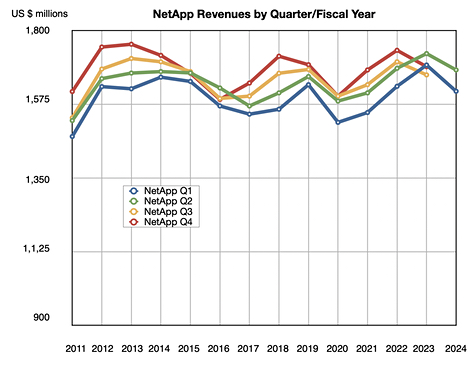

Revenues in NetApp’s second quarter of fiscal 2024, which ended on October 27, were $1.56 billion, at the mid-point of its guidance and 6.1 percent down year-on-year. The $233 million profit was 69 percent lower than a year ago.

CEO George Kurian’s statement said: “Q2 improved on our solid start to FY’24 in what continues to be a challenging macroeconomic environment. We delivered another strong quarter, with revenue above the midpoint of our guidance and all-time highs for gross margins, operating margins, and EPS.”

Revenues were down year-on-year for the fourth quarter in a row, however. CFO Mike Berry said: “Q2 was a very solid quarter in what continues to be a challenging macro environment with soft IT spend.”

Financial summary

- Billings: $1.5 billion, down 9 percent y/y

- Gross margin: 72 percent, up 0.58 percent y/y and a record

- Operating cash flow: $135 million compared to $214 million a year ago

- Cash, cash equivalents & investments: $2.62 billion

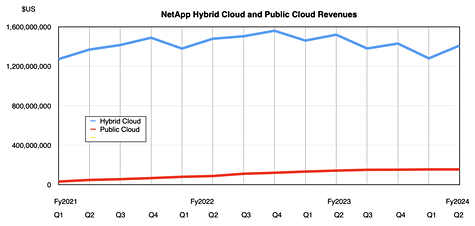

NetApp reported Hybrid cloud revenues of $1.41 billion, down 7.8 percent year-on-year, while public cloud revenues rose 8.4 percent to $154 million. Product sales of $706 million were 15.7 percent down annually but up 19.7 percent quarter on quarter as all-flash array sales increased, helped by lower cost models. Kurian said: “Our all-flash array business benefited from growth of the AFF C-series.”

The all-flash array ARR was up 3.2 percent to $3.2 billion.

Kurian added: ”We remain relentlessly focused on managing the elements within our control while driving better performance in our storage business and building a more focused approach to our Public Cloud business. We are seeing positive results from these actions, with increased profitability and a stronger position for delivering long-term growth.”

For the public cloud that meant a strategic review in the quarter. Kurian said: “As a result, we will continue to prioritize cloud storage offerings delivered through the hyperscalers, while refocusing some services, such as Cloud Insights and Instaclustr, to complement and extend our hybrid cloud storage offerings, creating greater differentiation and additional value for customers.”

“We will integrate other services that are sold as standalone subscriptions today, such as data protection, into the core functionality of Cloud Volumes. We will also carefully manage the transition of cloud storage subscription services to align to customer preference for consumption offerings.”

“And, we have decided to exit the SaaS backup and virtual desktop services.”

A lot of attention is being paid to growing public cloud revenues but they will have to grow at a high rate to offset declining hybrid cloud revenues, as the chart above shows.

The outlook for the third quarter is for revenues of $1.59 billion +/- $0.08 billion, representing a 3.9 percent increase at the mid-point and – potentially – growth at last. Kurian said: ”We expect the momentum we saw in Q2 to continue through FY’24, despite continued softness in the demand environment due to the challenging macro.”

Berry said: “We expect our continued focus and discipline to deliver year-over-year growth in the second half of the year. As a result, we are raising all our guidance measures for fy’24.”

Full fy2024 revenues are now forecast to be 2 percent down on fy2023 at $6.23 billion.