Storage supplier Quantum has encountered significant challenges due to a decrease in device and media sales, and reduced spending by hyperscale customers.

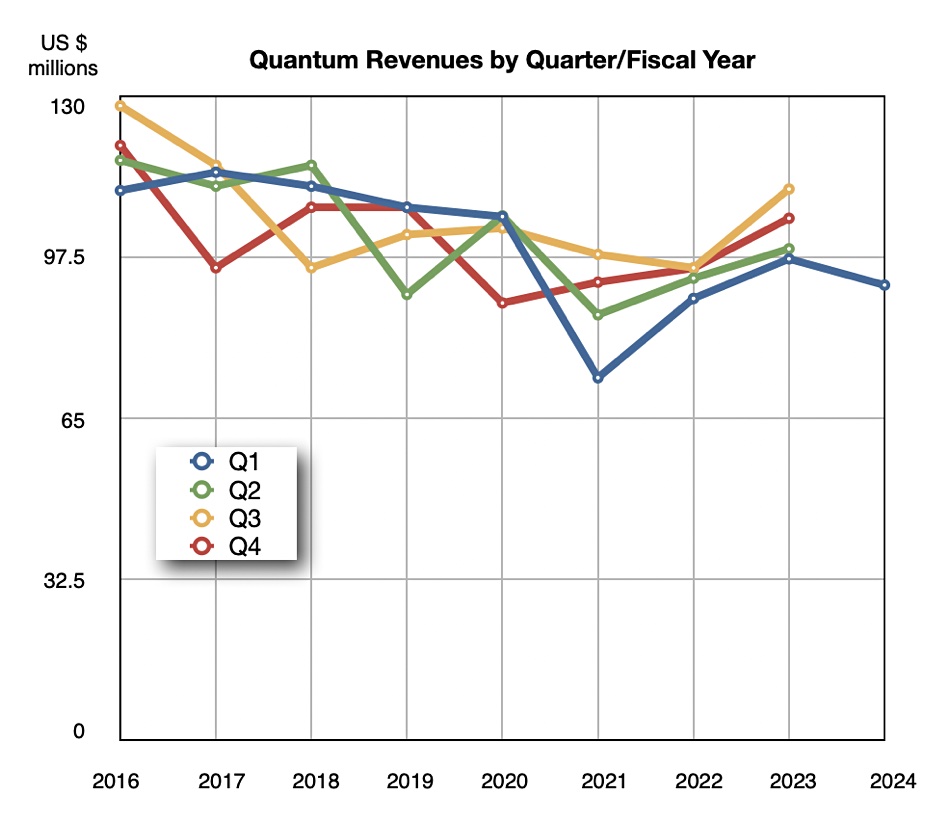

In the first fiscal quarter of 2024 ending June 30, Quantum experienced a 5.4 percent year-over-year decline in revenues, recording $91.8 million. This resulted in a net loss of $10.6 million, a figure consistent with the previous year’s results. Notably, this marks Quantum’s 14th consecutive quarter with a loss, following five quarters of year-over-year revenue growth.

CEO Jamie Lerner said: “First quarter revenue was impacted by booking delays; an unanticipated drop in device and media sales late in the quarter; and higher than anticipated weakness in the hyperscale vertical.

”Our subscription ARR in the quarter increased 78 percent year-over-year and 9 percent sequentially as we continue to advance recurring software subscriptions across our customer base.” Over 89 percent of new unit sales were subscription-based.

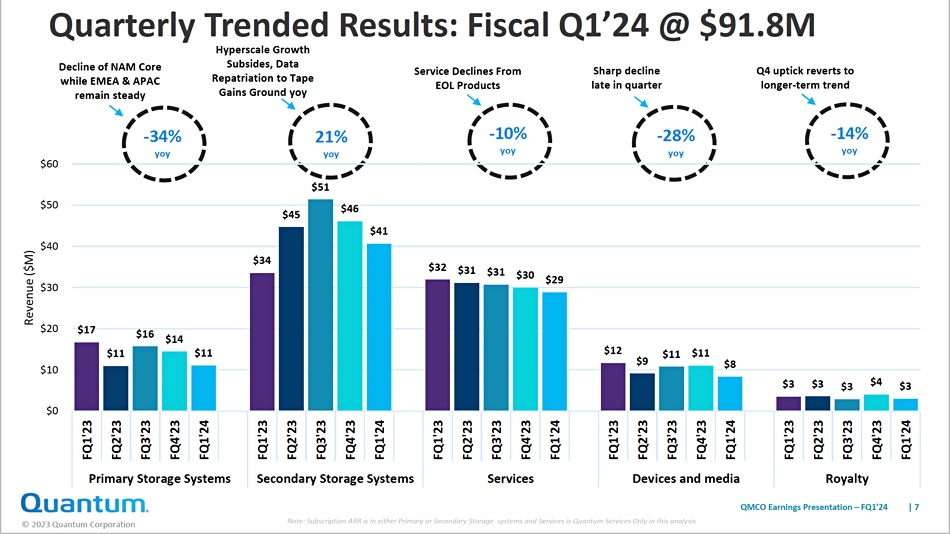

A chart shows the damage by product sector, with secondary storage the only growth area:

There was a decrease in sales of primary storage systems, device and media, as well as lower services business, partially offset by growth in hyperscale secondary storage systems.

Then this happened: “Subsequent to quarter-end, our largest hyperscale customer paused orders due to excess capacity driven by broader macro weakness. This development was unexpected and will have a meaningful impact on our second quarter and full year outlook and further punctuates the importance of transitioning our business to a more stable, subscription-based business model to moderate quarterly volatility.”

Financial summary:

- Gross margin: 38.1 percent vs 35.1 percent a year ago

- Operating expense: $40.8 million vs $41.1 million the year prior

- Cash, cash equivalents and restricted cash: $25.7 million

- Outstanding term loan debt: $88.6 million vs $78.4 million on June 30, 2022

Lerener was open about the need to end dependence on lumpy perpetual license sales and hyperscale customers, saying: “Our entire team is fully focused on executing with a high sense of urgency to secure and convert our expanding pipeline of opportunities into customers. This includes aggressively scaling our non-hyperscale businesses and ramping our full portfolio of end-to-end solutions. We are also further tightening spending across the organization, while maintaining our investment in key sales, marketing, and product development initiatives.”

For the upcoming quarter, the revenue projection stands at approximately $80 million, with a variance of +/- $3 million, translating to a 19.3 percent decline at the midpoint. The revenue forecast for the entire fiscal year is set at around $360 million, with a possible variance of +/- $10 million, which is 12.8 percent less than the fiscal 2023 revenues.

CFO Ken Gianella said: “Not reflected in our original full year outlook was more pronounced declines in both our hyperscale and media businesses as well as the potential impact of a prolonged entertainment work stoppage.

“Our total gross margins are improving with the rotation to a higher revenue contribution from primary storage and non-hyperscale secondary storage customers.”

Quantum reckons its primary and non-hyperscale secondary business is poised to grow up to 40 percent year-over-year. Its hope is the worst should be over in a quarter or two, with things improving in the second half of the year.