Quantum reported its third growth quarter in a row and reckons it can see the end of a downturn affecting its markets. A prolonged downturn in its revenues has possibly/probably ended.

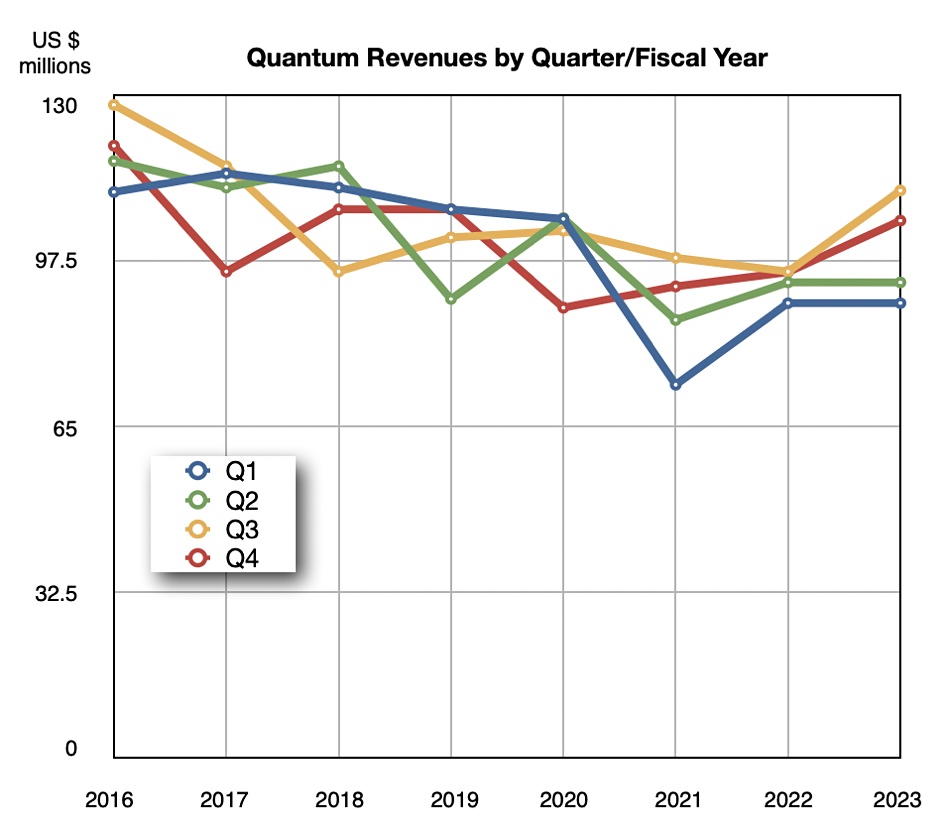

Revenues in the fourth fiscal quarter, ended March 31, were $105.3 million – up 10.7 percent and beating its $102 million guidance – due mainly to strong growth with hyperscale customers. There was a loss of $13.6 million – 74.4 percent more than a year ago. Full year revenues were $412.8 million, 11 percent higher annually, with a loss of $38.3 million, 18.6 percent more than its FY2022 loss of $32.3 million. Quantum attributed the full year rise to strong secondary storage performance.

CEO and chairman Jamie Lerner said in the earnings call: “We are pleased with the revenue results, we feel good about the supply chain, and we’re excited about recent product launches, but we have work to do in fiscal year 2024 to improve our bottom line results.”

He added: “Having weathered a macro environment marked by a global pandemic, supply chain challenges, and disruptive inflation, we are beginning to see signs of improvement across our business.”

Financial Summary

- Gross margin: 30.2 percent vs 38 percent year ago

- Subscription ARR: $13.4 million, up 81 percent year on year

- ARR: $156 million

- Adjusted EBITDA: $1.0 million vs $0.4 million a year ago

- Cash, restricted cash and equivalents: $26.2 million vs $5.5 million a year ago

The gross margin was down year-on-year due to non-recurring inventory charge and revenue mix.

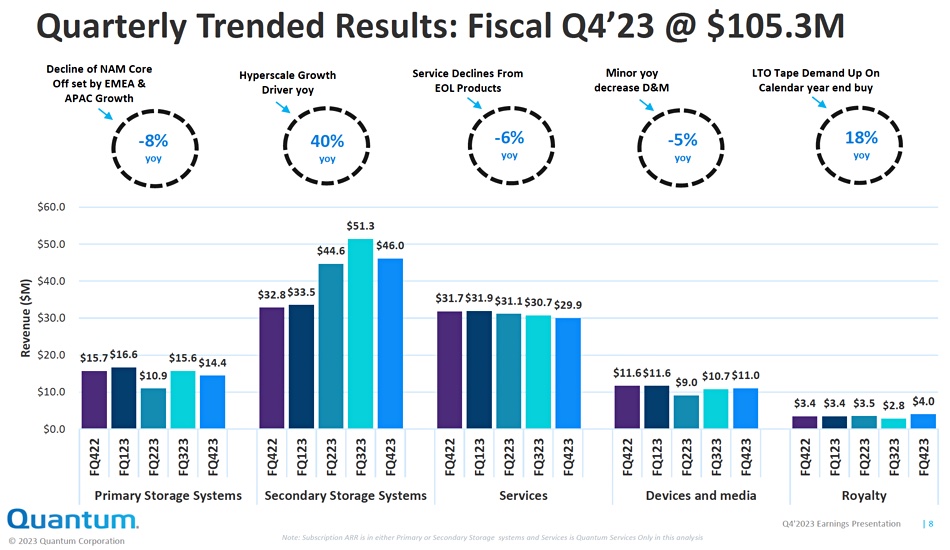

The business segment results were:

