HPE managed to grind out a small annual revenue increase in fiscal 2023 despite disappointing final quarter results.

Revenues in the quarter ended October 31 were $7.35 billion, down 6.6 percent annually, with a profit of $642 million, compared to the year-ago $304 million loss. Full fiscal 2023 revenues were $29.14 billion, 2 percent up on 2022’s $28.5 billion, with profits 133 percent higher at $2.03 billion. HPE raised its annual dividend in consequence.

President and CEO Antonio Neri stated: “In fiscal year 2023, HPE clearly demonstrated that our strategic investments and extraordinary innovation across the growth areas of Edge, Hybrid Cloud, and AI are resonating with customers.””

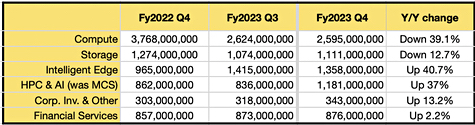

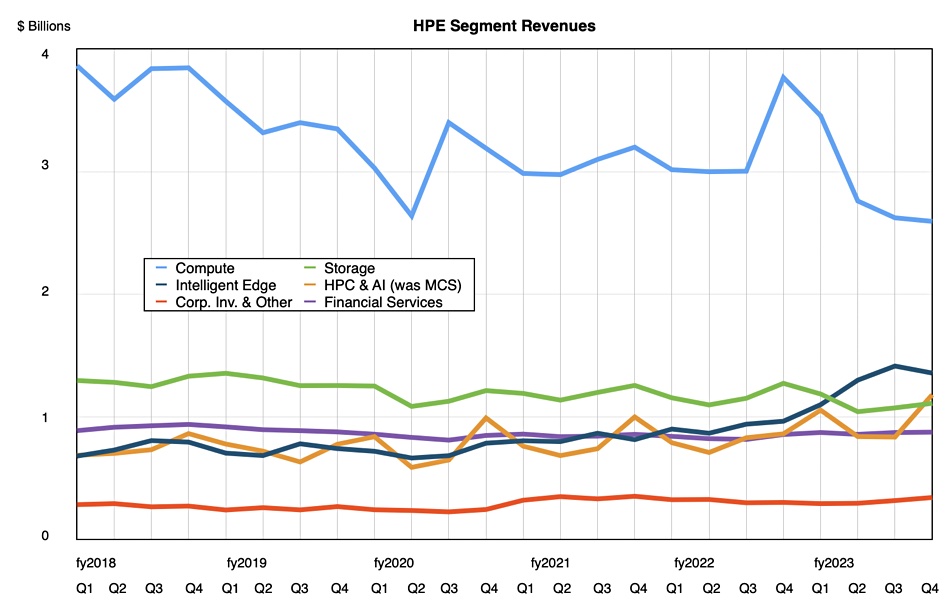

The Intelligent Edge (Aruba) and HPC &AI (Cray) business segments delivered the goods as the Compute and Storage segments fell short, as numbers and a chart indicate:

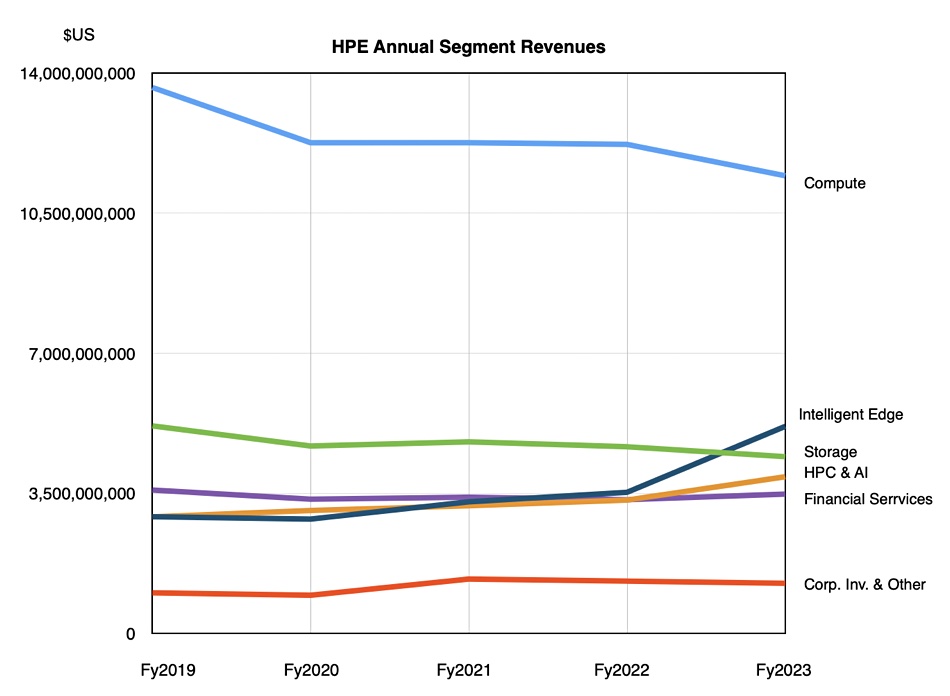

If we chart the same segment results by fiscal year, the results of Neri’s bets on the Edge and HPC/AI markets become clearer:

