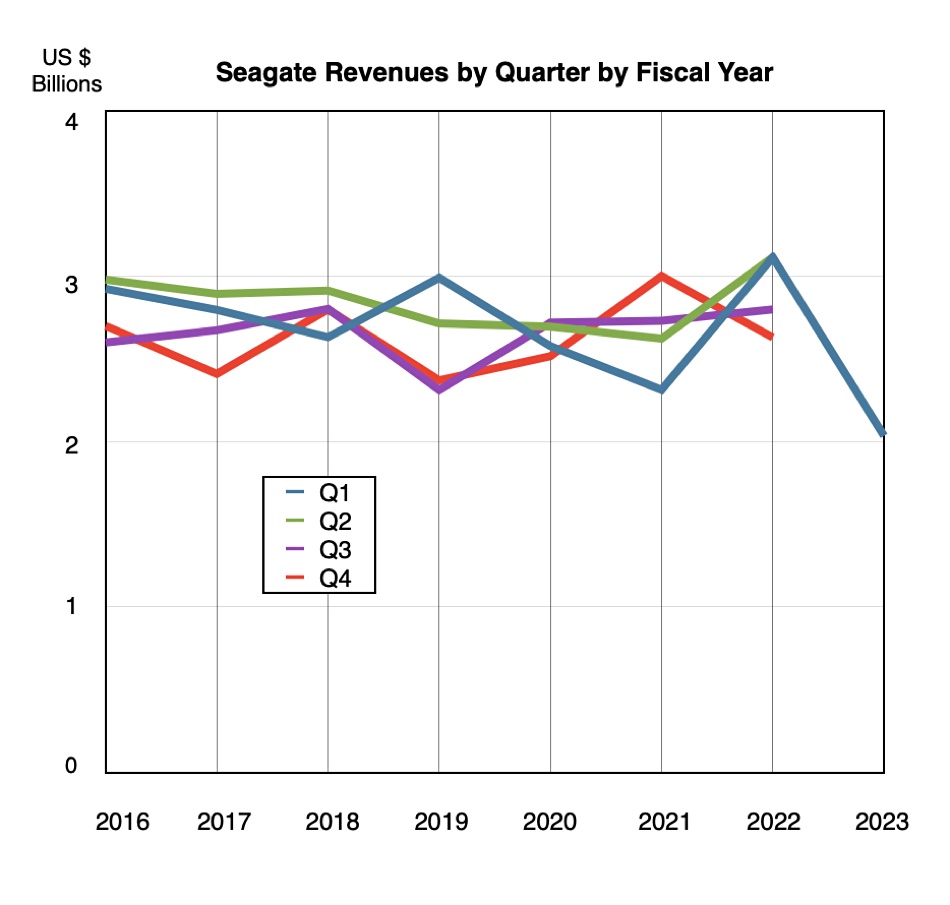

Seagate has announced a restructuring plan that includes around 3,000 layoffs – 8 percent of its workforce – after revenues dived 35 percent to $2.04 billion in its first quarter of fiscal 2023.

There was a profit of $29 million in the three months ended September 30, down 94 percent from last year’s $526 million. The disk drive maker blamed the downturn on global macro factors – the Russia-Ukraine war, COVID, inflation, China slowdown, supply chain issues – and customers running down disk drive inventories instead of buying new drives.

In addition, the video surveillance market was affected by the global economic slowdown which delayed project budgets and installation timing. Legacy drive revenues declined due to the COVID pandemic and inflation. Mission-critical drive demand fell meaningfully compared to the prior quarter, and consumer spending on disk drives also fell.

CEO Dave Mosley said: “Global economic uncertainties and broad-based customer inventory corrections worsened in the latter stages of the September quarter, and these dynamics are reflected in both near-term industry demand and Seagate’s financial performance.”

He added that Seagate is “adjusting our production output and annual capital expenditure plans, and announcing a restructuring plan that will deliver meaningful cost savings while maintaining investments in the mass capacity solutions driving our future growth.”

The 3,000 layoffs will cost $60-70 million in pre-tax charges for employee severance and one-time termination benefits, and will be mostly completed by the end of the second quarter. Annualized savings of $110 million are expected.

