A Kioxia merger with Western Digital could be agreed in August, the month the latter reports its fourth quarter and full year results.

The duo have engaged in merger discussions since January. An agreement would provide an exit route from Kioxia Holdings for the current owners, financially troubled Toshiba and private equity house Bain Capital, and potentially help to get activist investor Elliott Management off WD’s back.

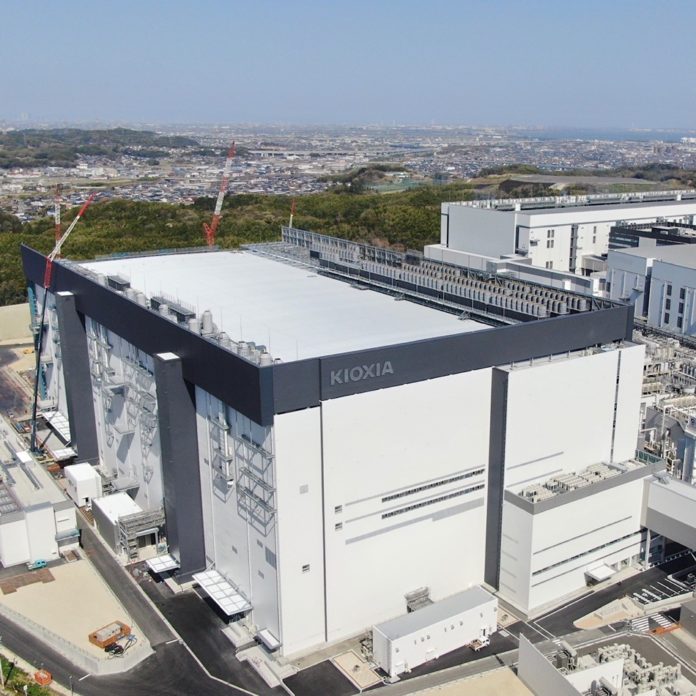

WD already uses Koixia’s fabrication plants to make its flash memory chips and Elliott Management had previously called for WD management to consider strategic alternatives, including separating the flash and hard drive divisions.

The Japan Times media outlet, citing sources close to the discussions, reported that Western Digital would own slightly more than 50 percent of the merged entity but Kioxia execs would run it. It would be a Nasdaq-traded operation with a Tokyo listing at some point in the not-too-distant future.

Financing has reportedly been organized and involves Bain Capital, whose consortium owns 56.2 percent of Kioxia, getting a special dividend. It’s unclear whether this will be company shares or cash.

Western Digital’s current operation would necessarily divide into an HDD business and the combined NAND and SSD entity with current shareholders getting their shares split into two components; one for the HDD business and the other for the merged Kioxia+Western Digital NAND+SSD company.

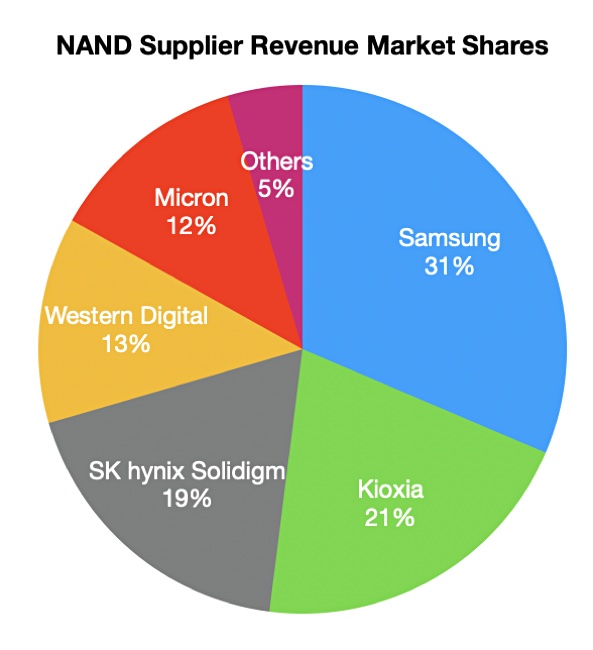

A combined Kioxia/Western Digital NAND operation would have a leading 34 percent revenue share of the NAND market, according to TrendForce numbers from November last year:

Samsung would then become number two, SK hynix with its Solidigm subsidiary number three, and Micron number four. The NAND market is currently over-supplied and capital-intensive as new and higher layer-count 3D NAND technologies are being developed.

Western Digital’s Q4 financial results report is expected around August 5.

A WD spokesperson said: “We don’t speculate on M&A activity,” and Kioxia’s spokesperson followed suit, saying: “Kioxia America has no comment and does not comment on market rumors.”

Bootnote

B&F has previously waxed lyrical about the history of the merger talks between WD and Koixia here.