-feature play quadrant of GigaOM’s Radar diagram (see bootnote) while the K8S-native suppliers are placed in the three other quadrants.

Portworx is the clear leader in terms of innovating faster than all the other suppliers and with a balance of being innovative and a platform supplier. It is followed by IBM’s Red Hat and then LINBIT, with all three in the Leaders’ section of the chart.

There are five challengers, which includes the three trad players followed by SUSE, classed as an entrant. Only Portworx is classed as an outperformer with the rest rated as fast movers.

Piscaer writes: “Portworx remains the gold standard in cloud-native Kubernetes storage for enterprises. Portworx is a complete enterprise-grade solution with outstanding data management capabilities, unmatched deployment possibilities, and superior management features.”

In an emerging features comparison Diamanti (4) scores higher than Portworx (3.5) on Generative AI support, Edge support and fleet management. LINBIT (4.8) is placed ahead of Portworx (4.3) in business criteria such as efficiency and manageability.

GigaOM subscribers can access the Kubernetes data storage supplier report here.

Bootnote

The GigaOm Radar diagram locates vendors across three concentric rings, with those set closer to the center judged to be of higher overall value. The new entrants are in the outside ring, challengers in the next inner ring, and leaders in the one closer to the center after that. The central bullseye area is kept clear and positioned as a theoretical target that is always out of reach.

The chart characterizes each vendor on two axes – balancing Maturity versus Innovation and Feature Play versus Platform Play – while providing an arrow that projects each solution’s rate evolution over the coming 12 to 18 months: Forward mover, fast mover, and outperformer.

GigaOm says mature players have an emphasis on stability and continuity and may be slower to innovate. Innovative suppliers are flexible and responsive to market needs. Feature players provide specific functionality and use case support while perhaps lacking broad capabilities.

Platform players have the broad capability and use case support with, possibly, more complexity as a result.