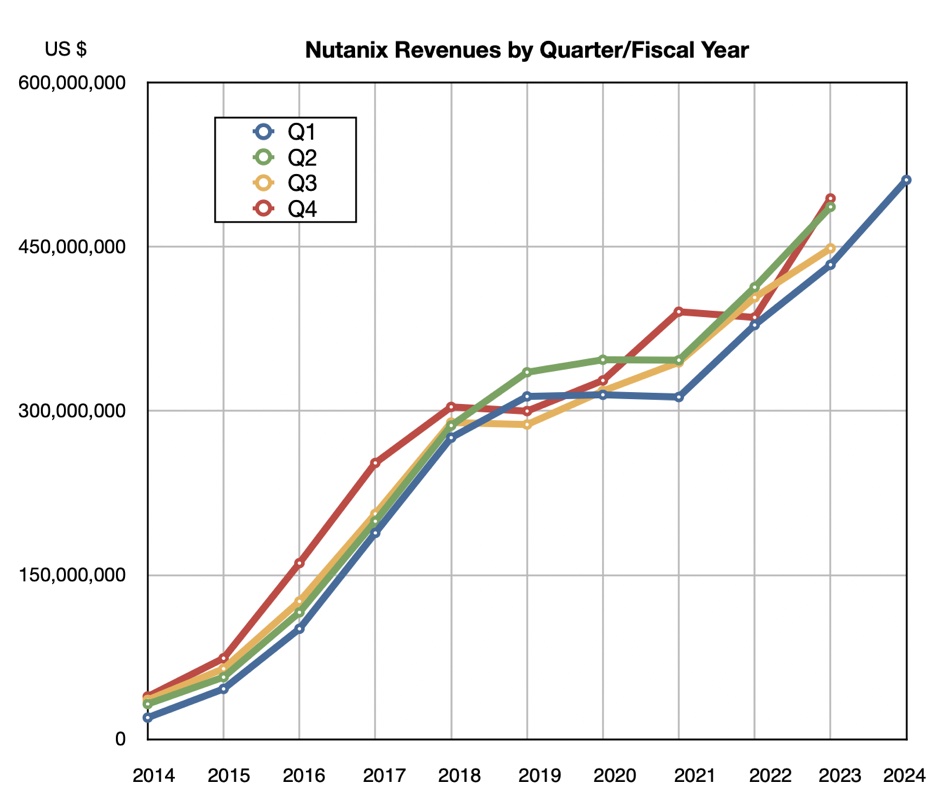

Hyperconverged infrastructure software vendor Nutanix announced record revenues in its latest quarter, its eighth of successive growth, and hit a $2 billion annual revenue run rate for the first time.

Revenues in the quarter ending October 31 were $511.1 million, up 18 percent on a year ago, with a loss of $15.9 million, significantly lower than the year-ago $99.1 million loss. It gained 380 new customers, taking its cumulative total to 24,930. Nutanix also began a share repurchase program to bolster its stock price.

President and CEO Rajiv Ramaswami said: “We delivered a solid first quarter with results that came in ahead of our guidance. The uncertain macro backdrop that we saw in our first quarter was largely unchanged.”

CFO Rukmini Sivaraman added: “Q1 ’24 was a good quarter in which we exceeded the high end of the range on all guided metrics. ACV billings in Q1 was $287 million, above the guided range of $260 million to $270 million and a year-over-year growth rate of 24 percent.”

Performance in its US Federal business was stronger than expected, with a sale of its August-launched GPT-in-a-box system. The partnership with Cisco, which recently canned its HyperFlex HCI product in favor of selling Nutanix, is also off to a good start. Nutanix “secured a few wins for this new offering, which were conversions of customers, who had previously been planning to purchase Cisco’s HyperFlex,” Ramaswami said.

But he tempered future prospects by saying in the earnings call: “Our pipeline takes six to nine months to go close deals for us, right? So we don’t expect a huge amount of Cisco this year.”

Although the macro environment didn’t change from the last quarter, Sivaraman said: “We saw a modest elongation of average sales cycles, relative to the year-ago quarter.”

Financial summary

- Gross margin: 84 percent vs 81 percent a year ago

- Free cash flow: $132.5 million vs $45.8 million a year ago

- Operating cash flow: $145.5 million vs $65.5 million a year ago

- Cash and short-term investments: $1.57 billion vs $1.39 billion a year ago

Ramaswami is hoping for “an ARR compound annual growth rate of approximately 20 percent through fiscal year ’27 and generation of $700 million to $900 million of free cash flow in fiscal year ’27.”

The outlook for Nutanix’s second 2024 quarter is for $550 million in revenues +/- $5 million, 13.1 percent growth annually. Guidance for the full year is now $2.11 billion +/-$15 million, up 13.3 percent on last year at the mid-point. Sivaraman said: “We are seeing continued new and expansion opportunities for our solutions, despite the uncertain macro environment.” The fiscal 2024 guidance has been raised for all guided metrics, including revenue, ACV billings, non-GAAP operating margin, non-GAAP gross margin, and free cash flow.

One of these opportunities is for Red Hat OpenShift to run on top of Nutanix. Ramaswami said Red Hat competes with VMware on the application side and Nutanix infrastructure also competes with VMware so it is a natural partnership. Several Nutanix customers are running OpenShift, including Global 2000 banks. One G2K bank win in the Asia-Pacific region chose Nutanix because of uncertainties about VMware’s future as part of Broadcom. Other Nutanix deals this quarter also benefited from that uncertainty.

But the opportunity is complicated as Nutanix can run on top of the VMware hypervisor. Also, some VMware customers have signed long-term deals and cannot shift across easily to Nutanix, even if they wanted to.

Ramaswami mentioned this in the earnings call, saying: “We have a significant pipeline of opportunities, and it’s growing and a good degree of engagement with prospects, driven by these concerns. It’s just difficult to predict timing and magnitude of wins.”

In general, Nutanix is benefiting from weakened competition from VMware and Cisco’s withdrawal from HCI. These two opportunities will provide a positive growth environment for Nutanix in the next few quarters if not years.