Bloomberg reports Kioxia and Western Digital are discussing a merger in renewed talks that could create a force in the NAND industry to rival Samsung.

Kioxia and Western Digital operate a joint-venture producing NAND chips at foundries in Japan, and previously discussed a merger last year.

Kioxia was formed by Toshiba selling 60 percent of its NAND foundry and SSD business to a Bain-led consortium for $18 billion in 2017. This was a way of recouping losses incurred by Toshiba’s Westinghouse nuclear power station building business, losses severe enough to make a Toshiba bankruptcy possible.

Kioxia, which inherited Toshiba’s share in the Western Digital JV, has since prospered, building new fabs through the JV, and considered an IPO, which would provide Toshiba with cash, but the plan was put on hold in October last year due to a NAND oversupply depressing prices and hence revenues.

The JV arrangement is that Kioxia owns the foundries and that it and WD each buy half of the fab’s output at a small markup on the production cost. Kioxia has its own NAND production capacity outside the JV and Wells Fargo analyst Aaron Rakers estimates this is equivalent to about 20 percent of the JV’s output.

Western Digital has two main business units: hard disk drives (HDDs) and SSDs, built using the JV’s NAND chips. WD is involved with activist investor Elliott Management has a stake in WD and is campaigning for a separation of the two businesses, claiming that the valuation of the two separate parts would be higher than WD’s present valuation in stock price terms. WD’s board and CEO, David Goeckeler, are presently engaged in a strategic review of the business as a result of Elliott Management’s engagement.

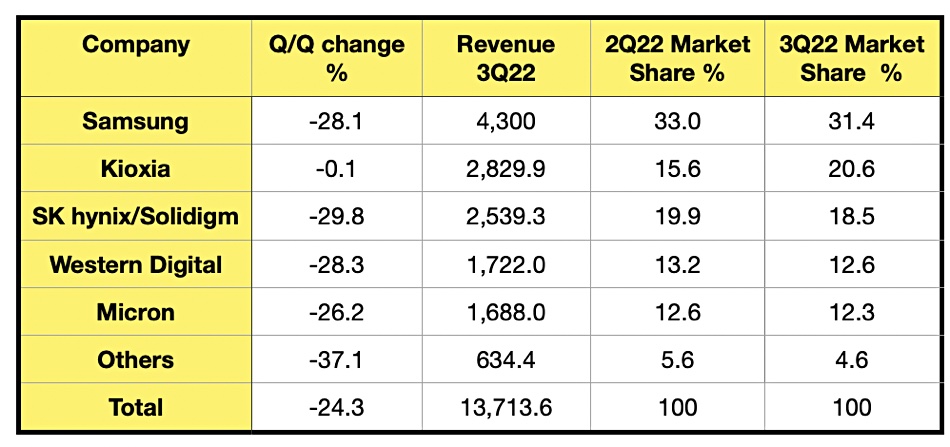

Were Kioxia and WD to merge then the two would have a NAND market share larger than current market leader Samsung.

Research house TrendForce estimated Samsung’s NAND market revenue share at 31.4 percent in the second half of 2022, with Kioxia at 20.6 percent and WD at 12.6 percent. Combine the two and we have 33.2 percent. SK hynix would be third with 18.5 percent and Micron fourth with 12.3 percent, possibly prompting an alignment between the two to gain manufacturing economies of scale.

A merged Kioxia-WD NAND business would most probably have a higher valuation than WD’s current NAND business unit, and possibly even higher than WD’s total current valuation of $10.5 billion. Such an outcome would please Elliott Management. Spinning off a separate WD-Kioxia NAND business could provide Elliott and other WD shareholders with an increased valuation of their combined stock in WD’s HDD business and the enlarged NAND/SSD business. WD’s shares rose 5.2 percent to $33.05 in the NYSE when news of the merger talks was published by Bloomberg. They rose another 8 percent in after hours trading.

It is thought by analysts such as Rakers, that WD would need outside financial help to complete a merger with Kioxia. An obvious partner here could be Bain and its Kioxia ownership consortium which could see shares in a combined Kioxia-WD entity worth more than their shares in Kioxia alone.

WD’s HDD business is currently operating in a depressed and oversupplied market and the company reported an overall 26 percent revenue decline in its third calendar 2022 quarter. It is expecting a 38 percent year-on-year revenue decline at the mid-point of its fourth quarter guidance, down to $3 billion.

Although the NAND market, like the HDD market, is also over-supplied, both are expected to recover as the world’s demand for storing and accessing data continues unabated.

Bootnote

Both Kioxia and Western Digital refused to comment on Bloomberg’s merger talks report.