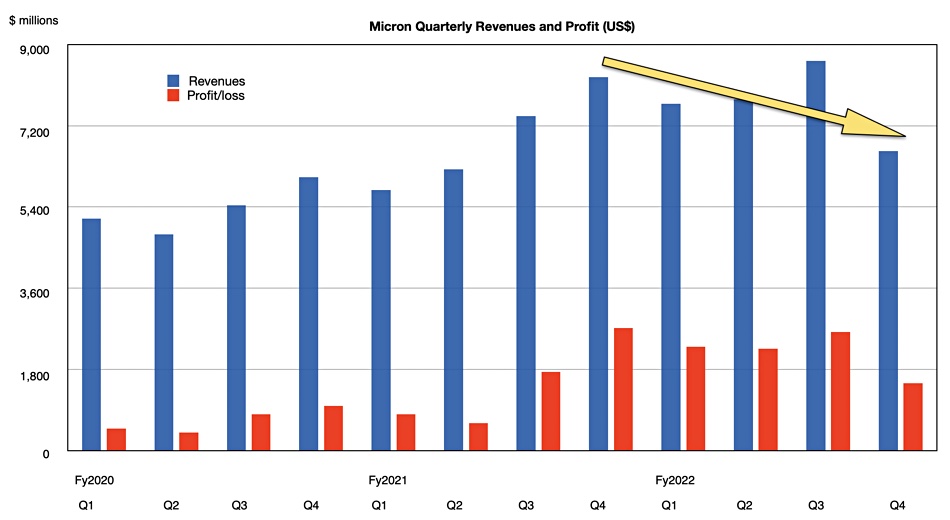

Micron revenue dropped 19.7 percent year-on-year in its its fourth fiscal 2022 quarter, with the expectation of a 44.7 percent drop set for the next. Boom has turned to bust as demand-driven trading turns to a supply glut situation.

The company reported revenues for the quarter ended September 1 of $6.64 billion, down nearly a fifth, with profits of $1.5 billion, 45 percent lower than a year ago. Full fiscal year revenues were $30.8 billion, up 11 percent annually, with profits of $8.7 billion, a 48.3 percent rise on the year.

President and CEO Sanjay Mehrotra focused on the fiscal year rather than the poor fourth quarter: “Micron generated record revenue of $30.8 billion and delivered our sixth consecutive year of positive free cash flow, allowing us to return a record $2.9 billion to our shareholders.”

But hard times are here: “Our technology and manufacturing leadership in both DRAM and NAND, deep customer relationships, diverse product portfolio, and strong balance sheet put Micron on solid footing to navigate the weakened near-term supply-demand environment. We are taking decisive steps to reduce our supply growth including a nearly 50 percent wafer fab equipment capex cut versus last year, and we expect to emerge from this downcycle well positioned to capitalize on the long-term demand for memory and storage.

“We are confident that the memory industry supply-demand balance will be restored as a result of reduced industry supply growth combined with the long-term demand growth drivers for memory.”

Financial summary – Q4

- Cash from operations: $3.8 billion

- Free cash flow: $196 million

- Gross margin: 40.3 percent

- Cash, investments, etc: $9.33 billion ($10.23 billion in prior quarter)

- Diluted EPS: $1.35 ($2.39 a year ago)

Financial summary – fy2022

- Cash from operations: $15.2 billion

- Free cash flow: $3.21 billion

- Gross margin: 45.9 percent

- Cash, investments, etc: $11.06 billion

- Diluted EPS: $7.75 ($5.14 a year ago)

Revenue analysis

DRAM revenues were $4.8 billion, down 21 percent year-on-year, with NAND declining less, 14 percent, to $1.69 billion. The company said it experienced rapidly weakening consumer demand and significant customer inventory adjustments across all end markets, meaning customers bought less product. Datacenter revenue, PC (client), and mobile product revenues all fell quarter-on-quarter and year-on-year. Datacenter products saw declines in average selling prices. There was lower PC unit demand and Micron’s PC customers reduced their inventory of Micron chips.

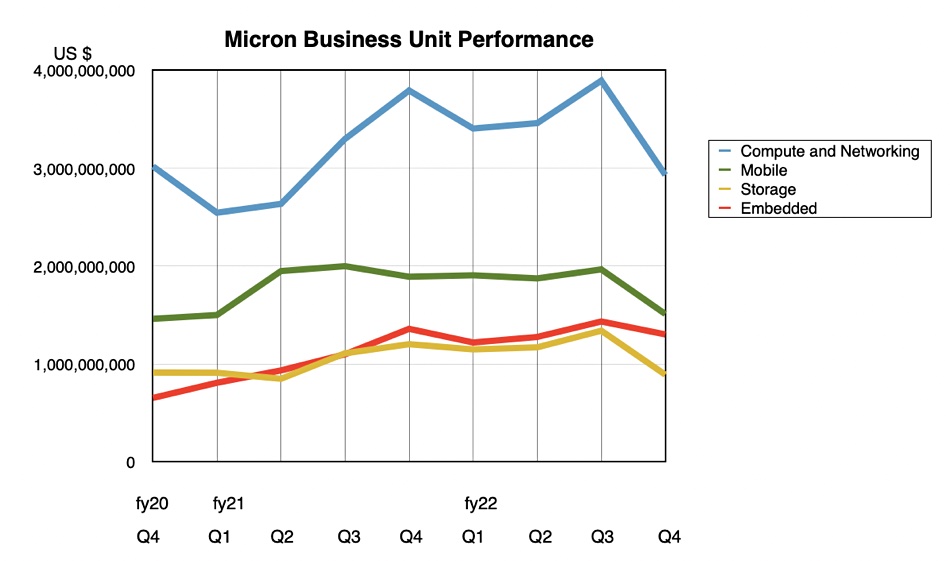

The four business units’ results were down double digits, except for embedded:

- Compute & Networking: $2.93 billion; down 23 percent

- Mobile: $1.5 billion, down 20 percent

- Storage: $891 million, down 26 percent

- Embedded: $1.3 billion, down 4 percent

A bright spot was the automotive sector part of the embedded market, where there was record revenue, and fiscal 2022 auto revenues grew 30 percent year-over-year, setting a new all-time high. Mehrotra sees a slowdown next quarter “as our customers rebalance DRAM and NAND inventory levels as they deal with non-memory semiconductor shortages and production challenges.“

Overall: “We are extremely excited by the long-term prospects for memory and storage in the automotive market and expect long-term CAGR for DRAM and NAND in autos to be at about twice the rate of the overall DRAM and NAND markets.”

The industrial IoT section of the embedded market “saw sequential and year-over-year revenue declines in fiscal Q4.” He said the long-term outlook was strong.

Downturn and outlook

This downturn was signalled by Micron, which forecast a 13 percent revenue fall for this quarter back in July, and then deepened the expected decline as it progressed through the quarter.

Micron is preparing by cutting its capex and reducing utilization in its fabs, lowering output. It’s also slowing new technology product progress, with Mehrotra saying in the earnings call: “We are delaying the ramp of 232-layer [NAND] and 1-beta [DRAM] technologies versus our prior plans.”

Preparing to look ahead, Mehrotra summed up the current situation: “An unprecedented confluence of events has affected overall demand, including COVID-related lockdowns in China, the Ukraine war, the inflationary environment impacting consumer spending, and the macroeconomic environment influencing customers’ buying behavior in multiple segments. In addition, inventory adjustments at customers across all end markets are also contributing to demand weakness.”

These factors are depressing DRAM and NAND demand, and on top of that: “We are also seeing an extremely aggressive pricing environment “

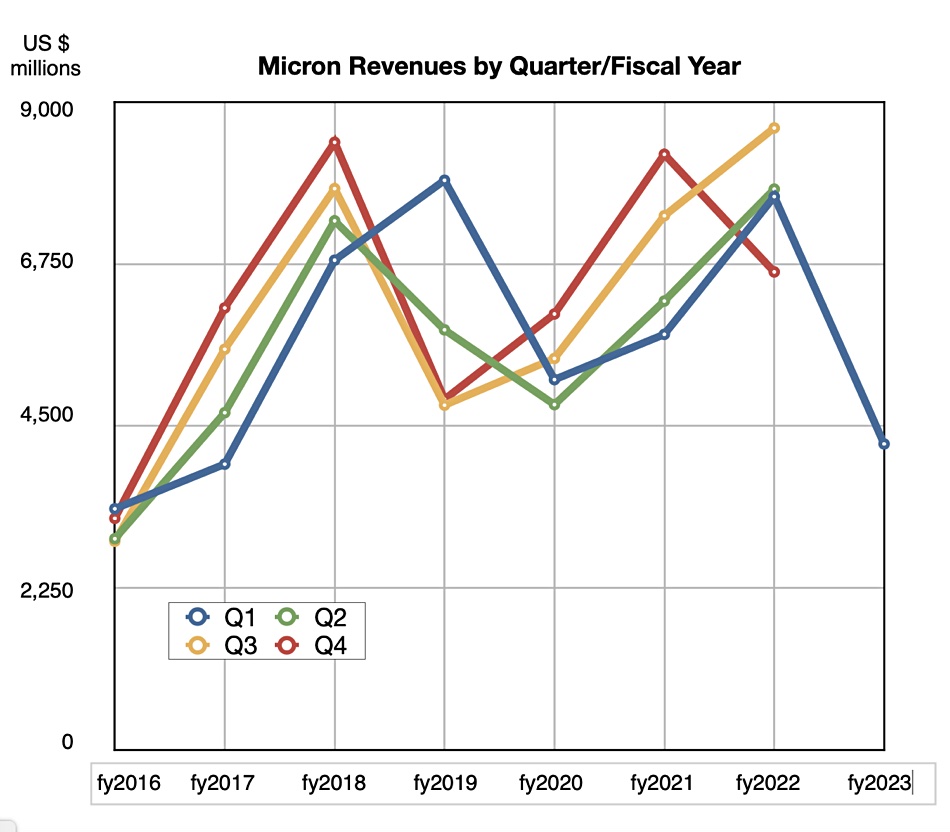

As a consequence, the guided outlook for the next quarter, Q1 fy2023, is for revenues of $4.25 billion, plus or minus $250 million, which will be a 44.7 percent fall on the year-ago $7.687 billion. This is a savage drop as a look at a revenues by fiscal year chart with this added guidance number shows:

The latest quarterly $4.25 billion number (blue line) was last seen back in Micron’s fiscal 2016 and 2017 period.

Mehrotra sees “demand to rebound starting from the second quarter of calendar 2023,” two quarters ahead. That indicates the second fiscal 2023 quarter’s revenues will be weak as well. Then: “Following a weak first half of fiscal 2023, we expect strong revenue growth in the second half of fiscal 2023 as bit demand rebounds, following substantial improvement in customer inventories.” And its own inventories too, as Mehrotra said: “We will be … relying on using the inventory to supplement our reduced supply growth to meet the uptick in demand that we expect in fiscal year ’23.”

Semiconductor analyst Mark Webb posted a note saying: “Micron predicted strong second half of F2023. There is no data to support this but historically we expect 3 quarters of downside to get to target inventory, 2-3Q of average after inventory is corrected and then “the good times” with price increases and a boom.”