- Primary storage (Myriad, StorNext, surveillance) – $14.4 million, down 8.3 percent

- Secondary storage (ActiveScale, DXi, Scalar tape) – $46.0 million, up 40.2 percent

- Services – $29.9 million, down 5.7 percent

- Devices & media – $11.0 million, down 5.2 percent

- Royalty – $4 million, up 17.6 percent

It was Quantum’s strongest fourth quarter result in six years – since 2017. Secondary storage products contributed 42 percent of the revenues – ten percent more than their contribution a year ago. The hyperscale market (tape libraries) did very well, with Lerner commenting: “We had an incredible year of hyperscale sales with two times revenue growth versus the prior year.” A stabilizing supply chain helped as well.

However, hyperscaler competion is rising. Lerner again: “Two years ago we were the only company that had a hyperscaler tape offer, now two other companies offer something similar to us.”

It anticipates its primary storage products will return to growth, and CFO Ken Gianella said: “We are seeing positive signs of recovery of our primary storage systems going forward due to increased market demand, the introduction of our Myriad platform, and our multiple year investment in our US and international sales teams.”

Lerner added: “[Myriad] will have revenue impact this year. We’ve modeled it very conservatively until we start to see POs coming in, but there will be revenue impact in this fiscal, for sure.”

Myriad sales could also involve accompanying ActiveScale data lake and CATdb data tagging sales. Quantum is naturally excited by this prospect.

Lerner said the company was making progress in transforming sales with direct engagement “in larger enterprise deals, especially in areas of repatriation of data back on premise from cloud providers.” It’s also focussing its salesforce on end-to-end selling. As a result, Lerner said, Quantum is now “seeing a higher volume of large deals becoming a bigger component of our revenue mix in the pipeline.”

He mentioned another sales initiative: “We are also working on several OEM partnership opportunities with global technology providers. Just this past quarter, we secured an active scale OEM win at a global provider of video streaming solutions that will add to our subscription ARR in fiscal year 2024.”

Turning a corner

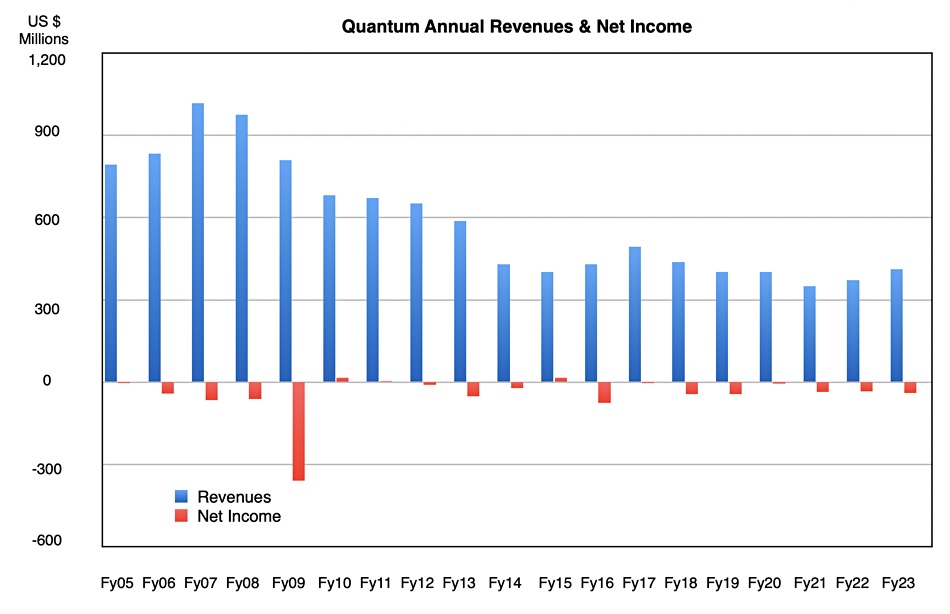

Quantum’s annual revenue history indicates that its general revenue decline over the past fifteen years may be ending and turning upwards.

To help ensure it keeps on doing that it’s recently implemented cost reduction measures and extended its credit facilities. Lerner said: “Subsequent to the end of the fourth quarter, we implemented a global efficiency plan that includes a cost reduction action.” This involved more than ten percent of its workforce globally and should result in annualized net savings of around $14 million from fiscal 2025 onwards.

He said about the credit moves: “To support greater operational flexibility in the near term, we proactively secured an additional $15 million of liquidity and greater covenant flexibility from our current lenders to capitalize on the cost savings initiative and position the company for growth as we bring our recent product innovations to market.”

Quantum is also increasing its operational efficiency to squeeze cost out of the business.

Outlook

The outlook for Q2 is $97 million plus/minus $3 million which compares to the $97.1 million revenues from Q2 last year – essentially flat. However, the full 2024 year outlook is for $415 million plus/minus $10 million. This would represent a 11 percent annual rise at the mid-point. Lerner said: “Although we anticipate the first fiscal quarter to be seasonally lower, we expect a resumption of revenue rotation to higher margin products and EBITDA expansion throughout the remainder of the year.”

Quantum is assuming that its secondary storage revenues will be lower, due to declining hyperscale revenues, but more than offset by higher primary storage revenues in the rest of the year. That will be influenced by repatriation from the public cloud and more business based on AI and machine learning.