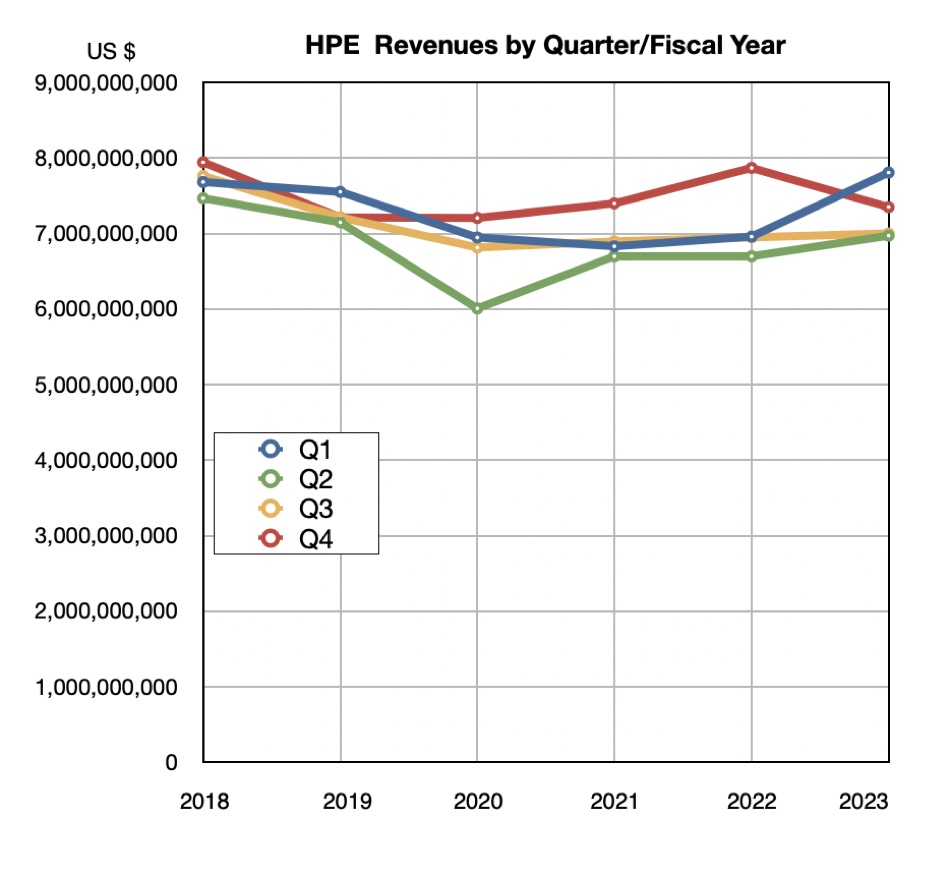

The Intelligent Edge and HPC & AI segments are the only growth business units over the fiscal 2019-2023 period. Compute revenues are so large, though, that the rise in Edge and HPC/AI revenues have not yet compensated for the decrease in compute, leaving HPE quarterly revenues coasting along in the $6.5-8 billion area for 24 quarters in a row – level pegging almost, as a third chart makes clear:

Unless HPE stops its compute revenue decline, or Edge and HPC/AI revenues surge higher, it will stay at this quarterly revenue level, unable to break out. A halt to its storage revenue decline would be a good thing as well but storage revenues are dwarfed by compute, where HPE needs to take share from Dell and Lenovo if it is to make progress and bust the $8 billion/quarter barrier.

Neri added: “We delivered record performance against key financial metrics this year. Our steady execution resulted in higher revenue, further margin expansion, larger operating profit, and record-breaking non-GAAP diluted net earnings per share and free cash flow.”

Quarterly Financial Summary

- Gross margin: 34.8 percent up 1.95 percent annually

- Free cash flow: $2.2 billion

- Operating cash flow: $2.8 billion, up $326 million annually

- Greenlake ARR: $1.3 billion

Wells Fargo analyst Aaron Rakers told subscribers: “We think HPE delivered solid results/guide, and more importantly highlighted continued momentum in AI orders, which we think should overshadow incremental Intelligent Edge weakness and uncertainty over a Compute recovery.”

Regarding the storage business segment, Rakers said HPE “noted that storage demand has been flat to up for three straight quarters, but highlighted Alletra growth of over 50 percent year-over-year as a pocket of strength.”

The outlook for the next quarter is for revenues of $6.9 billion to $7.3 billion, representing a 10.4 percent year-on-year decline at the $7 billion mid-point.