Mosley hopes the dip in demand is relatively short-term : “We continue to meet our development milestones for the 30+ terabyte product family, which is based on industry leading HAMR technology. Our team is executing well on our innovation roadmap and we are seeing strong engagement from cloud customers. Looking beyond the current macro uncertainties, we are confident in the secular demand for mass capacity storage driven by the underlying growth in data and believe Seagate is in a great position to capture growth opportunities over the long term.”

Financial summary

- Operating cash flow: $245 million compared to year-ago $496 million

- Free cash flow: $112 million compared to year-ago $379 million

- Gross margin: 23.7 percent compared to year-ago 30.7 percent

- Diluted EPS: $0.14, it was $2.28 this time last year

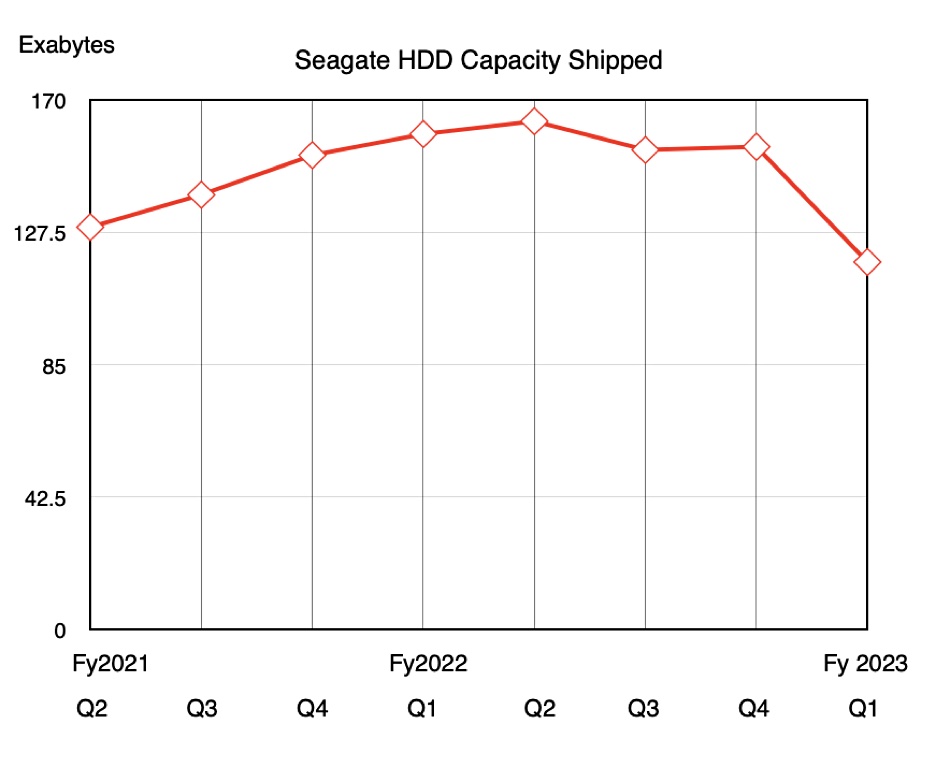

Seagate said its shipped exabytes totalled 118EB, down 26 percent from last year’s Q1. The average capacity per drive was 7.5TB, down from last quarter’s 7.8TB but still well up on the year ago quarter’s 5.5TB.

Disk drive revenues were $1.8 billion, 38 percent down on the year, but SSDs and other system (Lyve Cloud, etc.) revenues rose 5 percent to $263 million.

Seagate’s 20+TB disk drive platform is now its highest volume shipping product, representing over 40 percent of mass capacity drive EB shipped. Next-generation CMR products have started qualification at multiple US cloud customers and its HAMR technology is achieving development milestones, being on-track for mid-2023 shipments of 30+TB.

The outlook for the next quarter, which could change if circumstances get worse, is $1.85 billion plus or minus $150 million, which is 59 percent less than the year-ago second quarter’s $3.12 billion.

Western Digital quarterly earnings are due in a day or so and are expected to be similarly bad. Micron and SK hynix have already posted downbeat earnings for their DRAM and NAND products. As far as storage media producers are concerned, the recession is here already.