The NAND market shrank by almost a quarter in the third quarter, according to TrendForce, hit by plummeting demand as consumers bought fewer PCs and phones with server sales declining as well.

The Taiwan-based research house said that suppliers have cut back on foundry capex and reduced production plans in the face of a pessimistic outlook. Excess inventories have caused a price fall with the overall NAND ASP declining by 18.3 percent quarter on quarter. NAND bit shipments declined less by 6.7 percent.

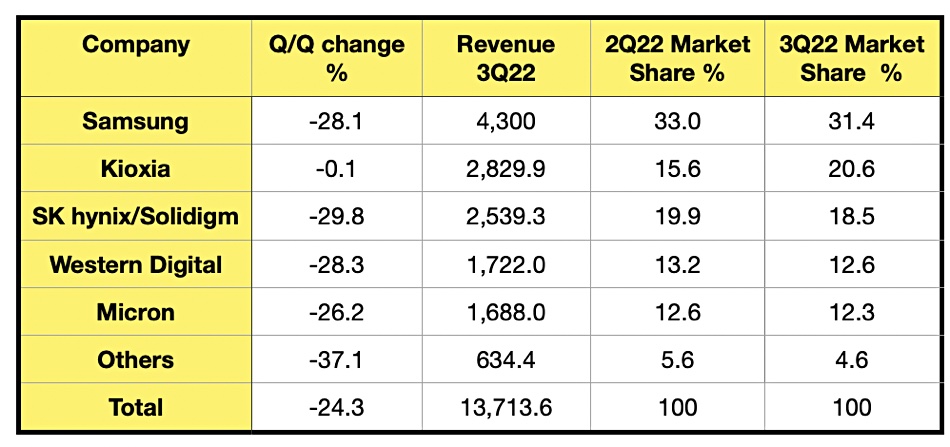

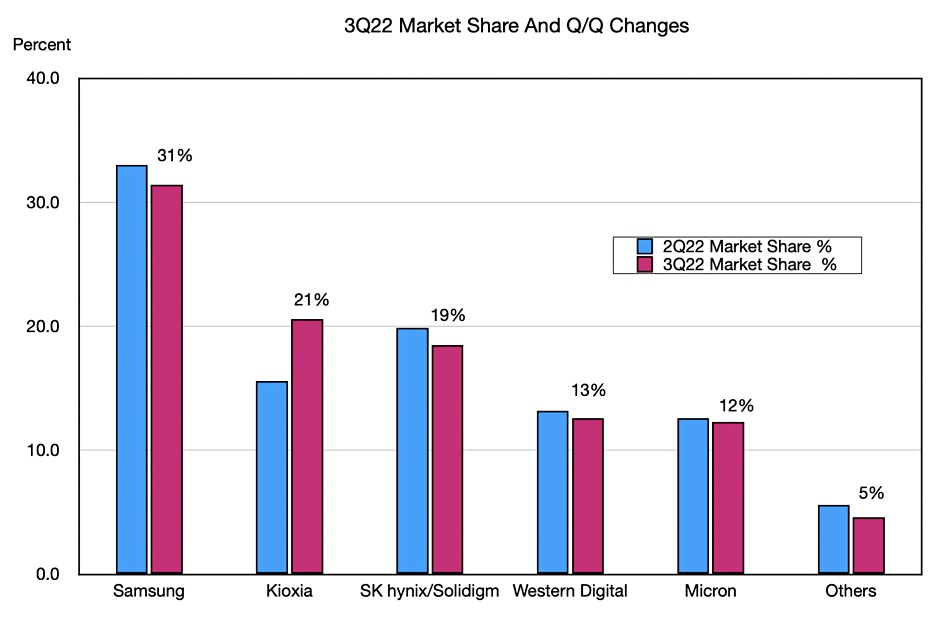

TrendForce has worked out individual supplier market shares and the change from the last quarter, with the overall market declining 24.3 percent to $13.7 billion and only Kioxia almost resisting this with a 0.1 percent decline.

That’s attributed to the global economic situation discouraging people buying PCs, laptops and other smart devices this quarter. The reason for Kioxia’s dramatic difference from the other suppliers is attributed to its production recovering from a foundry chemical contamination incident earlier in the year.

Market leader Samsung “saw a drop in its enterprise SSD shipments during 3Q22 as server demand slowed down.”

SK hynix was the second largest supplier in the second quarter but has now been overtaken by the recovering Kioxia. TrendForce says SK hynix revenues dropped almost 30 percent as it suffered the most from “the significant deterioration of the demand for PCs and smartphones [and] its subsidiary Solidigm was also affected by the slowdown in server procurements.” It adds: “Server demand … buckled in 3Q22 as result of enterprises cutting capital expenditure and undergoing a period of inventory correction.”

On the other hand, the smartphone market was kind to Kioxia, with TrendForce noting that although “Kioxia did suffer a significant decline in its ASP due to the slumping demand for consumer electronics, its bit shipments were bolstered by the seasonal stock-up activities of its clients in the smartphone industry and rose by 23.5 percent QoQ.”

A chart using TrendForce numbers shows the supplier market share changes:

Kioxia and Western Digital are foundry partners and their combined share is 34 percent, ahead of Samsung.

The outlook for the fourth quarter is more market contraction. TrendForce notes: “The usual demand surge in connection with the year-end holiday sales has failed to materialize this year,” and so suppler inventories are increasing. Therefore: “NAND revenue will show a QoQ drop again for 4Q22 as inventory pressure continues to mount and production cuts bring no immediate relief.” The production cuts’ “effect on the market will not be apparent for at least a quarter.”

TrendForce says “the NAND Flash industry is … forecasted to post a QoQ decline of almost 20 percent in its total revenue for 4Q22.”

Consolidation point

After supplier consolidation there are only three disk drive manufacturers – Seagate, Western Digital, and Toshiba. On that basis there is scope for NAND supplier consolidation. The common sense moves would be for Kioxia and Western Digital to become a single entity, and for a Micron-SK hynix combination.

National sensitivities around Japanese, Korean, and US semiconductor interests may be resistant to these possibilities but the three countries banding together to face up to the geopolitical threat posed by China could overcome this. The NAND supplier situation could look rather different in 2030.