Preliminary hard disk drive shipment numbers for the second 2023 quarter are down, according to TrendFocus, with Toshiba losing market share to Seagate and Western Digital.

The research house sends its numbers to paying subscribers and some, such as Wells Fargo, pass them on in turn to their subscribers and contacts. The figures should be taken with a pinch of salt, but TrendFocus says there were between 30.8 million to 32.2 million disk drives shipped in the quarter compared to 38.6 million shipped a year ago, a 20.2 percent drop. There was a 33.5 percent fall from Q1 2022 to Q1 2023..

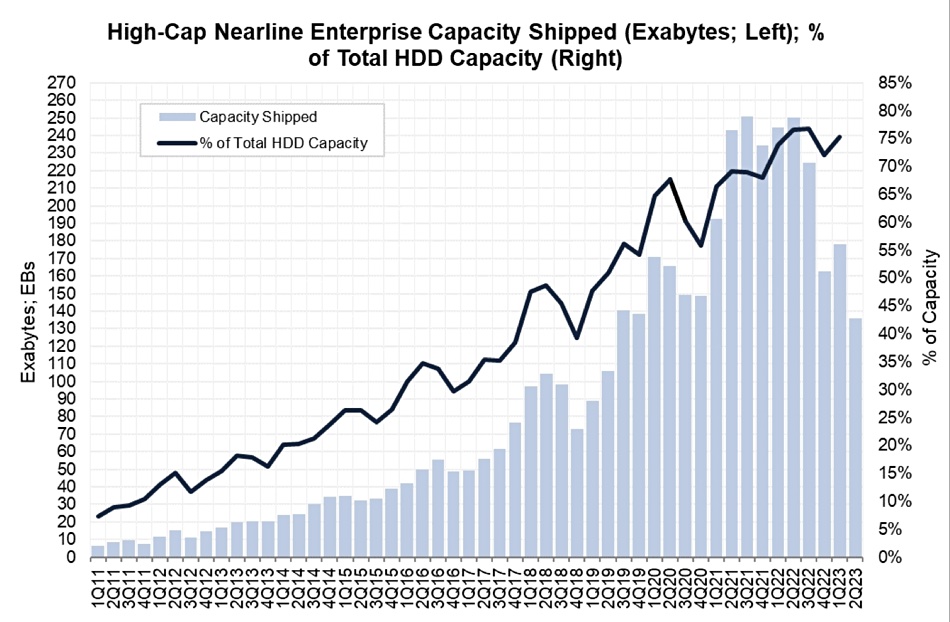

TrendFocus splits its total three ways into nearline (3.5-inch), desktop and consumer electronics in 3.5-inch and 2.5-inch formats, and then adds the numbers up by supplier. Aaron Rakers from Wells Fargo says there were about 9.5 million nearline (3.5-inch high capacity) drives shipped in the quarter, with about 136EB of capacity. This is down roughly 45 percent Y/Y, way more than the 30.5 percent decline in 4Q 2022 and the 27 percent slump in the first 2023 quarter.

Will the nearline exabytes shipped number recover? Rakers’ chart shows that here hasn’t been a slump like this in the past, but the suppliers, quoting IDC data storage growth trends, are convinced that demand will return and nearline exabytes shipped will resume growth.

They expect that disk drive units and exabytes shipped outside the nearline sector will both probably decrease as SSDs take market share. Total non-nearline ships in the quarter were about 22 million, down a little from the 22.1 million in Q1 and 17 percent down from the 26.2 million shipped a year ago.

There were between 11.5 and 11.9 million 3.5-inch desktop and consumer electronics (CE) drives shipped, compared to 11.07 million shipped in the first quarter and 14.23 million shipped a year ago. Just under 9 million 2.5-inch mobile and CE HDDs shipped in the quarter, down from the from the 9.64 million that went out from the suppliers’ factories in Q1 and 9.97 million a year ago.

We don’t have numbers for the mission-critical 2.5-inch 10K drive sector. This has been particularly sensitive to SSD replacement.

We are into the third or fourth year of general SSD cannibalization and still see more desktop and CE drives shipped than enterprise nearline drives – the HDD market most resistant to SSD replacement. HDD shipments have very long tails. Even the notebook form factor 2.5-inch disk drives are still shipping nearly 9 million a quarter, with many of them going into small form-factor desktop PCs.

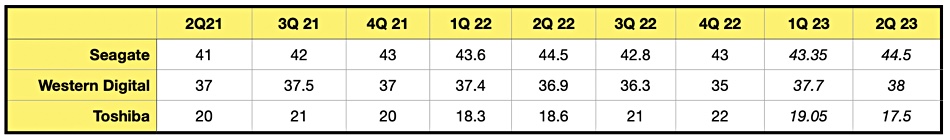

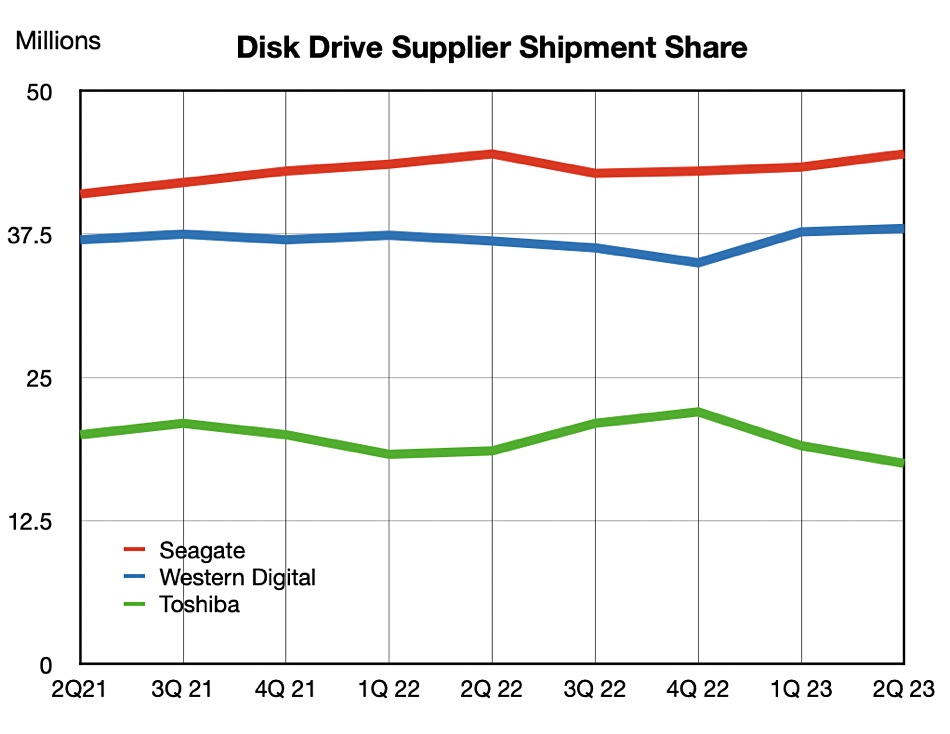

The supplier unit ship totals are not being supplied but Rakers does give us approximate percentage shares. We’ve rounded them up to give Seagate 44.5 percent, Western Digital 38 percent, and Toshiba 17.5 percent.

We’ve tabulated them over time to get a picture of share changes:

We can see Seagate has maintained a unit ship lead over Western Digital and both have gained share from Toshiba over the last two quarters, Western Digital particularly. Toshiba shipped, we calculate, about 5.4 million drives. It needs to keep up with the other two suppliers, capacity-wise, or risks falling further behind.