While the total global datacenter infrastructure market for 2023 managed some growth, the data storage and server segments showed major declines, according to a report from analyst house Dell’Oro Group.

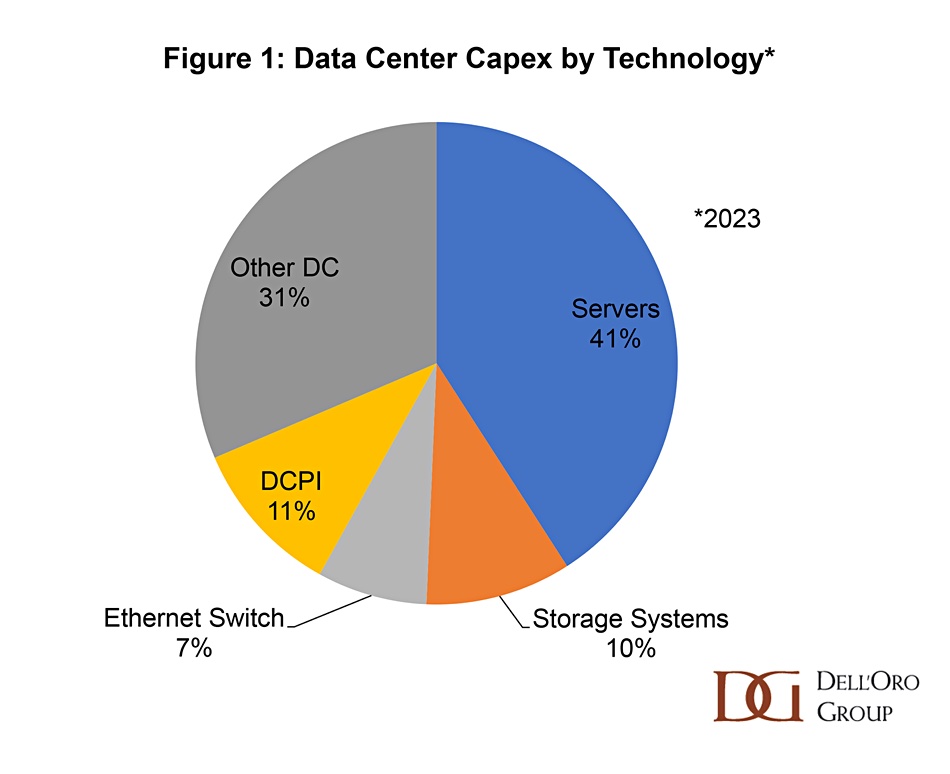

It said total global capital expenditure growth crept up 4 percent year-on-year to $260 billion, with servers leading all technology areas in revenue. However, this growth rate marked a slowdown from the double-digit growth seen in the previous year.

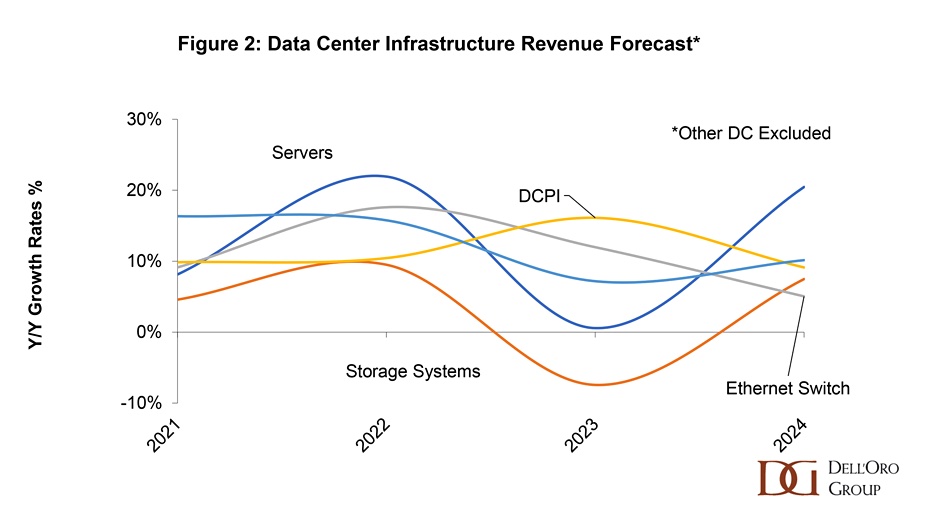

Reduced investments in general purpose servers and storage systems was attributed to supply issues that occurred in 2022, prompting enterprise customers and resellers to place excess orders, which led to inventory surges and subsequent corrections. Consequently, server shipments declined by 8 percent in 2023.

The demand for general purpose server and storage system components, such as CPUs, memory, storage drives, and NICs, saw a “sharp decline” in 2023, said Dell’Oro, as the major cloud service providers and server and storage system OEMs reduced component purchases in anticipation of weak system demand.

In contrast, there was a shift in capex towards accelerated computing. Spending on accelerators, such as GPUs and other custom accelerators, more than tripled in 2023, as the major cloud service providers raced to deploy accelerated computing infrastructure that is optimized for AI use cases. Accelerated servers, although comprising a small share of total server volume, command a high average selling price premium, contributing significantly to total market revenue.

The storage system market witnessed a 7 percent decline in revenue in 2023, with Dell leading in revenue share, followed by Huawei and NetApp. But Huawei was the only major vendor to achieve growth, driven by its success in adopting the latest all-flash arrays among enterprise customers.

Dell again led in server revenue share, followed by HPE and IEIT Systems. Excluding white box server vendors, revenue for original equipment manufacturers declined by 10 percent in 2023, with lower server unit volumes attributed to economic uncertainties and excess channel inventory. However, some vendors experienced revenue growth through shifts in product mix towards accelerated platforms or general-purpose servers with the latest CPUs from Intel and AMD.

In the cloud service provider market, Microsoft and Google increased total datacenter investments, particularly in AI infrastructure, while Amazon underwent a “digestion cycle”, said the analyst, following pandemic-driven expansion. In contrast, the major Chinese providers experienced declines in datacenter capex due to “economic, regulatory, and demand challenges.” Enterprise datacenter spending also declined “modestly” in 2023, “reflecting weakening demand amid economic uncertainties.”

Looking ahead to 2024, Dell’Oro forecasts a double-digit increase in total worldwide datacenter capex, driven by increased server demand and higher average selling prices. Accelerated computing adoption is expected to continue, supported by new GPU platform releases from Nvidia, AMD, and Intel.

It adds that “recent recovery” in server and storage component markets for CPUs, memory and storage drives is “signalling the potential” for increased system demand later this year.

According to Marketresearch.biz, the global datacenter storage market is expected to be worth around $159.7 billion by 2032, a rise from $50.2 billion in 2022, growing at a CAGR (compound annual growth rate) of 12.6 percent.

That compares with Data Bridge Market Research, which says the worldwide market will reach $132 billion by 2031, up from $55.53 billion in 2023, growing at a CAGR of 11.49 percent.