GigaOm analytical gurus have made large changes in their latest Primary Storage for Large Enterprises report, with only three leaders – NetApp, Pure and Infinidat – compared to six last year. Dell, Hitachi Vantara and IBM have been demoted to challenger status.

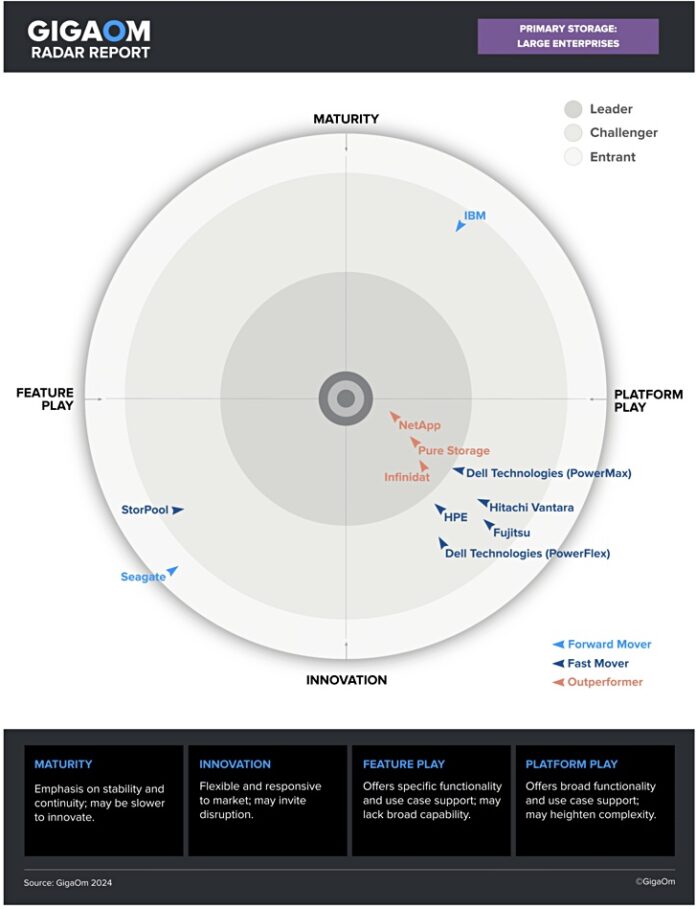

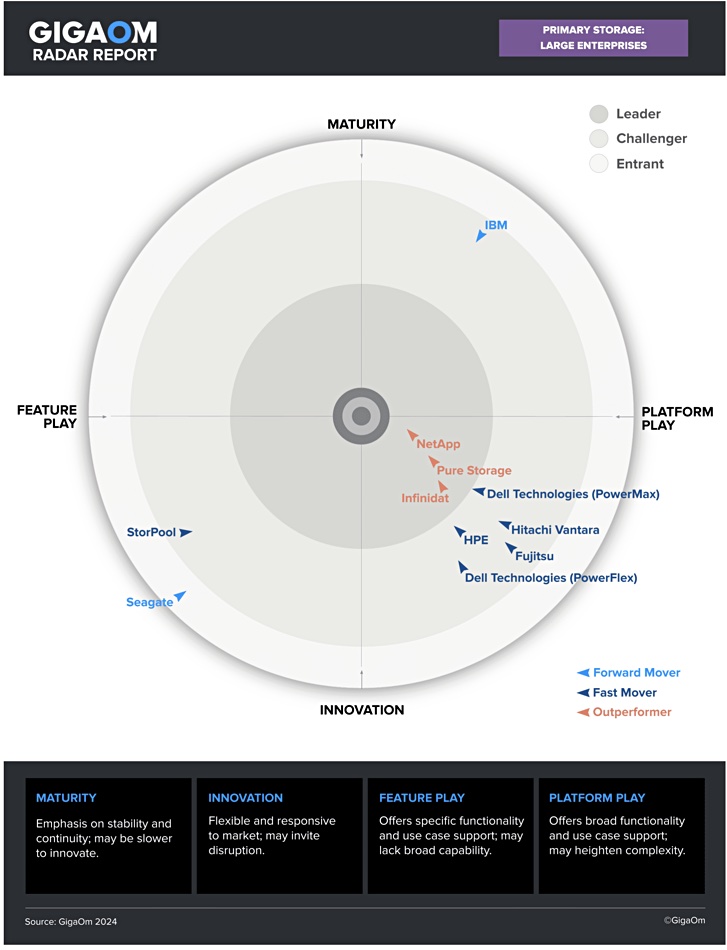

The GigaOm Radar for Primary Storage for Large Enterprises looks at 11 of the top primary storage products for large enterprises in the market and compares offerings against the capabilities (table stakes, key features, and emerging features) and non-functional requirements (business criteria) outlined in a companion Key Criteria report. Here is the Radar diagram:

(Its construction is described in a bootnote below.)

