The sales outlook for Micron has worsened so it’s cutting DRAM and NAND wafer starts by 20 percent compared to its prior quarter.

In Micron’s fourth quarter of fiscal 2022 ended 30 September, revenues dropped 19.7 percent year-on-year due to weakening consumer demand and significant customer inventory adjustments across all its DRAM and NAND end markets. The situation has deteriorated further.

Micron president and CEO Sanjay Mehrotra said in a statement: “Micron is taking bold and aggressive steps to reduce bit supply growth to limit the size of our inventory. We will continue to monitor industry conditions and make further adjustments as needed. Despite the near-term cyclical challenges, we remain confident in the secular demand drivers for our markets, and in the long term, expect memory and storage revenue growth to outpace that of the rest of the semiconductor industry.”

At the end of its last quarter, Micron decided to make a near 50 percent cut in Capex spending and reduce the utilization of its fabs. At that point, Micron estimated calendar 2022 industry bit demand growth for DRAM would to be in the low-to-mid-single digit percentage range and for NAND, slightly higher than 10 percent. It now thinks its year-on-year bit supply growth will be negative for DRAM, and in the single-digit percentage range for NAND.

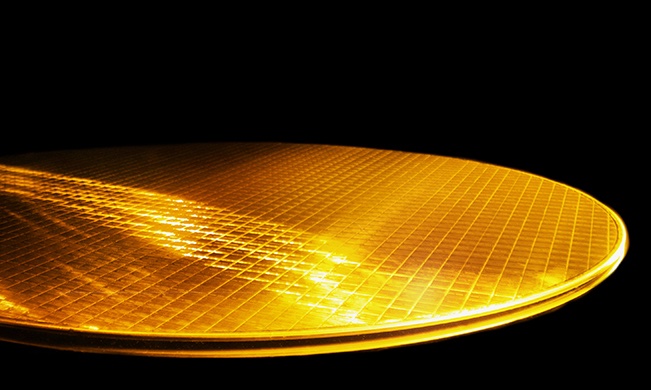

The wafer start reduction will be made across all DRAM and NAND technology nodes where Micron has meaningful output. Micron is also working toward additional capex cuts, implying more than the 50 percent already decided.

These moves indicate Micron may have lower revenues for Q1 2023 than the $4.25 billion it originally anticipated.

We can assume that Micron is not alone, and that similar market conditions are being experienced by Kioxia, Samsung, SK hynix and its Solidigm unit, and Western Digital’s DRAM and NAND businesses. As both Western Digital and Seagate recorded a downbeat disk drive market in their latest results, we might realistically expect their HDD revenues to be depressed even more than anticipated in the current quarter as well. A full-scale storage media recession looks likely.