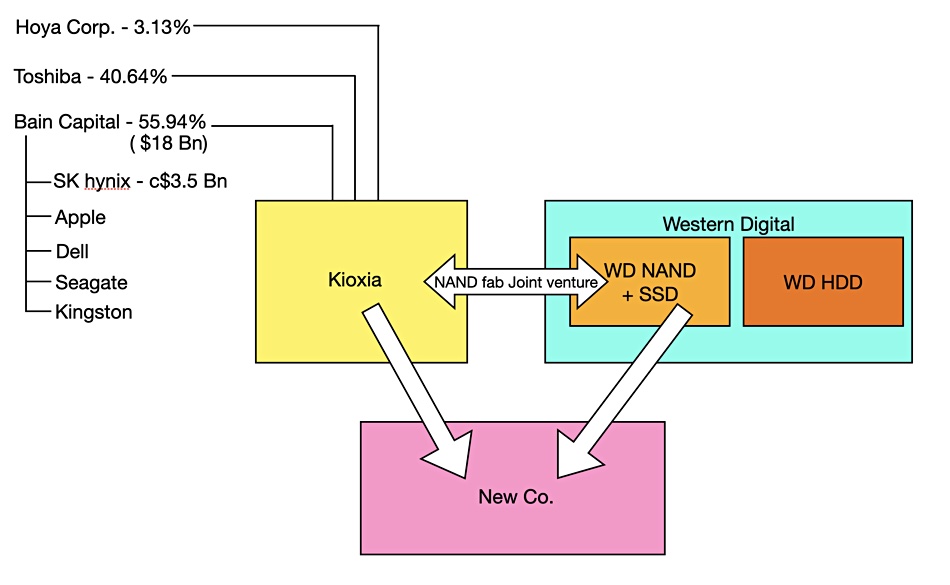

The cancelled merger talks about a combined Kioxia-Western Digital NAND/SSD business could be on again with Kioxia reportedly talking to WD and Kioxia majority shareholder Bain Capital locked in discussions with minority investor SK hynix, which previously blocked the pairing.

As reported by the Japanese outlet, 47News, Kioxia and Western Digital are reconsidering a unification of the NAND and SSD businesses. The two have a joint-venture to manufacture NAND chips in Japan and they take an approximately equal share of the produced chips to build SSDs. The on-off talks have been complicated by Kioxia having three owners: a Bain Capital consortium with around 56 percent, Toshiba with a near 41 percent, and Japan’s Hoya Corp with the remaining three percent.

This is further complicated by the Bain consortium having five participants, one of which is South Korea-based SK hynix that makes NAND chips and SSDs in competition with Kioxia and Western Digital. This dynamic caused previous merger talks to collapse due to SK’s concerns about its stake’s valuation and its competitive position in the NAND/SSD market when faced with a merged Kioxia-WD NAND+SSD business.

TrendForce measured the relative market shares of the players in the NAND market in 2023’s third quarter as being:

- Samsung: 31.4 percent valued at $2.9 billion

- SK hynix + Solidigm subsidiary: 20.2 percent equating to $1.86 billion

- WD: 16.9 percent with $1.56 billion

- Kioxia: 14.5 percent with $1.34 billion

- Micron: 12.5 percent with $1.15 billion

- Others: 4.6 percent with $423 million

A combined Kioxia + WD business would have a 31.4 percent share of market sales, equal to Samsung’s portion, and leaving SK hynix facing two much larger players.

The situation is muddied further by Western Digital responding to activist investor Elliott Management and agreeing to separate its disk drive and NAND/SSD businesses into separate entities. That separation would be complete some time in the second half of this year.

Kioxia reportedly wants to collaborate with SK hynix in some way without violating antitrust laws. 47News also says Bain is talking with SK hynix about potential involvement in a Kioxia-WD SSD business unit merger. That suggests that SK hynix could own part of a merged Kioxia/WD SSD business.

We note that SK hynix already has two different NAND foundry operations and NAND architectures; its own and that of its acquired Solidigm business. Adding a third NAND architecture to the mix may complicate matters.

There is also the possibility of Kioxia becoming an independent public company as a way for its owners to get a more direct stake in the business. An attempt was made to do this in 2020 but it failed.