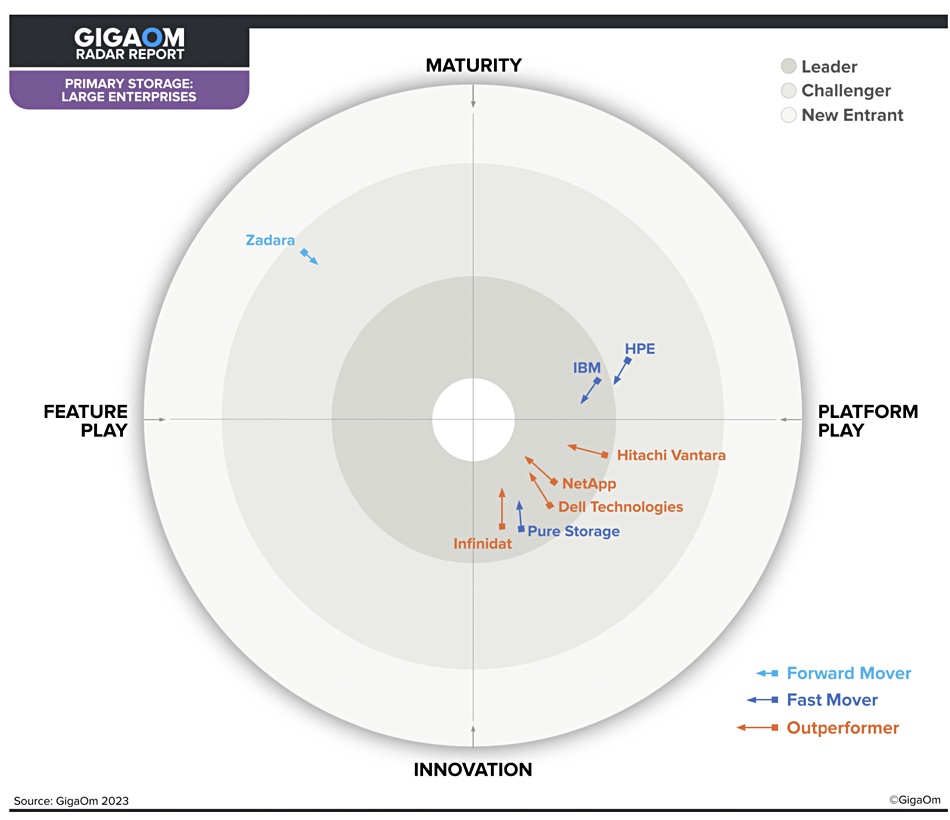

Here for comparison is last year’s diagram:

There were eight evaluated vendors in February 2023: Dell, Hitachi Vantara, HPE, IBM, Infinidat, NetApp, Pure Storage and Zadara. This year there are ten.

Storage-as-a-Service (STaaS) supplier Zadara has disappeared and is now evaluated by GigaOm in its Sonar for STaaS report. Fujitsu, Seagate and StorPool have entered.

Assessing the leadership circle rankings last year was complicated by the suppliers all being close to the outside edge of the leadership quadrant. Now we have NetApp clearly in front of Pure Storage, which is in front of Infinidat. All three have a nice balance between innovation and platform product plays, and are classed as outperformers.

There are three outliers. Newcomer Seagate is classed as an entrant based on its Exos X appliances. StorPool, another newcomer, is classed as a challenger with more of a feature play than a platform focus.

IBM is up on its own in the Maturity-Platform Play quadrant and, like Seagate, judged to be a relatively slow mover. GigaOm looked at its established FlashSystem 9500 all-flash array and Spectrum Virtualize architecture.

We would point out that IBM also sells its DS8000 high-end enterprise arrays to its mainframe customers, and these have not been considered by the report’s authors.

There is a group of four challenger vendors following the three leaders in the Innovation-Platform Play quadrant: Dell, newcomer Fujitsu with its ETERNUS and OEMed NetApp arrays, Hitachi Vantara (VSP 5000), and HPE (Alletra 9000). This group is led by Dell (PowerMax), with HPE close behind and then Hitachi Vantara, Dell again (PowerFlex), and finally Fujitsu.

The GigaOm analysts describe and measure each supplier’s offerings in detail in the full report, which is available to GigaOm subscribers.

Bootnote

The circular Radar diagram has four quarter-circle segments defined by a feature-vs-platform play horizontal axis and an innovation-vs-maturity vertical axis. Three concentric rings are overlaid on this with the outer one for new entrants, the middle one for challengers and the inner one for leaders. Vendor placements have direction of progress arrows indicating if they are a forward, fast or out-performing mover towards the center of the circle.